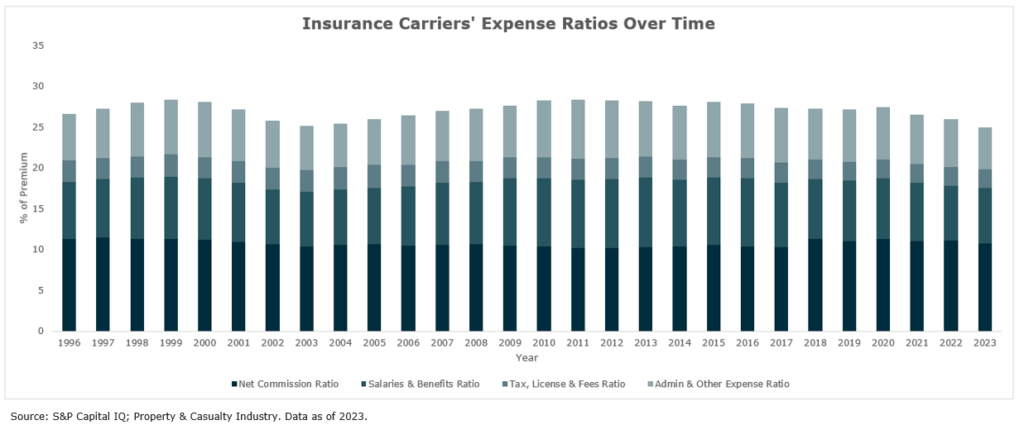

It’s obvious that technology has changed the world, fostering an efficiency explosion across many sectors. But has it changed the insurance industry? Let’s take a look at carrier data. One way to measure the impact of technology is to look at the evolution of the expense ratio (specifically salaries & benefits and admin & other expense ratio) over the past thirty years. Is technology allowing insurance carriers to produce more with less? The answer has been “not really”. In looking at overall expenses relative to premiums across the past thirty years, it’s clear that little has changed. Small gains over the past few years can be attributed to the rising rate environment.

Compared to insurance carriers, delegated authority firms have proven to be more nimble, which has enabled them to gain relevance over the past decade. But what will the future hold?

There is no question that the convergence of AI and big data is changing the rules for underwriting and is expected to put increasing pressure on firms that are not levelling up on the technology front.

How will the instant accessibility of data transform underwriting?

The abundance and availability of data today is unprecedented – as are the AI tools capable of analyzing the data at record speed to generate meaningful insights. In this new world of technology, it may no longer be about the “big fish eating the small fish” but rather the “fast fish eating the slow fish.” And the little fish may actually have a speed advantage. While it appears that delegated authority firms are better positioned to adapt to the changing environment than insurance carriers, they still have a long way to go as well.

Today’s status quo is characterized by systems that are typically disconnected, incapable of sharing information within the organization and built on an old architecture, while providing a user experience that can be (politely) described as “unfriendly.” Failure to address this antiquated infrastructure could prove to be the “death blow” for any firm seeking to fully leverage AI’s potential power. To take full advantage of the developing AI technology, 100% of data within a firm needs to sit in one, central source. Once you have that, virtually every aspect of the business can be digitized, tracked and, ultimately, analyzed.

As AI develops, this centralization and connectivity of data is particularly important because one of AI’s most revolutionary advantages is its ability to access and rapidly analyze external data, in order to verify information that’s being provided by brokers/insureds as well as enrich an existing dataset to make more informed underwriting decisions.

How AI can improve underwriting

While underwriting has always been about the collection and accurate analysis of relevant data, traditionally, the underwriting process has been periodic or event-driven, rather than ongoing. Underwriters take a “snapshot” of risk and establish a premium based on that static image. Technology has the potential to enable delegated authority firms to validate the risk profile of insureds on a continuous basis and make changes to their coverage based on that in real-time.

To start, AI can perform predictive analysis by scouring vast amounts of data (social media, financial transactions, behavioral trends) to predict shifts in the risk profile before traditional underwriting could have flagged them. Next, real-time data-feeds from smartphones, IOT devices, surveillance cameras, GPS systems, alarm systems, and more, will allow firms to constantly assess risk instead of waiting for manual, periodic updates. For example, a restaurant might begin selling liquor and change its closing time from 10pm to 2am. Ongoing data analysis can be programmed to identify these types of changes.

The power of AI is enabling delegated authority firms of any size to process structured and unstructured data, rapidly “ingesting” and incorporating anything and everything into the database. Most importantly, what would have equated to an insurmountable effort previously, can now be done with a click of a button.

Additionally, a digital underwriting platform can unlock unique insights into agents’ behavior on the platform that can be incorporated into a behavioral underwriting model. Is an agent changing information in order to achieve the results they know their client will accept? Wouldn’t that be good to know?

Emerging technology can also improve – and scale – underwriting productivity

In addition to improving underwriting results, there is no question that technology can create significant efficiencies throughout the underwriting process that have the potential to boost profitability. As automation increases efficiency, it also increases the scalability of the system. Every broker can attest to the fact that there’s a talent shortage in this industry and technology can enable brokers to do more with less. Who in their right mind would say no to that?

Pulling it all together: Deploying a full-stack digital system can not only lead to increased scalability, but also profitability, in part enabling more informed and consistent underwriting decisions.

While transforming your business is no small feat, it can be done – by firms of any size.

Moving rapidly from transformative technology to “table stakes”

All of this presents a real opportunity for managing general agents (MGAs), managing general underwriters (MGUs) and program administrators (PAs) to lead the charge in driving the industry forward. The first step is to digitize (as much as possible) the underwriting process in order to harness all the data that already sits within the four walls of every firm, then train systems to access and integrate relevant data beyond those walls. While this approach may give firms a competitive advantage today, it will likely become table stakes tomorrow. In other words, change seems inevitable. Why not start now?