The best firms in the industry look beyond their own results and seek to understand how they compare with peers to drive top performance. MarshBerry recommends focusing on five key areas for improving your firm today.

Profitability: Finding the proper balance between growth and profitability is one of the largest challenges facing management and executive teams. In all business decisions, from setting an attainable budget, managing personnel or finding cost-cutting technology solutions, optimizing operations is a challenging – yet necessary – step in increasing a company’s bottom line.

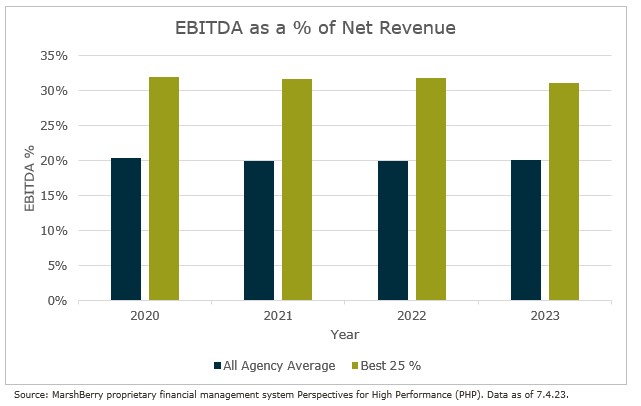

Cutting unnecessary costs should consistently remain on the to-do list of every management team. The average insurance firm has an EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization) margin of 20.1%, while the top quartile of the industry has margins as high as 31.2%.1 But it is still a balancing act. While a focus on profitability is necessary, too much profit could indicate a ‘lazy balance sheet’ where firms should consider reinvesting those dollars into new technology, talent, or other growth initiatives.

Perpetuation: As more independent firms take advantage of the competitive merger & acquisition (M&A) market, those that choose to remain independent should assess the state of their firm’s ownership and ask themselves tough questions. For instance, have you identified the next generation of leaders? Have you implemented a perpetuation plan? According to MarshBerry’s proprietary database, Perspectives for High Performance (PHP), 33.2% of independent ownership remains with baby boomers (1946-1964), while only 17% of ownership is held by millennials (1981-1996).1

Consider calculating your firm’s Weighted Average Shareholder Age (WASA), which shows the average of the shareholders’ age weighted by the percentage of stock they own. A high result may indicate the need to transition stock or perpetuate. MarshBerry’s 2023 MAX Performer regional winning firms have a WASA of under 48 years old. How does your firm compare?

Growth: Firms typically identify a list of multiple drivers of organic growth. Technology, value-added services, increased account size and others make the list, but some strategies are consistently at the top of the list. According to MarshBerry research – producer training, management and hiring, and new business prospecting and closing efficiency have remained in the top three reported growth drivers for the past several years.

Increased account retention should always be a prioritized expectation, especially during this hard market. But leaders should be aware of the additional, intentional efforts that are required to enhance a sales culture. Does your firm have increased new business sales goals? Have you invested in a pipeline management platform to organize sales efforts? When was the last time you’ve hired sales talent with the intention of building new books of business? Are you growing organically by at least 12% – the current industry average? These are only a few questions to quickly gauge your efforts in intentionally building a stronger sales culture.

Culture: Employees want to feel as though they are an important part of a greater purpose. Feedback from employee engagement surveys must be carefully considered by management when evaluating proposed actions or inactions. Using survey data demonstrates that your organization is dedicated to enhancing performance and sparking change. More importantly, firms should benchmark themselves against other organizations, enabling leadership to compare results to industry averages. Employee turnover can gauge the effectiveness of these actions. MAX Performer regional winners in 2022 had less than 12% turnover.

The insurance industry remains at 2.5% unemployment, so the best talent remains in high demand and is likely receiving unsolicited information about compensation and other job opportunities.2 But, it’s a balancing act. While little to no employee turnover would be impressive, it could result in a culture of complacency or tolerance of underperformance or bad behavior.

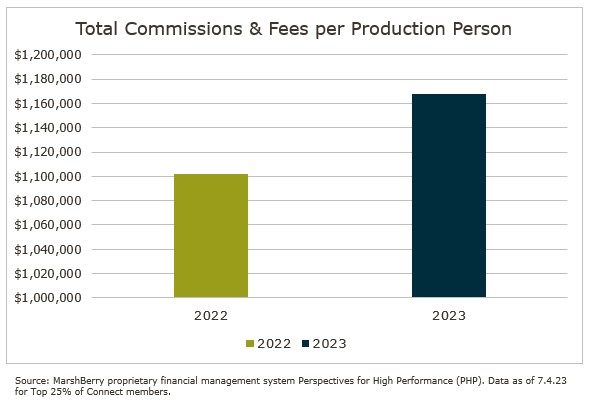

Productivity: The average “Total Commissions & Fees per Production Person” for the Best 25% of member firms in MarshBerry’s executive peer exchange, Connect, is currently $1,167,348, which is an increase from $1,101,697 in 2022.1 This could be due to rate lift, investment in new technologies, outsourcing, and/or the realignment of servicing vs. production responsibilities. How does this compare to your production team? Do you have this number available at your fingertips?

Producers or owners who are effectively delegating their servicing load should have higher than average performance in this area, but this ratio could be further analyzed depending on the firm’s average account size. Knowing how your firm compares to some of the industry’s most elite peers can either provide peace knowing you’re a top performer or give your team something to strive for.

It’s difficult to track, monitor, and improve every metric. But, if nothing is tracked, leadership will not know whether the agency is improving. Management should select key ratios which align with the corporate goals. Once selected, the metrics should be used to communicate the goals and related objectives to the entire organization.

If you have questions about Today’s ViewPoint, or MarshBerry’s benchmarking practices, peer exchange, and how you can be a MAX Performer, please email or call Brooke Lugonjic, Senior Vice President, at 616.828.0741.

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.