Key Takeaways from FOCS Q1 2022 Earnings Report

Focus Financial Partners (NASDAQ: FOCS) recently released its first quarter earnings. Key takeaways from the call included:

M&A Activity

Slow to Start but Bullish on Year Ahead

FOCS completed one merger in 1Q2022. Despite this, the Company believes that 2022 will be another robust year for merger & acquisition (M&A) activity, following the 38 deals closed in 2021. The Company cited a strong pipeline, with three deals closed on April 1, one on May 1, and two more signed and pending close.

Pricing Stability

The Company is seeing stable or even improving multiples in their pipeline. Management believes that many of the completed transactions in 2021 were heavily overpriced. They maintain that several of their competitors are now suffering from last year’s overpriced deals as a result of rising interest rates and market corrections impacting both equities and bonds, while FOCS has been able to avoid multiple inflation.

Flexible Deal Structures

FOCS believes that its three-pronged approach to M&A provides it with unique flexibility in the market:

- Direct acquisitions allow new partner firms to operate autonomously.

- Acquisitions made through Connectus Wealth Advisers allow new partner firms to retain their brand identity and client relationships while leveraging Connectus’ infrastructure and services.

- Acquisitions made by existing partner firms can be merged into the local partner firm.

Weathering Market Volatility

Reliance on Revenue Diversification

FOCS offers a robust collection of services including alternative investments, credit, trust and estate planning, and insurance, that provide the Company with non-market correlated revenue. The Company is seeking to continue extending its value-added capabilities. In 1Q2022, an increase in FOCS’s family office services, which generates revenues not tied with the market, was in fact one of the primary drivers of overall revenue growth. Diversification in revenue streams like these provides the Company protection from volatile equity markets. In 1Q2022, 21.8% of FOCS revenue came from these services.

Recurring, Predictable Revenues

The vast majority of FOCS’s revenue is recurring, and rather than being based on commission or transaction fees these revenues are primarily fee-based. In 1Q2022 wealth management fees accounted for 96.0% of Company revenue. This fee-based model allows FOCS to more easily weather times of market volatility.

Geographic Diversification: Going International

At the end of 1Q2022, FOCS’s international holdings were located in Australia, Canada, and the United Kingdom. One of FOCS’s current deals pending close is the acquisition of Octogone Group based in Geneva, Switzerland and is their first Swiss partner. Swiss market demographic trends are similar to those in the U.S. where regulators are implementing new licensing requirements for independent wealth managers. This will likely initiate consolidation in that country. FOCS believes that due to their acquisition of Octogone, they hold the first mover advantage as the market consolidates.

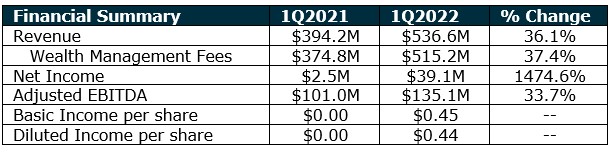

1Q22 Financial Highlights

- Revenue growth: 36.1% Year-Over-Year (YoY)

- Organic growth: 22.0% YoY

- Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization) margin: 25.2%

- Net Leverage Ratio: 3.84x

- Debt Outstanding: $2.5 billion.

- FOCS normally uses cash for M&A deals and will continue this approach in 2022. The company reported LTM 1Q22 cash flow available for acquisitions of $299.6 million.

Financial Summary

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help expand your wealth management portfolio, please email or call Kim Kovalski, Managing Director, at 440.769.0322.

Subscribe to MarshBerry’s Today’s ViewPoint blog for the latest news and updates and follow us on social media.