A year ago, inflation was on everyone’s mind, sparking plenty of talk about what the Federal Reserve may or may not do. The conversations in the insurance brokerage space were more about the impact the rising Federal funds rate might have on mergers & acquisitions (M&A) activity due to the higher cost of capital. But in the end, 2022 delivered the second most transactions on record, as well-capitalized buyers continued their pursuit for quality targets.

In 2023, the talk has shifted towards “recession or soft landing” as inflation continues and the Fed keeps pace with interest rate hikes. There is no shortage of opinions for how the 2023 U.S. economy will shake out. In fact, if you get 10 economists in a room, you’ll get 10 different opinions. But again, for the insurance brokerage industry the question still lingers – what impact might the higher cost or availability of debt capital have on M&A in 2023?

One acquirer – BRP Group, Inc. (BRP) – indicated during its recent Q4 2022 earning call that it would be more focused on organic growth versus acquisitions in 2023. CEO Trevor Baldwin stated, “The reality is the cost of capital is up meaningfully. And as a result, a lot of the larger, higher-performing businesses are choosing not to come to market and transact in that type of a backdrop, the type of assets that we would typically be most interested and excited about.”1

Of course, this is one firm’s position and not necessarily the sentiment of the industry as a whole. But the key to this statement is the reference to “higher-performing businesses” and “the type of assets we would typically be most interested and excited about.” Performance is king. In this environment, it doesn’t matter how large or small you are. If you aren’t significantly growing (organically), you aren’t going to attract the interest of potential partners. Read on to learn how to grow your insurance brokerage so you can be attractive to potential partners.

A Focus on Organic Growth

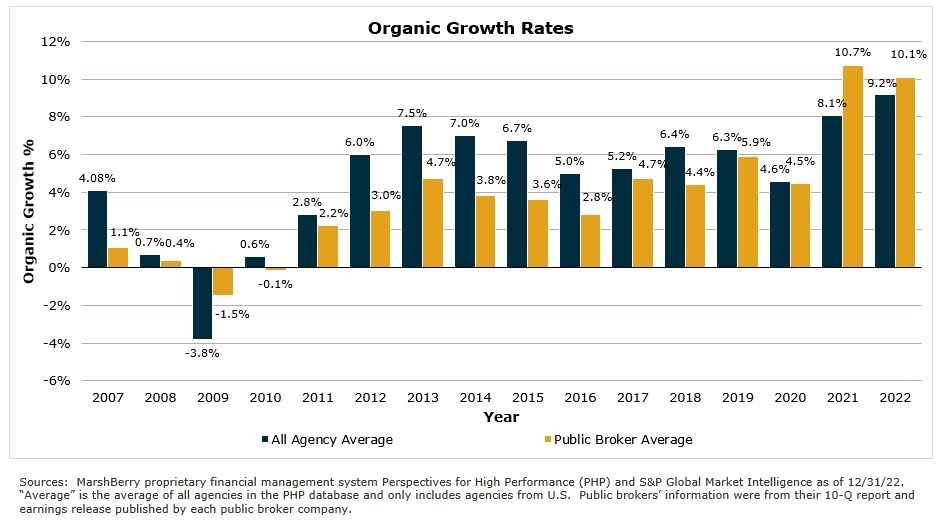

It’s never too late to focus on organic growth. But for many firms, this may be the year to significantly ramp up your organic growth strategic planning. Being average isn’t going to be good enough as buyers are taking a more conservative approach in their M&A growth strategy and looking for those quality firms that can clearly add value and help them grow.

Acquirers are looking for companies that show greater growth potential than themselves. If the average buyer is growing at 8%-10%, why would they be interested in a firm that grows less than that?

Insurance Brokerage M&A Market Update

As of February 28, 2023, there have been 48 announced M&A transactions in the U.S. Activity through February is similar to the start of 2022, which saw 51 transactions announced through this time last year.

Private Capital backed buyers have accounted for 31 of the 48 transactions (64.6%) through February, which is consistent with proportion of announced transactions over the last 5 years. Total deals by these buyers increase at a compound annual growth rate (CAGR) of 26.9% since 2018. Announced transactions by Independent Agencies have continued to decline since 2021. On average, 23.1% of total deals were done by Independent Agencies from 2018-2021 compared to 12.6% in 2022 and 12.5% to start 2023. High valuations and availability of capital could be two of the main drivers for this section of buyer’s decline in deal activity.

Strong deal activity from the marketplace’s most active acquirers has remained constant to begin 2023. Ten buyers have accounted for 58.3% of all announced transactions observed, while the top three (BroadStreet Partners, Inc., Arthur J. Gallagher & Co., and Hub International Limited) account for 33.3% of the 48 total transactions.

2023 M&A Outlook

2023 has gotten off to a similar M&A start to the previous two years. A slow, methodical and deliberate pace. Despite some buyers projecting they may slow down their acquisition strategy, there are still plenty of well capitalized buyers who are active in the M&A market. The difference will be how targets are evaluated and compared to each other. For acquirers, “quality” and “significant organic growth” will be the key characteristics evaluated when deals get valued.

We remain cautiously optimistic but believe it’s going to be another strong M&A year, with plenty of demand. The question you need to ask is how can you become the higher-performing growth firm that shines brighter than the competition? Whether thinking about selling now, later, or never, today seems like a great time to start focusing on enhancing the growth capabilities of your firm and exploring M&A advisory services to ensure your success in the industry.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230