There’s currently an unprecedented hard insurance rate environment that has extended beyond five years. One of the primary factors driving this hard market trend is the rise of “nuclear verdicts.” These substantial legal judgments, emerging from courtroom battles between insureds and insurance markets, are creating a ripple effect throughout the entire value chain of the insurance industry.

By legal definition, nuclear verdicts refer to exceptionally high jury awards in excess of $10 million. These verdicts have been increasing significantly over the last decade, in both frequency and severity, including the median nuclear verdict for product liability cases growing by 50% (from $24 million in 2013 to $36 million in 2022). Furthermore, these claims have outpaced economic inflation by nearly 50% over the last 10 years.

With profound implications for insurance carriers, brokers are pressed to understand the drivers of this trend, comprehend its impact, and find ways to navigate this dynamic environment to optimally position their firm, markets, and clients.

The rise of nuclear verdicts

Several factors have driven the historic rise of nuclear verdicts:

- Social inflation: At a high-level, social inflation represents a notable shift in public opinion on corporate responsibility. In simpler terms, more people are looking to “stick it to the man.” The impact of social inflation is clearly quantified by jury award amounts growing at a significantly higher rate than economic inflation.

- Third-party funded litigation: A more recent development in the world of nuclear verdicts is the growth in litigation funded by third parties, which removes some of the financial constraints in staging a legal battle with corporations. While largely unheard of prior to 2010, third-party litigation is forecasted to be a $30 billion-plus industry in the U.S. in the coming years.

- Increased advertising efforts: Advertisements for plaintiff attorneys and nuclear verdict cases have seen a corresponding increase, including over $2 billion spent in the U.S. in 2023 on legal advertisements. This not only leads to more cases coming to fruition, but also reshapes jurors’ perceptions of what “normal” damages are.

The impact of nuclear verdicts

Insurance brokerages should ensure they understand how nuclear verdicts impact not only themselves, but their primary trading partners as well (insurers and insureds).

- Insurers: The most obvious group impacted by increasing nuclear verdicts is insurance carriers. Put simply, higher claims lead to higher loss ratios, which leads to lower profitability. This trend is forcing carriers to revisit rates/pricing and tighten underwriting standards.

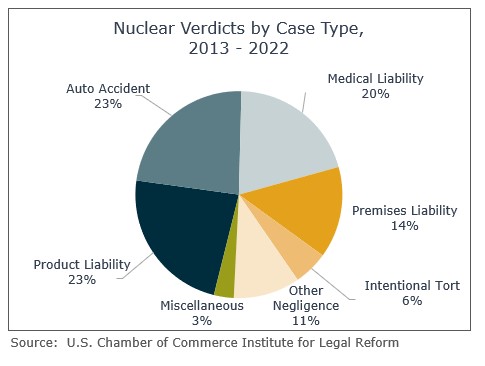

- Insureds: As carriers adapt pricing to the new claims environment, and create stricter underwriting guidelines, policyholders face greater challenges in finding a market to insure their risk and tend to pay more once they do. This is especially true for insureds with risks more prone to nuclear verdicts, including product liability, commercial auto, and professional liability.

- Insurance distribution firms: As the advisor working to bring these two parties together, insurance brokerages need to explore additional markets, increase research into client risk profiles, and recalibrate historical processes to meet the needs of clients and carriers.

Best practices for insurance distributors

While the trend of rising nuclear verdicts is largely out of the control of insurance distribution firms, there are numerous actions that may be taken to minimize the risks around nuclear verdicts.

- Client education: It’s crucial to educate clients on the factors driving nuclear verdicts and how they may impact the client’s ability to protect their assets, and the price they pay to do so. Whether through publications, webinars, or one-on-one meetings, insurance professionals should keep clients informed on the changing claims landscape. Specifically, helping insureds understand the need for proper protection from these verdicts is paramount, especially in an environment where umbrella coverage is becoming harder to find at higher limits.

- Enhanced risk management: Beyond providing the necessary information to clients, firms should help identify key risk areas and create loss prevention strategies. This can include guiding clients on implementing more stringent safety standards, additional compliance trainings, and more regular risk assessments. Brokerages can also explore outsourcing solutions, including businesses that provide third-party safety training, camera installations on commercial vehicles, and telematics offered through select carriers.

- Safeguard E&O coverage: Clients may attempt to hold their insurance agent responsible if claims arise that exceed their coverage. As such, it is essential to inform insureds on potential limits and document any instances where clients decline higher coverage, leaving a record to refer to if any issues arise.

- Specialty intermediaries: For those firms with authority over underwriting and/or policy pricing, more direct actions can be taken. These firms should ensure they have access to the claims data related to their book and analyze the impact of rising nuclear verdicts (now and in the future), in addition to tracking industry wide litigation trends. This information should allow specialty firms to revisit risk standards, IBNR (incurred but not reported) reserves, and underwriting guidelines/processes. Those firms with more advanced capabilities may choose to leverage AI or predictive analytics to proactively combat the threat of nuclear verdicts.

Nuclear verdicts pose significant challenges for the insurance industry, affecting everything from pricing and underwriting to client relationships. With contributing factors such as social inflation and third-party litigation funding showing no signs of slowing down, firms need to ensure they educate themselves and clients on the impacts of this trend. Adopting proactive strategic responses and emphasizing risk management is crucial to success, in both the short-term and the long-term.

In conclusion, its paramount that firms control the factors within their control while they have the ability to do so – because once a client enters a courtroom, it’s in the jury’s hands.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230.