Despite volatility in the financial markets, and continued uncertainty with inflation, interest rates and the labor markets – insurance brokerages continue to see growth and deliver profitability. Some of the largest public brokers are seeing all-time highs in stock price, including Arthur J. Gallagher & Co (AJG) and Brown & Brown (BRO). In Q2 2024 the largest public brokers reported positive earnings, strong organic growth and optimistic outlooks for the rest of the year – for both growth and merger and acquisition (M&A) activity.

BRO reported 10% organic growth in Q2 2024, with CEO, President & Director J. Powell Brown stating, “This is now our third quarter of double-digit organic growth out of the last six quarters.”

AJG’s Chairman & CEO J. Patrick Gallagher noted, “Our net new business is up. Our M&A pipeline is growing. I’m proud of the year-to-date financial performance. And as you can tell, I’m bullish on ’24 and beyond.”

Trevor Baldwin, CEO of Baldwin Insurance Group (BWIN), shared, “We are pleased with the results for the first 6 months of this year. The underlying strength of our franchise has never been stronger as evidenced by historically high net new business wins year-to-date.”

While many of the largest buyers in the M&A marketplace are reporting that they have “full pipelines”, it doesn’t mean buyers are not looking at new deals. There is still significant buyer capacity and demand. In fact, if signs continue to point towards the Federal Reserve cutting interest rates this year, resulting in the decrease in the cost of capital, compounded by the revival of the Democratic party and the chance that taxes may increase in 2025 – we may be primed for an incredibly strong end to 2024 for M&A deals.

M&A Market Update

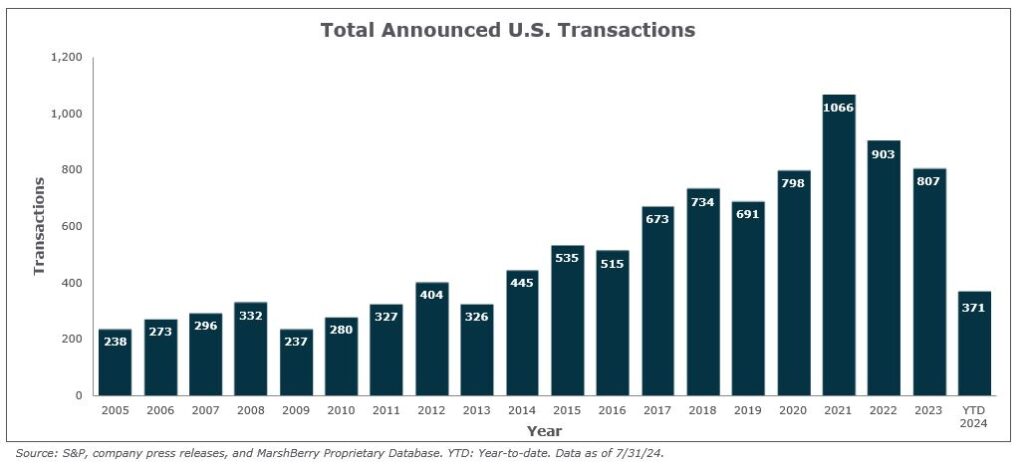

As of July 31, 2024, there have been 371 announced M&A transactions in the U.S. This activity through July is trending 10% higher than the start of 2023, which saw 338 transactions announced through this time last year.

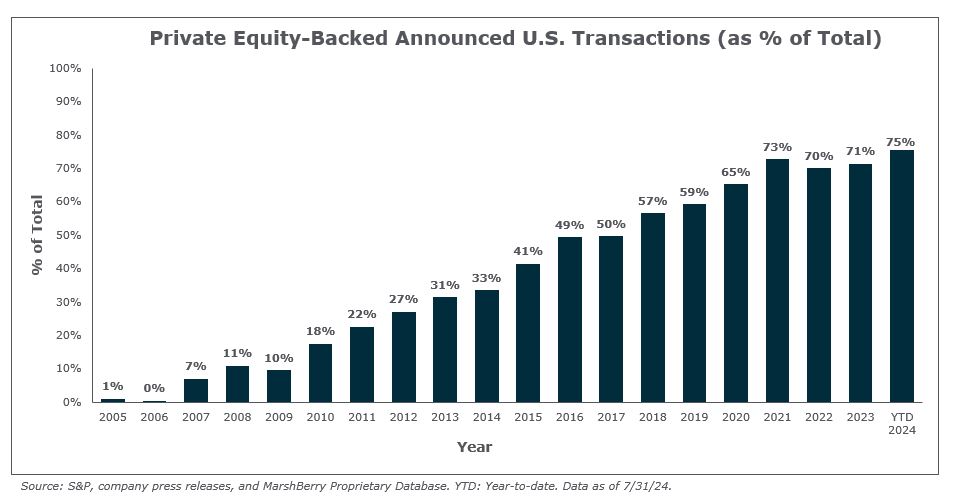

Private capital-backed buyers accounted for 280 of the 371 transactions (75.5%) through July. This represents a substantial increase since 2019 when private capital-backed buyers accounted for 59.3% of all transactions.

Independent agencies were buyers in 48 deals so far in 2024, representing 12.9% of the market, a slight decrease from 2023 when independent agency acquisitions represented 15.6% of the market. Transactions in which banks were buyers continued to fall, declining from 18 transactions in 2022 to nine transactions in 2023 – an all-time low. So far in 2024, bank buyers have completed three acquisitions.

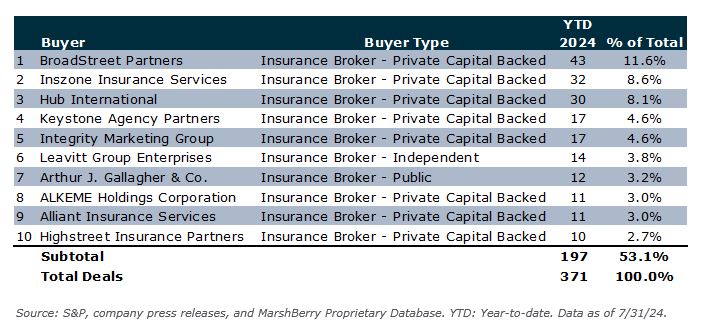

Deal activity from the top ten buyers accounted for 53.1% of all announced transactions through July, while the top three (BroadStreet Partners, Inszone Insurance, and Hub International) account for 28.3% of the 371 total transactions. For comparison, the top 10 buyers in all of 2023 accounted for 41.9% of total transactions, with the top three representing 16.2%.

Top Buyers YTD 2024, Announced U.S. Transactions

Notable transactions:

- July 10: Monarch E&S Insurance Services, a division of Specialty Program Group LLC, has acquired the assets of Commercial Sector Insurance Brokers, LLC (CSIB), an Excess & Surplus (E&S) wholesale broker based in Birmingham, Alabama. Specialty Program Group is a specialty division of Hub International. CSIB specializes in contract binding, the mining industry, and coastal property placements. This acquisition includes CSIB’s contract binding division, which handles various risks such as contractors, lessors’ risk, and hospitality. The integration of CSIB into Monarch E&S will enhance Monarch’s capabilities, enabling them to offer a more comprehensive contract binding solution nationwide and expand their service offerings, particularly in the mining sector. MarshBerry served as an advisor to CSIB on this transaction.

- July 18: IMA Financial Group has announced the acquisition of Michigan-based FC Underwriters LLC and its’ four divisions (Grand River Insurance Agency, Grand River Services, Stone Falls Insurance, and Bridge Excess Solutions) as its newest strategic partner. FC Underwriters, a managing general agent (MGA) with a specialty in small- to medium-sized businesses, will join Eydent Insurance Services LLC, an IMA company focused on providing commercial property and casualty alternative risk solutions. The acquisition aligns with IMA’s strategy to expand its program administration capabilities and further solidify its commitment to industry-specific risk solutions. MarshBerry served as an advisor to FC Underwriters on this transaction.

- August 2: NSM Insurance Group has acquired GIG Insurance Group (GIG) and Gifford Wells Insurance (GWI). GIG, based in Fort Lauderdale, FL, is a leading managing general agent (MGA) in the community association management liability and lawyers’ professional liability markets, while GWI specializes in professional liability insurance for various professionals, including lawyers, CPAs, doctors, and engineers. The acquisition strengthens NSM’s presence in the directors and officers (D&O) liability and crime insurance sectors and provides opportunities for cross-selling with NSM’s existing niche insurance programs. MarshBerry served as an advisor to both GIG and GWI on this transaction.

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help your firm determine its path forward, please email or call Phil Trem, President, Financial Advisory, at 440.392.6547.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230.

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2024 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.