Heterogenous workforces are often linked to higher growth. Research from Forbes shows more aggressive growth in companies with heterogenous workplaces as compared to ones with more homogenous talent. MarshBerry clients effectively leverage financial and production benchmarks to improve their firms. Now we encourage firms to take a similar approach with talent management initiatives. When it comes to diversity initiatives, firms should start with these questions:

- Do you have an understanding of the industry’s current diversity landscape?

- Do you know how your firm compares to the rest or the best of the industry as it relates to Diversity, Equity and Inclusion (DE&I)?

The Insurance Industry Falls Behind in DE&I

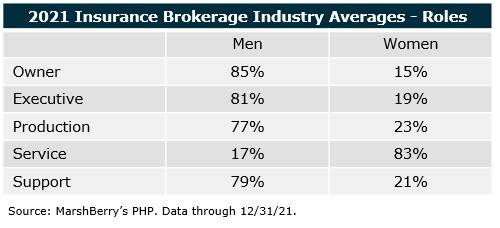

The diversity efforts within the insurance industry are currently lagging compared to initiatives in other sectors, leaving ample opportunity for firms to improve their DE&I measures. Currently, women are drastically underrepresented in owner, executive, and production roles, according to MarshBerry’s proprietary financial database, Perspective for High Performance (PHP), with men holding 80% of owner, executive, and production roles. Conversely, women had 80% of the roles in service and support categories.

Though slow, there’s been progress over the past ten years. The percentage of firms with at least one woman in an executive role increased from 31% of firms in 2011 to 44% in 2021. However, the recent improvement could be threatened by pandemic-related issues, which are driving more women to abandon producer and executive roles. According to an Accenture survey, 32% of women in the insurance industry left their jobs either permanently or temporarily over the course of the pandemic, with 20% of those claiming childcare or elderly care as the main reason. Additionally, the survey found another 30% of those still employed were considering leaving. In terms of compensation, more women also tended to report that they felt their salaries were lower compared to the same roles at competitive organizations.

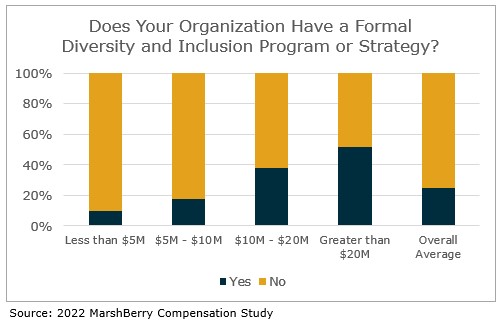

To combat these concerns, large and high growth firms are investing in efforts to boost diversity and inclusion, resulting in higher employee retention and potential growth. With the research seen from MarshBerry’s Organic Growth team, we continue to support similar growth strategies for insurance brokerages. Utilizing surveys to measure employee satisfaction with their DE&I efforts can be effective. Firms with annual revenues above $20 million are most likely to measure employee satisfaction and engagement with surveys (based on responses to MarshBerry’s 2022 Compensation Study). By comparison, fewer than 70% of firms that had $5M-$10M in annual revenue use employee surveys. While the largest firms (>$20M revenue) were the most likely to have a formal D&I program or strategy, only about 50% of this group reported having a formal strategy. This falls drastically to 10% in companies with annual revenue of less than $5M.

Getting Started With a DE&I Strategy

Since diversity and inclusion efforts can lead to increased growth, now is the time to implement DE&I programs, to reap the benefits of a diverse workforce. This doesn’t have to require tremendous effort as firms can start small:

- Companies can add inclusive language in job postings, small diversity committees and DE&I consultants.

- Firms can recruit volunteers and establish internal diversity committees to boost hiring and retention of diverse talent.

- Hiring diversity and inclusion consultants to uncover small changes in this field can potentially pay off tremendously in innovation and revenue growth.

Diversity, equity and inclusion can be vital to moving forward. Taking advantage now of these opportunities can put your firm ahead, creating valuable growth and profitability. Do you know where you stand with your employees on diversity, equity and inclusion? MarshBerry can help with surveys to gather information for strategic success.

If you have questions about Today’s ViewPoint or would like to learn more about DE&I or talent acquisition strategies that can help drive predictable, profitable organic growth for your firm, please email or call Brooke Lugonjic, Vice President, at 616.828.0741.