The U.S. inflation rate reached a 40 year high of a 7.5% annual rate in January, as measured by the Consumer Price Index (CPI). This was the biggest spike since 1982, and above December’s increase of 7%. This compares to December 2019’s pre-pandemic increase of 2.3%. Rising prices are a result of pandemic-related supply chain issues, monetary policy, geopolitical tensions and a tight labor market. Some analysts see inflation remaining far above the Fed’s target level for some time.

Higher than anticipated inflation could threaten reserve levels and underwriting profitability for the insurance industry. The early- to mid-1980s is an example of an extended high inflationary period, with CPI increases peaking at 14.6% in March 1980. Subsequently, the industry recorded combined ratios well above 100%, indicating underwriting losses. The impact of inflation on insurance industry professionals could be severe. However, inflation has only begun to rise to high levels in the past year, rather than being elevated over the past decade (vs. the historical example in the 1970s and 80s that lasted for years). Additionally, industry reserves are in a much stronger position now than they were then.

Rising Inflation Could Impact Insurers’ Solvency and Profitability

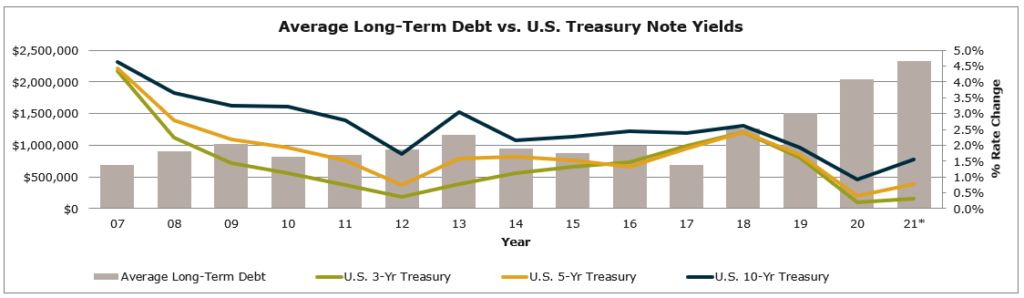

Higher inflation can impact the value of investments held on insurers’ balance sheets. Insurers tend to have a more conservative investment strategy and invest largely in fixed income investments. In 2020 Property & Casualty (P&C) insurers held about 27% of their assets in stocks and 55% in bonds, according to the Insurance Information Institute. Insurers are facing the risk that income from these bond investments are falling short in comparison to the rising inflation rates. Inflation risk is even greater in bonds with long maturities, which may have fixed lower yields. The chart below shows the recent uptrend of U.S. Treasury note yields.

P&C insurers potentially face fewer investment risks compared to life insurers as the sector has lower asset leverage (2.2x for P&C firms at year-end 2020 vs. 9.0x for life insurers, according to Fitch Ratings). Over the last 10 years, life insurers have invested more in long-term assets like corporate bonds, commercial real estate and alternative assets for income. The P&C firms’ shorter portfolio durations also subject them to lower interest rate risk.

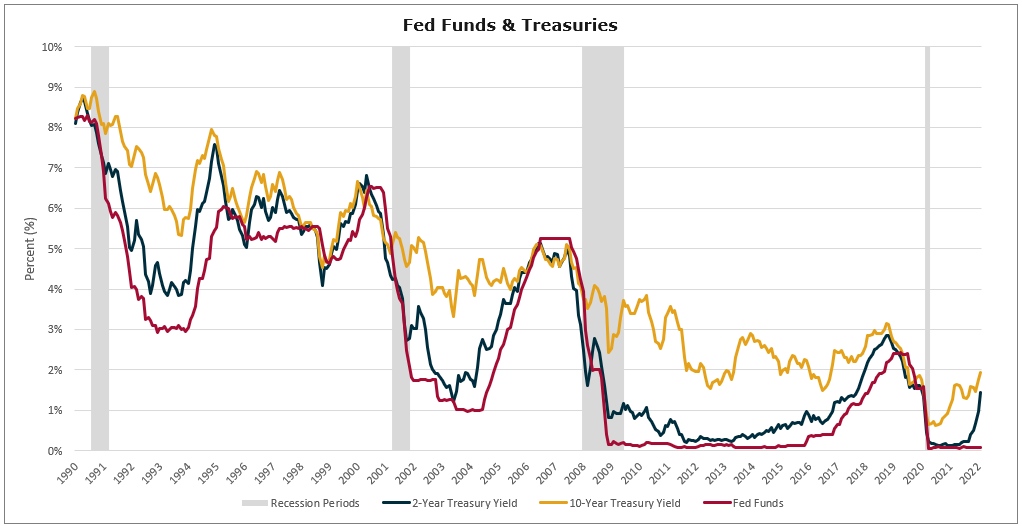

The Fed has signaled it would raise interest rates in 2022 to combat inflation, which could put downward pressure on bond values. Recently, the federal funds rates have been at historical lows.

Some insurers could face potential rate inadequacy as cost of claims rise. Personal lines and auto are facing high pressures from inflation. Auto insurers are already being impacted heavily by the rising costs of repairs and claims. According to the Auto Care Association, the consumer costs of motor vehicle equipment and costs are up 20% in 2022 vs 2021. Homeowners insurance margins are being squeezed by the rising cost of materials, labor and elevated CAT losses.

How Can Insurers Position Themselves in the Current Inflationary Environment?

To position investments, insurance companies can adjust their investment strategies. They can invest in Inflation Adjusted Treasuries (TIPs) and additional inflation-indexed investments. Insurers can also alter risk asset exposure by increasing allocations in value equities over growth or shifting geographic exposure towards regions that are better positioned for the current environment.

Some insurers may choose to hold more capital to cover risks of further rising inflation, particularly those in longer-tail segments. If higher inflation persists, profitability and reserve strength could diminish in longer-tail segments, including workers’ compensation or medical malpractice. Improving the data and process for reserving could also be a tactic to maintain profitability targets.

Overall, the P&C segment is in a stronger position to face the current rise in inflation, as industry reserves are in better position vs. past inflationary periods and technology and financial reporting improvements allow for faster and more comprehensive information on loss costs, allowing for faster reactions to adverse trends.

If you have questions about Today’s ViewPoint or would like to learn more about how rising inflation could impact the value of your business, please email or call Bill Bartok, Vice President, at 440.586.7183.

MarshBerry is excited to announce it advised more than 95 companies and completed 130 M&A transactions (83 sell side/47 buy side) in 2021, closing another record year for the firm. MarshBerry continues to remain the number one sell side advisor for the 23rd year in a row and retains the top spot in the industry for total number of clients advised.

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.