Evaluating a business’s value is essential for owners who want to manage equity while effectively creating transferable and sustainable value. For most business owners, a significant portion of their wealth is likely tied up in the business. Understanding the value of their most substantial asset and the key levers that can help grow and protect that value is crucial for making informed decisions and strategic plans to pursue their end goals for the business.

How Is Business Value Calculated?

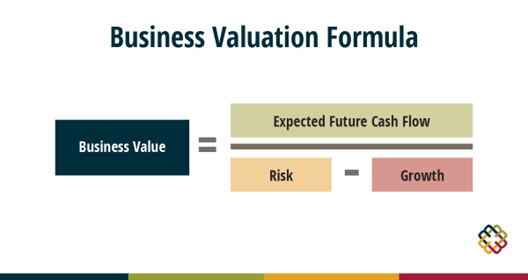

From a mathematical perspective, business valuation is a relatively straightforward calculation. The business valuation formula, also called a capitalization or ‘cap’ rate in its most basic form, helps assess the return on investment for an income-generating asset, such as an insurance brokerage.

Business valuation services will typically calculate value using the formula mentioned above when assessing most assets. Alternatively, the business value can also be determined as a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation, Amortization). In the formula above, EBITDA can be used as an alternative for expected future cash flow because it removes the impact of tax rates, interest expenses and other intangible assets.

The real story here, however, is not the business valuation formulas or calculation itself but the driving factors behind the variables and how they are generated, applied and positioned.

In the context of a sale, acquirers tend to focus primarily on an EBITDA multiple, but this fails to capture the complete picture of value. For this reason, MarshBerry’s approach involves optimizing how acquirers view the three variables used in a business valuation formula. Via our business valuation and advisory services, our role is to gather an intimate understanding of a business, which allows us to uncover the story behind its numbers across the following three areas.

How Expected Future Cash Flow Affects Business Value

Expected cash flow forecasts actual anticipated inflows and outflows of funds within a business or financial asset. By closely monitoring income against expenditures, a company can maintain an accurate financial snapshot, which will, of course, be a key factor in the valuation of the business.

Risk

The risk rate assumption is tied to the investor’s required rate of return and is associated with the business’s cash flows, operations and market environment. This concept determines the appropriate discount rate when valuing the business, as it affects the perceived stability and predictability of future earnings.

Risk comes in many forms, but one that is often overlooked is the lack of assessment and strategy around human capital. While most business owners understand their client demographics and revenue distribution, they rarely apply the same scrutiny to their employees. Just as relying on a single client for 50% of revenue is risky, depending heavily on one or a few employees for growth, management or client service creates key person dependency, a vulnerability that acquirers will quickly identify.

Risk also lies in the business’s transferability from a cultural perspective. According to a Deloitte study of 1,000 executives, “effective integration” is the most vital factor when merging two companies.[1] Understanding how companies define success, their values and the impact of hierarchy influences value and transferability. Buyers will often pay more when a business culture aligns well with theirs, even though culture isn’t a numerical factor in valuation. A good cultural fit reduces risks in business transfers, leading to higher upfront payments and better earn-outs.

Growth

The value of an asset is also influenced by the present value of its expected future cash flows, which fundamentally drives the interest of potential investors. Where the growth rate is strong, this tells a great story.

MarshBerry can dissect why this is happening and paint a picture of how a potential partnership could be the key to capitalizing on successes or addressing suboptimal performance. Positioning for growth is about uncovering what’s happening under the hood and positioning stakeholders to begin writing a new story.

Outside of the context of a sale, understanding these three key factors as they are used in a business valuation formula can help spotlight areas of a business that need improvements. Long-term initiatives to optimize these three factors (cash flow, risk and growth) can lead to a significant boost in enterprise value and can create powerful downstream momentum.

The Downstream Momentum of Growing Business Value

Consider two companies: Nvidia and Intel. Both have been giants in the tech industry, but today, they are on drastically different trajectories, from sales momentum to company culture.

Nvidia ranked No. 3 on Fortune’s 100 Best Companies to Work For list, marking its highest placement in eight consecutive years of recognition. Calculated by Great Place To Work® for 30 years, the metrics in this report have been able to predict employee satisfaction, retention, agility, business success and the quality of the work environment.

Nvidia’s soaring valuation, rapid growth and impressive $3.5 million in revenue per employee as of April 2024, highlight it as a dynamic, high-performing workplace. Alongside its focus on innovation, Nvidia’s operational efficiency drives productivity and fuels reinvestment in its employees through growth opportunities, benefits and perks. According to the aforementioned survey, 97% of Nvidia employees say it is a great place to work. Meanwhile, Intel did not make the list—a fact that can be interpreted as a statement in itself.

Intel, once the most significant and most valuable U.S. tech company, is one of the worst-performing stocks this year in the S&P 500. In August of this year, it was announced that Intel would be worth less than 5% of Nvidia.[2]

Its valuation is slipping, and with it, the company’s appeal. As Intel struggles, it’s likely scaling back employee perks and facing internal challenges in addition to recent lawsuits. These combined factors could make Intel a less attractive and potentially less enjoyable workplace.

A thriving company fosters shared success, creating a symbiotic culture that rewards talent and attracts top performers. High achievers typically choose rising companies unless they prefer to help turn around a struggling one, like Intel. Given comparable offers from Nvidia and Intel today, most candidates wouldn’t pass on the world’s most valuable company (as of June 2024).

Culture is hard to quantify, lacking precise data to measure human aspects. However, a positive feedback loop often exists between value and culture: as value grows, productivity, stability, and culture follow, serving to further boost value.

Building Business Value Allows for Greater Optionality

Preserving legacy is often a top priority for business owners in terms of succession planning. Focusing on growing equity value can create greater flexibility and optionality around the perpetuation discussion. Value is advantageous whether you’re creating a lifestyle business, transitioning ownership internally and maintaining independence or liquidating to sell externally or to a strategic buyer.

A widespread preference among owners is to transition internally or build a “forever agency” where the business is transferred to family or key employees. Even with an internal transition, value matters, as annual double-digit growth can help a business remain independent if that is the goal.

Want more? Check out the FocalPoint webinar replay of “Behind the Numbers: Understanding Valuation to Create Leverage and Optionality.” You’ll get even more insights, including steps to take today to grow value at every stage of your business.

[1]Source: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/mergers-acqisitions/us-ma-mergers-and-acquisitions-trends-2016-year-end-report.pdf

[2]https://www.forbes.com/sites/roberthart/2024/08/02/intel-shares-freefall-as-american-chipmaking-giant-careens-toward-worst-day-ever/