“Ask a question to 10 economists and you will get 11 different answers” goes an old joke.

The U.S. remains in a period of stubbornly high inflation. What first started as a notion of transitory inflation has evolved into the highest inflation in the past 40 years. The exact contributing factors are unclear, but we know it includes pent-up demand, supply chain issues, labor shortages, and consumer sentiment. Ultimately, the Federal Reserve (Fed) has been forced to combat inflation with increasing the Federal Funds Rate. So how does this impact the value of your brokerage? An economist would likely answer: “it depends.”

The value of an asset is often defined as the present value of future cash flows. As interest rates rise, the values of future cash flows are discounted at a higher rate, resulting in a lower value of assets. Put simply, if you were to receive a dollar in a year, that dollar is now worth less due to inflation.

What will the Fed do next?

Inflation remains steadfast. The Fed’s goal is to manage inflation without causing a recession. One way the Fed achieves this goal is through adjusting interest rates, which in turn impacts business spending and (should) ultimately impact employment. On March 22, The Fed increased rates by 25 basis points. However, labor shortages persist and, without stating outright intentions, the Fed would like to see unemployment rise to more sustainable levels.

As of March 4, 2023, the four-week moving average for new jobless claims was 197,000.1 Michael Pearce, lead U.S. economist at Oxford Economics in New York stated: “Even after factoring in the latest increase, jobless claims are exceptionally low by historical standards, underscoring just how tight labor market conditions still are.” If this number remains low, inflation could persist, and the Fed could maintain its current stance on rates.

Furthermore, the Fed needs to contend with recent turmoil in the banking sector, following the failures of Silicon Valley Bank and Signature Bank. These issues could lead to a tighter lending environment as banks face increased scrutiny from bank examiners and their own management teams to reduce risk. The Fed will meet next on May 2, and some economists think that potential instability at more U.S. banks may influence its stance on rate hikes.2

Conflicting forces in insurance brokerage valuations

Real estate has always been heralded as a hedge against inflation. Specifically, income-generating real-estate. This is largely due to the landlords’ ability to pass along rising rent increases. Sound familiar? Insurance brokerages have historically had success passing along inflationary costs. Additionally, insurance brokers with diversified client bases also offer risk mitigation, as exposure to even just a few unique industries can diversify unsystematic risk.

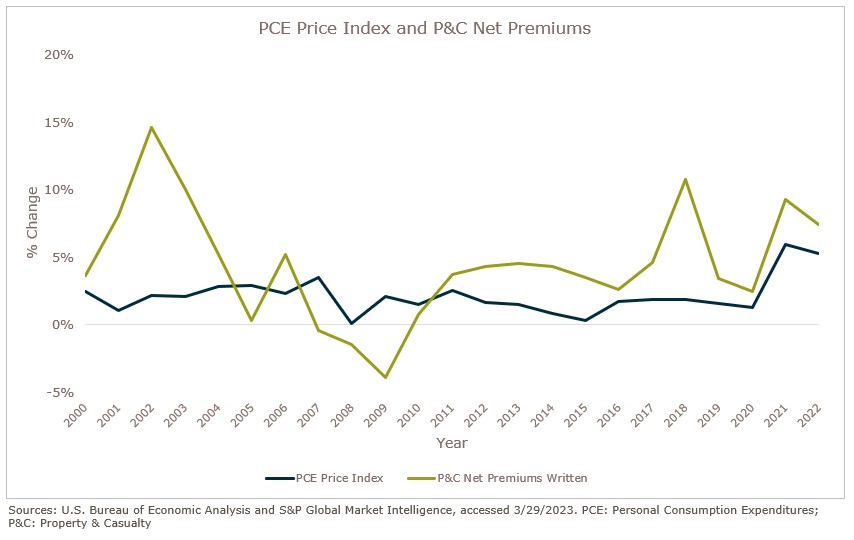

Over the last ten years, P&C net premiums written have increased at greater rates compared to inflation, as measured by the Personal Consumption Expenditures (PCE) Price Index.

While individual brokerages offer a hedge against inflation, private equity is still impacted by the rising cost of capital. Private equity has been, and will continue to be, the driver behind brokerage valuations.

Insurance brokerage valuations are likely to remain robust due to the underlying strength of the industry; however, the impact of rising costs of capital can’t be ignored. Simply put, as the cost of debt increases, investors are forced to adjust asset pricing in order to achieve desired return on investments (ROIs). This dynamic has ultimately shifted the market from a pure sellers’ market to something in between.

Key take-aways

Investments in the insurance distribution space continue to perform well, despite macroeconomic conditions, as buyers still have acquisition strategies and pipelines to fill. While it may no longer be a pure sellers’ market – valuations remain strong, especially for those targets that show strong organic growth. Buyers are still able to make accretive acquisitions; however, there will be more scrutiny during the mergers & acquisitions timeline from soliciting and negotiating offers to due diligence and the finalization of purchase agreements. As a result, it’s more critical than ever to seek the guidance of an experienced advisor.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230