As the stage is now set for the U.S. presidential election, with President Biden and former President Trump squaring off once again, what might be the impact on mergers and acquisitions (M&A) activity in the insurance brokerage space?

During the most recent State of the Union (SOTU) address, President Biden outlined his tax plan, for which he proposed several changes that would clearly impact high earners and corporations. President Biden was clear that it’s his goal to raise taxes on anyone who makes more than $400,000. For corporations, Biden is looking to raise the corporate tax rate to 28% and end tax breaks for executive pay above $1 million, which would keep corporations from deducting the expense above that threshold.

While President Biden did not specifically reference capital gains in his address, in the post-SOTU White House press statement, which details President Biden’s Fiscal Year 2025 budget proposal, capital gains tax increases are a key component. The proposal suggests doubling the capital gains tax to 39.6% on investors who make at least $1 million a year.

Could a possible second term for President Biden accelerate M&A activity in 2024? Just as we saw in 2020/2021, owners who might have been considering selling in the next few years, may start to ramp up their timelines and try to get ahead of any possible tax changes in 2025. There are many similarities to what happened in 2021, when a record number of firms sold believing that they might be negatively impacted by a potential federal capital gains tax increase.

Today, many firm owners are keeping a close eye on the political positioning of the 2024 candidates and may begin to consider the impact that any tax changes would have on the sale of their business and their personal net gain. Capital gains tax rates doubling would have a significant impact on your net proceeds. If interested in an assessment of your potential exposure, we have developed tools to help you clearly understand what could be at risk.

A lot can happen between now and November. For now, MarshBerry is watching and listening to the market and industry trends and working with both buyers and sellers to realize the best outcomes for our clients.

M&A Market Update

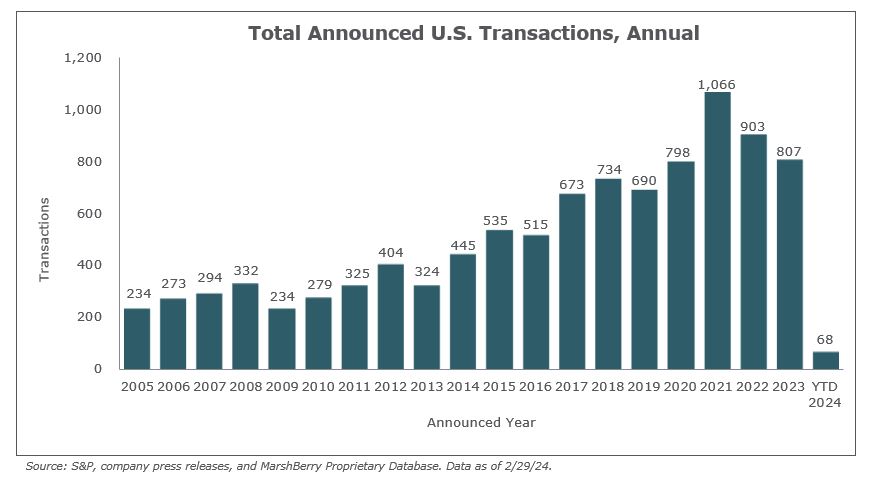

As of February 29, 2024, there have been 68 announced M&A transactions in the U.S. This activity through February is trending higher than the start of 2023, which saw 48 transactions announced through this time last year.

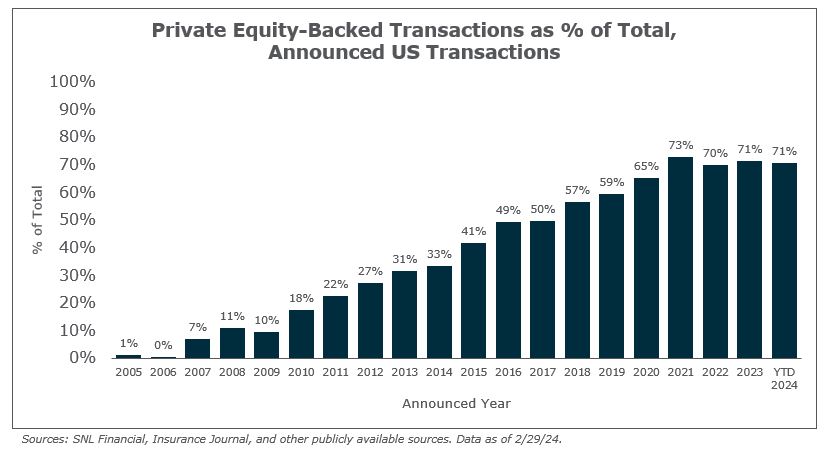

Private capital-backed buyers accounted for 48 of the 68 transactions (70.6%) through February. which is consistent with the proportion of announced transactions over the last five years. Independent agencies accounted for nine deals so far in 2024, representing 13.2% of the market, a slight decrease from 2023 when independent agency acquisitions represented 15.6% of the market. Bank buyers continued to fall, declining from 18 transactions in 2022 to 9 transactions in 2023 – an all-time low. Bank buyers had one transaction in February, the first bank acquisition of the year.

Deal activity from the marketplace’s most active acquirers has remained strong to begin 2024. Ten buyers accounted for 66.2% of all announced transactions, while the top three (BroadStreet Partners, Inszone Insurance, and Arthur J. Gallagher) account for 36.8% of the 68 total transactions.

Notable transactions:

- February 5: Arthur J. Gallagher & Co. acquired The John Galt Insurance Agency, comprised of John Galt Commercial Insurance Agency LLC and John Galt Insurance Agency Inc., based in Fort Lauderdale, Florida. Specializing in commercial and multifamily real estate across the state, John Galt has approximately 25 employees who will transition to Gallagher. The acquisition enhances Gallagher’s capabilities in the condominium and association entity real estate niche in Florida.

- February 10: Marsh McLennan Agency, a subsidiary of Marsh, acquired two Louisiana-based middle-market agencies, Querbes & Nelson (Q&N) and Louisiana Companies, doubling its presence in the state. Q&N, based in Shreveport, specializes in business insurance, employee benefits, and alternative risk financing, focusing on energy services, commercial contractors, and transportation. Louisiana Companies, based in Baton Rouge, offers business and personal lines insurance with expertise in construction, manufacturing, healthcare, and hospitality.

- February 20: Truist Financial Corporation (NYSE: TFC) finalized a deal to divest its remaining interest in Truist Insurance Holdings (TIH) to an investor consortium led by Stone Point Capital and Clayton, Dubilier & Rice. The agreement, valued at $15.5 billion in an all-cash transaction, marks a significant move for Truist, bolstering its capital ratio and tangible book value per share. This transaction follows an April 2023 transaction in which Stone Point acquired 20% of Truist at a $14.75 billion valuation. The transaction, subject to regulatory approvals, is expected to be finalized in the second quarter of 2024.

Investment banking services offered in the USA through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440)354-3230.