Into the home stretch of 2024, merger and acquisition (M&A) activity for insurance brokerage is expected to end strong – as deals that have been simmering for the past few months strive to close before the year ends.

Soon, focus will be on what to expect from 2025 with new Republican leadership and the proposed policies for taxes, regulations, immigration and tariffs – and their potential impact on business and economic growth. In general, under a second Trump administration, the U.S. economy could see higher economic growth due to lower taxes and reduced regulation. But Trump’s proposed policies on taxes, tariffs, and immigration could also result in higher inflation, interest rates, and budget deficits.

Tariffs are a key element of Trump’s campaign, and their implementation is highly likely. The main question is to what extent, and to what effect. Economists generally think Trump’s policies on tariffs could have inflationary effects and lead to higher prices, but the extent will depend on how the tariffs are imposed. Goldman Sachs estimates a universal tariff of 10% would raise core inflation by one percentage point.1 In our view, Trump will likely use the threat of tariffs as a negotiating tool but ultimately settle on lower tariff rates, and/or apply tariffs selectively to specific countries and products.

For the insurance industry, the incoming Republican administration – promoting stabilized or lower taxes, lower regulations, and pro-business policies – will likely have neutral-to-positive implications for carriers and brokers.

M&A Market Update

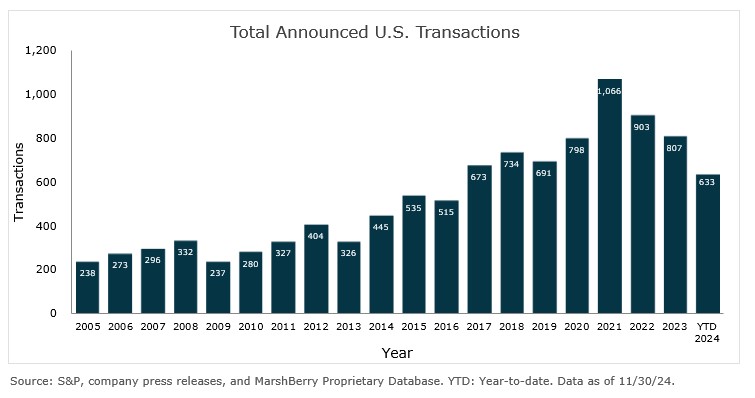

As of November 30, 2024, there have been 633 announced M&A transactions in the U.S. This activity through November is trending 2.5% higher than 2023, which saw 617 transactions announced through this time last year.

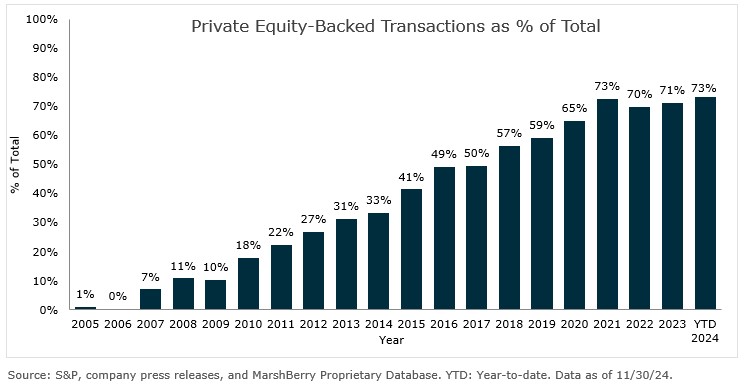

Private capital-backed buyers accounted for 465 of the 633 transactions (73.5%) through November. This represents a substantial increase since 2019 when private capital-backed buyers accounted for 59.3% of all transactions.

Independent agencies were buyers in 103 deals so far in 2024, representing 16.3% of the market, a slight increase from 2023 when independent agency acquisitions represented 15.6% of the market. Transactions in which banks were buyers continued to fall, declining from 18 transactions in 2022 to nine transactions in 2023 – an all-time low. So far in 2024, bank buyers have completed seven acquisitions. Deals involving specialty distributors as targets accounted for 96 transactions, or 15.2% of the total 633 deals in 2024.

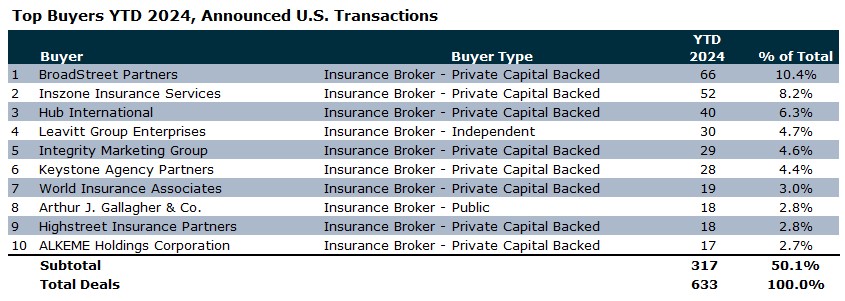

Deal activity from the top ten buyers accounted for 50.1% of all announced transactions, while the top three (BroadStreet Partners, Inszone Insurance, and Hub International) account for 25.0% of the 633 total transactions.

Notable transactions:

- November 4: Hub International Limited (Hub), a leading global insurance brokerage and financial services firm, acquired the retail insurance brokerage business of Western Growers Insurance Services (WGIS). This strategic acquisition enhances Hub’s services in the agribusiness and farm sectors while positioning WGIS for sustainable growth through expanded resources and capabilities. With 10 offices across California and Arizona, WGIS specializes in risk mitigation and management solutions, offering a comprehensive range of insurance products and employee benefits tailored to the agribusiness industry. The acquisition bolsters Hub’s Specialty practices by deepening its expertise in this critical market. MarshBerry served as advisor to Western Growers in the transaction.

- November 13: Hub International Limited (Hub) also acquired the assets of R.K. Gore & Associates, an independent insurance agency based in Lehi, Utah. Specializing in insurance solutions for the residential construction industry, R.K. Gore & Associates enhances Hub’s Specialty practice by bolstering its expertise in construction-focused insurance offerings. Robert Gore, the agency’s owner, and his team will join Hub Southern California and Utah, operating under the name “R.K. Gore & Associates, a Hub International company.” This acquisition aligns with Hub’s strategy of strengthening its industry-specific capabilities and expanding its reach in the construction insurance market. MarshBerry served as advisor to R.K Gore & Associates in the transaction.

- November 21: Higginbotham strengthened its presence in the Southeast by acquiring Fitts Agency, Inc., a family-owned firm with a 150-year legacy in Tuscaloosa, Alabama. With the addition of Fitts Agency, Higginbotham now solidifies its standing as a key player in West Alabama’s insurance market. The partnership aligns the two firms’ shared values of client-centric service, community involvement, and employee development. Fitts Agency, known for its deep expertise and long-standing relationships within the region, brings decades of industry experience and a commitment to professional development. Many of its staff hold advanced certifications, such as CIC, CRM, and CPCU, which have contributed to the agency’s reputation for excellence.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230.