After a strong year in 2024 for insurance brokerage mergers and acquisitions (M&A), focus is now on 2025. The presidential election of Donald Trump in November quickly quelled any fears for potential capital gains tax changes, resulting in many deals getting put on hold in December to delay their timing on paying taxes until 2026.

The 43 deals announced in January is a 48% increase in deals over last January (with 29), most likely the result of several deal holdovers from December 2024.

Optimism continues for strong deal activity in 2025, fueled by an improved economic backdrop of stabilized inflation and lower cost of capital (due to recent interest rate cuts). However, much will depend on the overall health of the U.S. economy going forward, including how the Fed continues to handle monetary policy, and how President Trump’s policies on trade, immigration and regulation impact inflation, business and the labor market. There’s also the continued question on the scheduled expiration of the Tax Cuts and Jobs Act (TCJA) at the end of 2025. Without executive action, the expiration of the TCJA could impact personal income and capital gains taxes in 2026.

Today, the economy feels strong and the debt markets are friendlier to buyers than they were a year ago. Many buyers are currently in the market repricing their debt stack to more favorable interest rates. This movement will create additional cash flow and flexibility for buyers to be aggressive on acquisitive growth in 2025.

M&A Market Update

As of January 31, 2025, there were 43 announced M&A transactions in the U.S. Private capital-backed buyers accounted for 34 of the 43 deals (79.1%) through January. Private capital-backed buyers accounted for 72% of all transactions in 2024. Independent agencies were buyers in seven deals, representing 13.3% of the market, while there were no announced transactions by bank buyers in January.

Deals involving specialty distributors accounted for only 7% of the total deals (three transactions) in January so far, continuing the trend of a low supply of specialty firm sellers.

Sources: S&P, company press releases, and MarshBerry Proprietary Database. YTD: Year-to-date. Data as of 1/31/25.

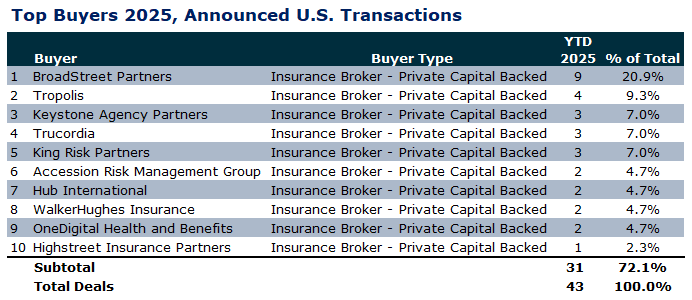

Ten buyers accounted for 72.1% of all announced transactions in the first month of the year, while the top three (BroadStreet Partners, Tropolis, and Keystone) account for 37.2% of the 43 transactions.

Source: S&P, company press releases, and MarshBerry Proprietary Database. Data as of 1/31/25.

Notable transactions:

- January 14: OneDigital acquired the Small Group Benefits division of Mylo, further expanding its comprehensive suite of insurance, financial services, and HR consulting solutions. The acquisition strengthens OneDigital’s presence in the small business segment, serving companies with 99 or fewer employees across national and regional markets. The Small Group Benefits portfolio includes medical, dental, vision, life, disability, accident, and critical illness insurance solutions. These offerings will now be integrated into OneDigital’s platform, ensuring continued service and support for clients. MarshBerry advised Mylo on the transaction.

- January 28: Trucordia acquired CADA Insurance Services, expanding its presence in Louisiana with new offices in Baton Rouge, Chalmette, Gretna, and Kenner. The acquisition strengthens Trucordia’s portfolio of auto, home, commercial, general liability, and workers compensation insurance solutions. This move aligns with Trucordia’s strategy of partnering with high-growth businesses to enhance service offerings and expand market reach. MarshBerry advised CADA Insurance Services on the transaction.

- February 3: Ryan Specialty acquired Velocity Risk Underwriters, a Nashville-based managing general underwriter (MGU) specializing in catastrophe-exposed property risks. Velocity, founded in 2015, provides coverage for perils such as hurricanes, earthquakes, tornadoes, and hail, focusing on small to mid-sized commercial businesses. The $525 million transaction strengthens Ryan Specialty’s underwriting capabilities in property catastrophe coverage, particularly in high-risk areas such as Florida, Texas, and the Southeast. The deal also enhances Ryan Specialty Underwriting Managers’ delegated authority platform while integrating Velocity’s technology, portfolio management, and data analytics expertise. As part of the transaction, Velocity’s wholly owned Excess and Surplus (E&S) carrier, Velocity Specialty Insurance, will be acquired separately by FM, a leading commercial property mutual insurer.