Over the last few weeks, six publicly traded insurance brokers reported results for the fourth calendar quarter of 2021: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW) and BRP Group, Inc. (BRP).

Below are notable themes and takeaways from these earnings reports and recent stock performance.

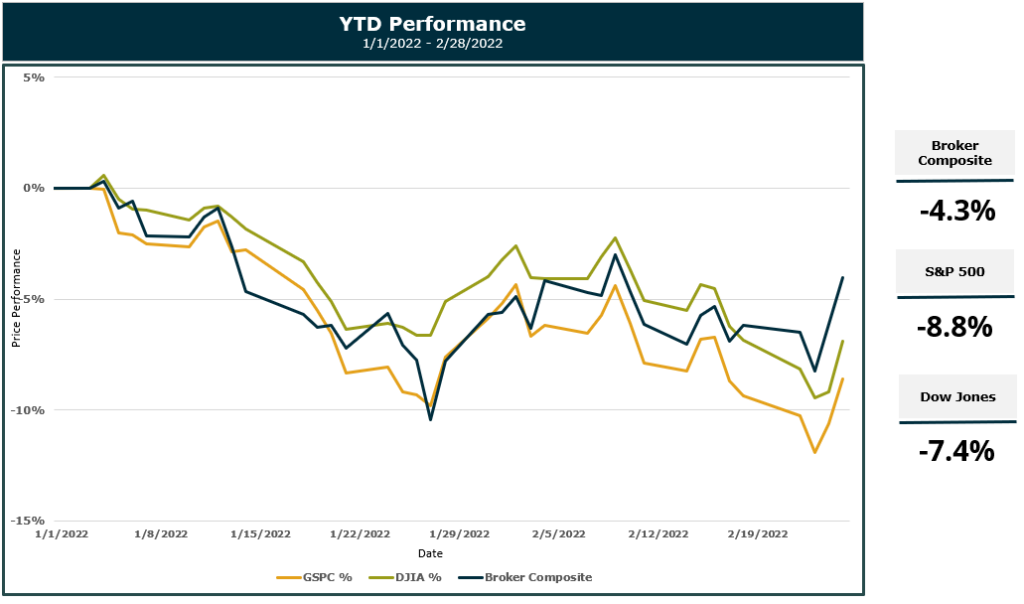

- The broker composite index outperformed benchmark indices year-to-date (through end of February), highlighting the resilience of the insurance brokerage industry. While all the indices illustrated here traded down on concerns around geopolitical conflicts, inflation, tightening monetary policy and other worries, the broker composite outperformed the DJIA and S&P 500.

- Resilience in insurance brokers has been seen previously, in the recent economic disruption of the great recession and the global COVID-19 pandemic. Insurance brokerage firms sailed through these global events with a few light bumps and bruises while other sectors were more heavily impacted. During 2009, the average insurance broker only declined 3.5% in commission income proving the resilience of the industry and prompting the largest influx of capital to enter the insurance brokerage industry ever witnessed.

Outlook: Insurance Brokers are Generally Optimistic About 2022

- Insurance brokers continued to have generally optimistic outlooks for 2022, but noted concerns around rising geopolitical tensions, supply chain issues, monetary tightening, ongoing effects of the pandemic and inflation.

- For 2022, MMC guided on its 4Q2021 earnings call for “underlying revenue growth of mid-single-digit or better, margin expansion and solid growth in adjusted Earnings Per Share (EPS).” The company was optimistic about growth in 2022, driven by factors including projected above-average GDP growth, continued firm property & casualty (P&C) pricing conditions and inflationary impact on exposures.

- On its 4Q2021 earnings call, BRP guided 2022 organic growth coming in at modestly above its long-term 10%-15% target, given momentum around strong organic growth and partnerships.

- AJG projected 2022 organic growth coming in a similar range to 2021’s, driven by both organic and inorganic growth and improving productivity.

Merger & Acquisition (M&A) Appetite is Still Strong in Q1 2022

- There’s still high interest in M&A and competition remains strong for acquisition targets. A number of firms noted that M&A will continue to be a part of core growth strategies. However, rising interest rates could affect activity (depressing valuations), according to some companies.

- BRO CEO J. Powell Brown spoke of expectations for future M&A activity: “Until interest rates increase materially and capital becomes constrained, we expect competition and valuations to remain at peak levels. We continue to feel good about our positioning and have a solid pipeline to attract great companies to join the Brown & Brown team.”

- BRP noted that rising interest rates are likely to have an impact on M&A valuations, which the company believes peaked in 2021 and will “slightly” pull back in 2022, with “signs of modest softening” already being seen in the market this year.

Overall, the fourth quarter results from the insurance brokerage companies came in fairly strong, with general confidence that 2022 organic growth would remain elevated, boosted by economic recovery, continued pricing increases, and contributions from acquisitions and partnerships at many firms.

Subscribe to MarshBerry’s Today’s ViewPoint blog for the latest news and updates and follow us on social media.

MarshBerry is excited to announce it advised more than 95 companies and completed 130 M&A transactions (83 sell side/47 buy side) in 2021, closing another record year for the firm. MarshBerry continues to remain the number one sell side advisor for the 23rd year in a row and retains the top spot in the industry for total number of clients advised.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, LLC. 28601 Chagrin Boulevard, Suite 400, Woodmere, Ohio 44122 (440.354.3230)

This earnings summary has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information.

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.