Even as U.S. inflation continues to track sideways, forcing the Federal Reserve (Fed) to revise its plans for rate cuts – now signaling just one cut in 2024 – merger and acquisition (M&A) activity in the insurance brokerage space continues at an active pace. This pace is expected to continue as we get closer to the presidential election, the outcome of which could impact capital gains tax rates in 2025.

Buyers are motivated by the potential for more affordable debt should the Fed cut rates and the number of attractive firms who are performing beyond hard market-driven premium growth. Sellers are eyeballing the potential tax implications of selling in 2025, motivating them to consider a sale in 2024. And while inventory has increased, there is still outsized demand by buyers seeking quality partners that will make them better and even more competitive.

M&A Market Update

As of May 31, 2024, there have been 242 announced M&A transactions in the U.S. This is 7% higher than the 226 transactions announced through this time last year.

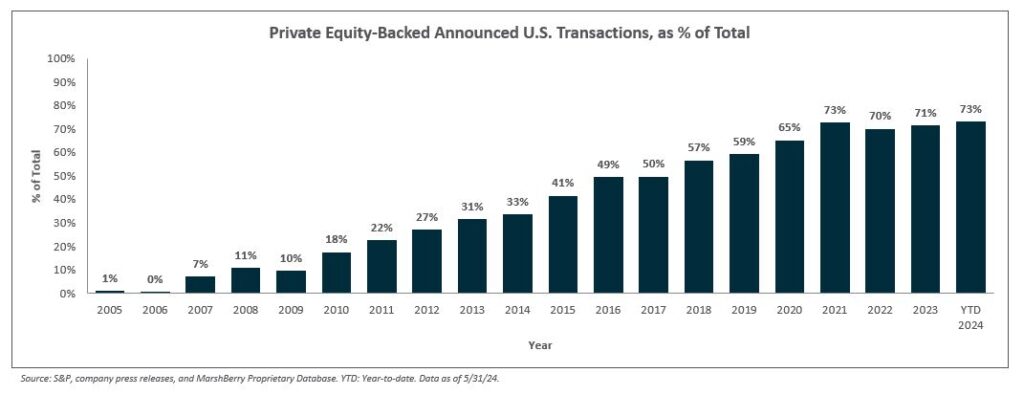

Private capital-backed buyers accounted for 177 of the 242 transactions (73.1%) through May. This represents a substantial increase since 2019 when private capital-backed buyers accounted for 59.3% of all transactions.

Independent agencies were buyers in 35 deals so far in 2024, representing 14.5% of the market, a slight decrease from 2023 when independent agency acquisitions represented 15.6% of the market. Transactions in which banks were buyers continued to fall, declining from 18 transactions in 2022 to nine transactions in 2023 – an all-time low. So far in 2024, bank buyers have completed only two acquisitions through May.

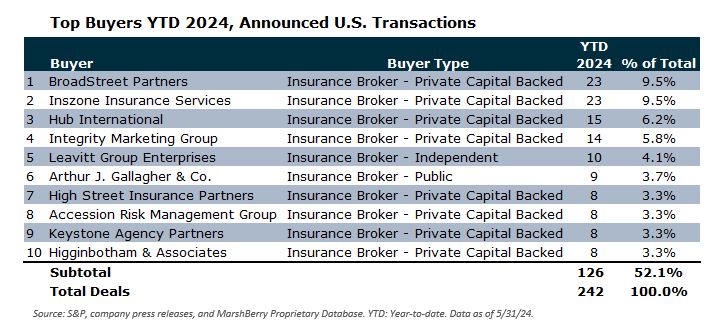

Deal activity from the top ten buyers accounted for 52.1% of all announced transactions through May, while the top three (BroadStreet Partners, Inszone Insurance, and Hub International) account for 25.2% of the 242 total transactions. For comparison, the top 10 buyers in all of 2023 accounted for 41.9% of total transactions, with the top three representing 16.2%.

Notable transactions:

M&A Market Update

- May 1: Hub International announced it acquired Merriwether & Williams Insurance Services (MWIS), enhancing their commercial insurance and risk management capabilities. MWIS, which offers contractor development, bonding programs, and special project consulting, will maintain its local management and client relationships while gaining access to Hub’s global resources. Founder Ingrid Merriwether will continue as president of Aligned Risk Management within Hub’s Central & Northern California unit. This partnership aims to expand MWIS’s reach and effectiveness in supporting contractors and public agencies in diverse communities. MarshBerry served as an advisor to MWIS on this transaction.

- May 6: USI Insurance Services acquired Hignojos Insurance Agency, a Texas-based firm specializing in commercial and personal risk insurance. Founded in 2009, Hignojos will continue to serve its clients with local, personalized service while gaining access to USI’s broader range of innovative solutions and expertise. Louis Hignojos Sr. expressed enthusiasm about the merger, highlighting the benefits for their clients in western Texas. John Collado, USI’s Regional CEO, emphasized the expansion of their Texas presence and the integration of Hignojos’ team into the USI network.

- May 9: Alera Group has acquired Texas-based Trimble-Batjer, an established agency founded in 1883 that specializes in surety and bonds, business solutions, employee benefits, and various insurance coverages. This acquisition will enable both companies to enhance their value and expand resources for clients while preserving the personalized service and local expertise Trimble-Batjer is known for. The Trimble-Batjer team will remain in their current roles, continuing to serve clients.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230.