Is now the time to consider a sale of your business that would allow you to partner with a more robust firm? It’s a perennial question no matter the market. As a wealth management advisor, you’re constantly making decisions for your clients about when to buy and sell based on historic performance, analytics, research, and business intelligence. Part of what makes you highly successful is an ability to remove emotion from these decisions – avoiding common human cognitive and psychological biases that lead to investment mistakes.

But when we talk about perpetuation planning for your own business and legacy, separating the emotional and operational components while optimizing the value of your business is a different story. For most, it’s nearly impossible. It’s like a realtor selling their own home, and making decisions based on personal and emotional attachments, rather than market conditions and industry metrics. As an advisor and business owner, grappling with the question, “Should I seek a strategic partner now?” does involve emotional biases. How could it not?

Strategic Partnerships Let You Sell on Your Terms

Here are five things to help you make an informed decision:

- Selling Decisions Require Data

- What the Market Data Really Says

- Private Equity is Bullish

- A Strong Business Always Has Value

- The Decision to Sell is Yours

Sell With Data Not Fear. As the economy struggles with a soaring inflation rate, increased interest rates, and the stock market in a relative slump, there’s a push-pull battle occurring for firms trying to decide on their next strategic step for financial, operational, and staffing goals. Some firms are convinced if they don’t sell their business now, the economic environment will only decline – and they’ll miss an opportunity. Others who might be in an ideal position to sell – may not pull the trigger, figuring they will ride out the market and see what tomorrow brings.

Would you allow your clients to make a decision based on emotion, rather than data? No. And you shouldn’t either. Important decisions such as this require a strong plan, one based on historic performance, analytics, research, and business intelligence.

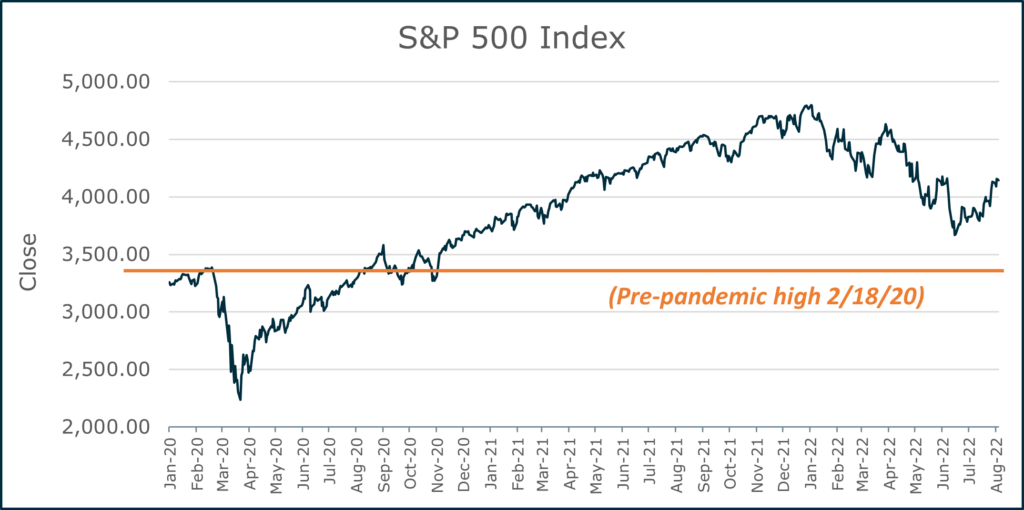

What the Market Data Really Says. While the stock market seems to be in a slump, this is by no means a “sky is falling” scenario. In fact, the S&P 500 is still in high territory and up by 22.4% (as of 8/8/22) from its pre-pandemic high on 2/18/20.

And as interest rates are starting to rise, take a look at historic rates over time. They are still comparatively low and haven’t reached a point of impacting debt decisions.

Source: https://fred.stlouisfed.org/series/FEDFUNDS. Data as of 8/1/22

Private Equity is Bullish. Private equity (PE) is investing heavily in the wealth management space and there is plenty of unused capital to support continued strong valuations and demand. In the last four years, over 40 RIAs with an excess of $1B in assets under management have received PE funding. Many of the advisory firms receiving PE funds are focused on building infrastructure, services, capabilities, and technologies to attract RIAs with the promise of delivering a higher level of service to advisors and their clients. They are developing the business tools and processes wealth management firms need to deliver value to the modern client who expects highly personalized, real-time service.

A Strong Business Always Has Value. If you operate a fundamentally strong business, now is as good a time as any to partner with an organic growth advisor to gain more scale, or to monetize the business and move on to a next chapter. If you’re managing a firm with strong organic growth, demonstrate new client development and are delivering value-added capabilities to gain a greater wallet-share from clients, your business is desirable in any market condition – bear or bull. In fact, a market slump can expose vulnerabilities and tease out the stronger firms from those that are perhaps complacent or not reinvesting in operations. When the market is up and assets are growing, it can tend to hide weaknesses. The existing economic environment shines a bright light on those who have focused on long-term, sustainable organic growth and can make them more valuable to a buyer for a potential merger or acquisition strategy. For an outside perspective of where your firm stands, MarshBerry offers a full suite of market intelligence insights to help guide your firm forward.

The Decision To Sell is Yours. The bottom line is, rather than timing your decision to sell based on market dynamics, instead consider whether now is the time for you. A strategic partnership to sell your agency can unlock more organic growth, allow you to plug into robust infrastructure and capabilities, and give you the freedom to focus on what you love most about wealth management: helping people. Strong businesses will always be in demand.

So, is now the right time to sell? If you think you are ready to start the conversation about exploring strategic partnerships or would like to learn more about how MarshBerry can help expand your wealth management portfolio, please email or call Kim Kovalski, Managing Director, at 440.769.0322.

Sources: Source: MarketWatch. Data as of 8/8/22; https://fred.stlouisfed.org/series/FEDFUNDS. Data as of 8/1/22

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

MarshBerry is your trusted advisor in the wealth industry.

MarshBerry is a leading sell side advisor in the financial services industry with specialty practices in insurance and wealth management. Our advisory and consulting practices support advisors throughout their business lifecycles and include sell-side advisory, perpetuation planning, equity and debt capital raises, business and strategic planning, valuations, and industry benchmarking. Learn more about MarshBerry’s Wealth Advisory services.