A noteworthy trend in the specialty distribution merger and acquisition (M&A) market is the growing buyer demand for life and health (L&H) distributors. Specifically, an increasing number of buyers are driving heightened acquisition activity of Brokerage General Agents (BGAs), General Agents (GAs), Insurance Marketing Organizations (IMOs), Field Marketing Organizations (FMOs), and Managing General Underwriters (MGUs) in the L&H space. Although this trend isn’t new, it’s impressive when set against the overall decline in M&A volume for specialty firms in 2024. Historically, L&H brokers garnered limited attention when compared to the broader insurance broker landscape, but a shift has emerged in recent years.

Four years of market share expansion

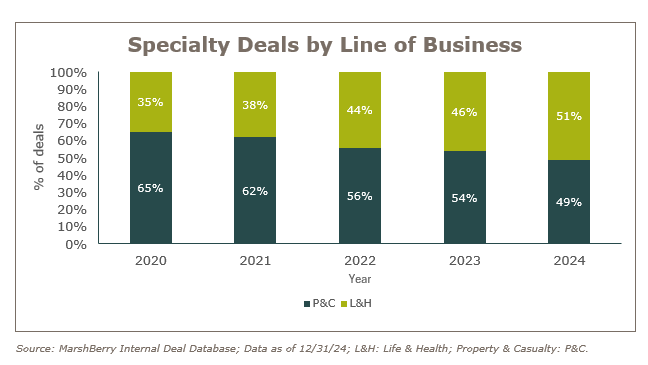

Historically, property & casualty (P&C) firms dominated specialty deals, but now L&H focused distributors have taken the lead in the specialty sector. L&H-based transactions have risen from 35% of specialty deals in 2020 to 51% of deals in 2024. As shown in the chart below, there’s been a steady year-over-year increase in market share with a compound annual growth rate (CAGR) of 10% since 2020. For the first time since MarshBerry has tracked this statistic, L&H specialty distributors made up the majority of deals in the specialty space this past year. This strong momentum has been propelled by a variety of factors.

The story behind the numbers

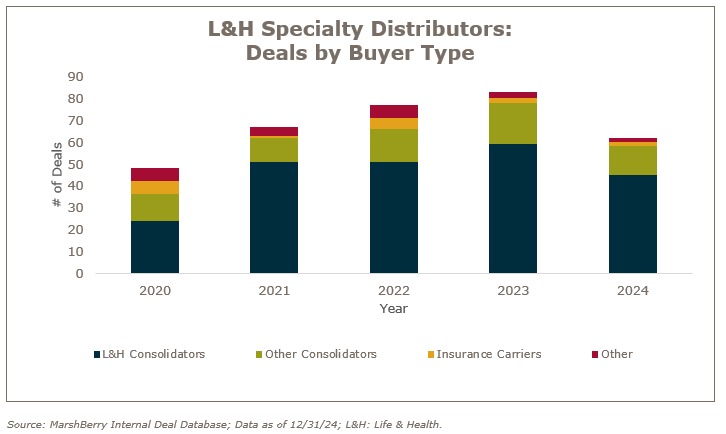

The trend is being driven by a handful of large L&H-focused aggregators, as well as established P&C consolidators entering the L&H space. These established consolidators are seeking new growth strategies as the market for more traditional P&C-focused firms has become increasingly competitive. As a result, these consolidators have turned toward L&H as a means of continuing their growth trajectory, diversifying operations and ultimately, generating returns for investors. In addition, L&H specialty firms offer a unique range of products and expertise, giving the buyer opportunities to attract more clients and cross-sell within their existing client base. Finally, the increasing demand for L&H firms is paired with a relative lack of supply, resulting in a decrease in deal volumes in 2024. The smaller number of potential sellers has driven heightened competition among the growing L&H buyer community, which, in turn has driven increasing valuations.

The growing buyer community

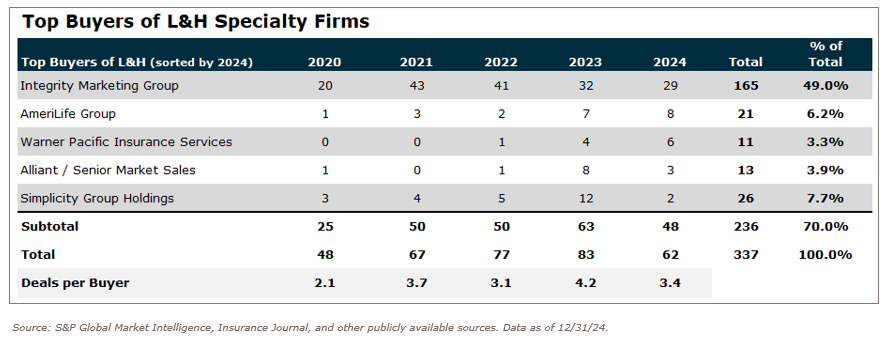

The table below presents the top buyers in 2024 based on deals closed in the L&H specialty distribution space. The top two buyers, Integrity and AmeriLife, were also the top buyers across the specialty marketplace as a whole. Notably, private equity (PE) backed firm AmeriLife went from completing just one deal in 2020 to closing seven in 2023 and eight in 2024, following AmeriLife taking on new capital from Genstar Capital in 2022. Similarly, PE firm Lovell Minnick invested in Warner Pacific in 2022, and they subsequently became an active buyer, with six deals closed this past year. Other buyers have strategically entered the marketplace over the past several years, contributing to the growing market share of M&A transactions for L&H distributors.

Looking forward

In 2025, the level of specialty acquisition activity is predicted to rebound across both the L&H and P&C sectors. Other transformative forces, such as technology innovations, economic conditions, capital costs/availability, or buyer appetite may influence shifts in the pattern, but MarshBerry expects another strong year of consolidation for L&H specialty distributors.