As a firm leader, it can be lonely at the top. While service staff maintain accounts, production staff drum up new business, and managers run the day-to-day; leaders in the C-suite are left with isolating responsibilities like long-term planning, strategic staffing decisions, and firm perpetuation. For many reasons, these responsibilities can’t be socialized with the whole staff, but decisions can affect the fate of the entire company. So how do you know you’re making the right decisions and setting forth the best strategic plan?

Peer to Peer Network

Those that are part of an executive peer to peer network know that their participation is the best way to go from lonely-at-the-top to CONNECTED-at-the-top. A peer network (noun) is different than the act of networking (verb). At networking events, attendees swap business cards and share a drink at happy hour to increase their centers of influence. Peer network participants roll-up their sleeves and open the figurative kimono to their firm’s goals, challenges and best practices. Imagine sitting in a room with over a hundred firm executives. Someone else in that room has likely already changed agency management systems, perpetuated from their parent, or any of the other business decisions on your priority list for the year. Wouldn’t it be helpful to hear about those other executives’ experience: the mistakes they made, or what they would do differently next time?

Peer to Peer Network Advantages

The best peer networks offer more than sharing experiences. The best peer networks offer benchmarks, accountability, and objective results; otherwise, how can you measure your return on dues investments and ultimately determine we’re better together?

BENCHMARK

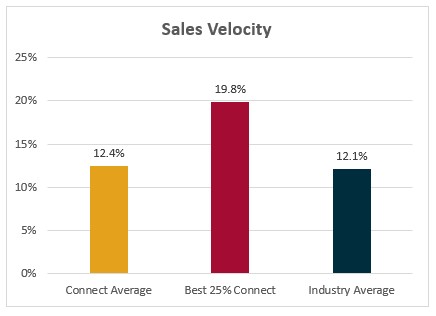

Without benchmarks, it’s easy to mistakenly assume the loudest voice in a peer network is the smartest. MarshBerry’s Connect network participants contribute to a quarterly data collection exercise, which includes financial statements, production book, and employee roster data. Each quarter, members receive 600+ benchmarks from MarshBerry’s proprietary financial management system, Perspectives for High Performance (PHP), to better understand how they compare to their network peers as well as the industry overall. These reports make it easier to identify the areas for firm improvement on a consistent basis. For example, the insurance industry’s average sales velocity (new business as a percentage of prior year commissions and fees) is 12.1%, but the best quartile of MarshBerry’s Connect members have a sales velocity of 19.8%. What are those top firms doing to increase and maintain such a healthy sales velocity? Is there a specific initiative those firms have implemented to generate predictable profitable organic growth (PPOG)? The benefit to participating in a peer network with benchmarks is getting answers to these types of questions as opposed to empty rhetoric.

ACCOUNTABILITY

Without accountability, peer network meetings are merely a boondoggle to talk shop. MarshBerry’s Connect network members attend at least two in-person summits a year and are challenged to identify one to three action items to complete before the next meeting. For example, a firm about to cross the 50-employee threshold may realize through peer discussion it’s now necessary to hire a designated HR professional to better manage new compliance requirements like FMLA. MarshBerry consultants keep record of action items like these to solicit updates on progress at the next meeting. A former 18-year member shared, “The accountability [from the peer group] is what keeps you focused. You don’t want to come back and admit you didn’t get your action items done.”

OBJECTIVE RESULTS

Without objective results like tangible growth or increased profitability, spending money on peer network dues is a draining expense that does not recuperate value. For example, another long-term MarshBerry Connect member increased their revenue by 95% in less than ten years before perpetuating externally. When asked what the key was to that firm’s exponential growth, the President shared that their Strategic Issues Group (SIG) peers provided ‘informed encouragement’ to tackle action items like expanding internal perpetuation opportunities, raise the average account size and focus on talent. “As soon as we did that, revenue doubled even during the Great Recession!”

MarshBerry understands it can be difficult to take time away from the business to work on the business. Participating in data collection exercises and completing action items might feel like another task to add to your to-do list, but isn’t that extra effort worth it if the outcome could be as enormous as doubling your firm’s revenue?

If you have questions about Today’s ViewPoint or MarshBerry’s approach to peer exchange, email or call Brooke Lugonjic at 616.828.0741.

MarshBerry 360 Forum – Registration Now Open!

Join MarshBerry for a day of learning, networking, and strategizing with leading growth consultants, analysts, and industry experts. Sessions are designed to help improve firm performance, earnings, value, and market resiliency. In addition, gain valuable insights, methodology and resources from MarshBerry’s team of in-demand industry speakers.

Seating is limited and reserved on a first-come, first-served basis. Reserve your spot now at www.MarshBerry.com/360.

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.