September has seen some of the most volatile financial markets of the year. Some of it has been the reaction to the most recent jobs report, which showed slowing job growth and rising employment. Some of it may be in anticipation of the Federal Reserve’s (Fed) meeting on September 18th, in which the Fed is expected to cut the federal funds rate.

The big question is – by how much? Most are expecting 25 basis points. But there are those that are calling for 50 basis point cut, pointing towards four consecutive months of rising unemployment. In either case, an interest rate reduction should trigger a rush on debt capital borrowing for everything from auto loans, home mortgages, and merger and acquisition (M&A) opportunities.

M&A Market Update

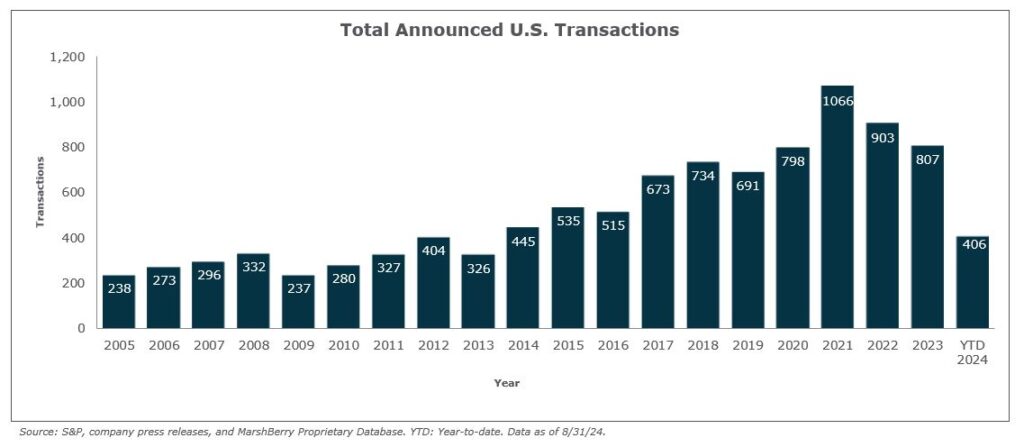

As of August 31, 2024, there have been 406 announced M&A insurance brokerage transactions in the U.S. Activity through August is trending higher than the start of 2023, which saw 379 transactions announced through this time last year.

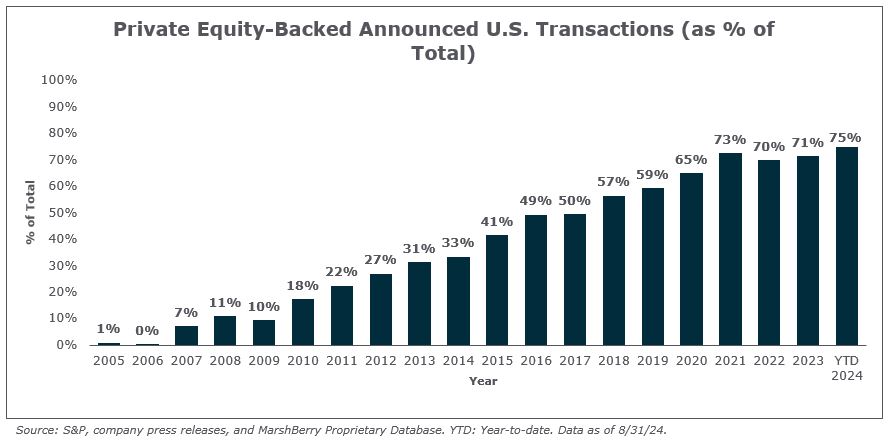

Private capital-backed buyers accounted for 304 of the 406 transactions (74.9%) through August. This represents a substantial increase since 2019 when private capital-backed buyers accounted for 59.3% of all transactions.

Independent agencies were buyers in 58 deals so far in 2024, representing 14.3% of the market, a slight decrease from 2023 when independent agency acquisitions represented 15.6% of the market. Transactions in which banks were buyers continued to fall, declining from 18 transactions in 2022 to nine transactions in 2023 – an all-time low. So far in 2024, bank buyers have completed two acquisitions.

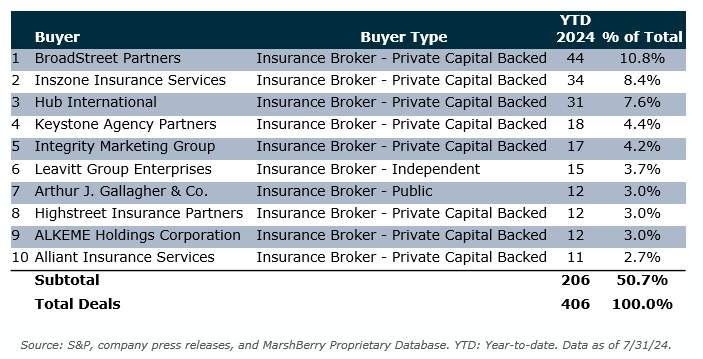

Deal activity from the top ten buyers accounted for 50.7% of all announced transactions, while the top three (BroadStreet Partners, Inszone Insurance, and Hub International) account for 26.8% of the 406 total transactions.

Top Buyers YTD 2024, Announced U.S. Transactions

Notable transactions:

- August 6: King Insurance Partners has acquired Lincoln Insurance Group, an independent insurance agency based in McDonough, Georgia, with over 70 years of experience. Lincoln Insurance Group is known for providing auto, home, life, and business insurance through partnerships with multiple carriers, offering personalized and affordable solutions.

- August 15: PCF Insurance Services, a top 20 U.S. insurance brokerage, has acquired Asset Insurance Agency, a firm based in Peabody, Massachusetts. PCF Insurance CEO Felix Morgan highlighted that the acquisition aligns with the company’s strategy by adding an experienced team that shares their collaborative culture and commitment to growth and service excellence. Asset Insurance Agency offers auto, home, commercial, and life insurance solutions across six states in the Northeastern U.S. and Florida. Through this acquisition, Asset’s clients will gain access to PCF’s broader range of coverage options, competitive pricing, and additional services such as risk management and claims advocacy. MarshBerry served as an advisor to PCF on this transaction.

- August 19: Ryan Specialty (NYSE: RYAN), a leading international specialty insurance firm, has signed a definitive agreement to acquire certain assets of Greenhill Underwriting Insurance Services, LLC from Alera Group, Inc. Greenhill, founded in 2014, is a technology-enabled managing general underwriter specializing in small-to-mid-sized allied healthcare policies, including coverage for home healthcare, physical therapy, and social service organizations. Greenhill operates in the surplus lines market and uses its proprietary technology, Triton, to manage the entire policy lifecycle. Greenhill will join Sapphire Blue, Ryan Specialty’s healthcare managing general underwriter. MarshBerry served as an advisor to Greenhill on this transaction.

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help your firm determine its path forward, please email or call Phil Trem, President, Financial Advisory, at 440.392.6547.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230.

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2024 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.