It’s a quarter of the way into a year that has been projected to see an “economic slowdown” — perhaps even a recession — and yet the indicators and markets don’t seem to be aware of the plan. Even as the Federal Reserve (Fed) continues to push the agenda with another 0.25% increase to the Federal Funds Rate in March, there is no clear sign that inflation, hiring trends, or the financial markets intend to slow down.

Even the recent bank collapses of Silicon Valley Bank and Signature Bank in early March seem to be receding from investor memories quicker than anticipated, with the major U.S. markets ending Q1 2023 in positive territory. At the close of March, the S&P 500 rose 7%, the Nasdaq was up nearly 17%, and the Dow Jones just finish above water at 0.4% for the quarter.1

So much for an economic slowdown.

A nice start for insurance distribution M&A in 2023

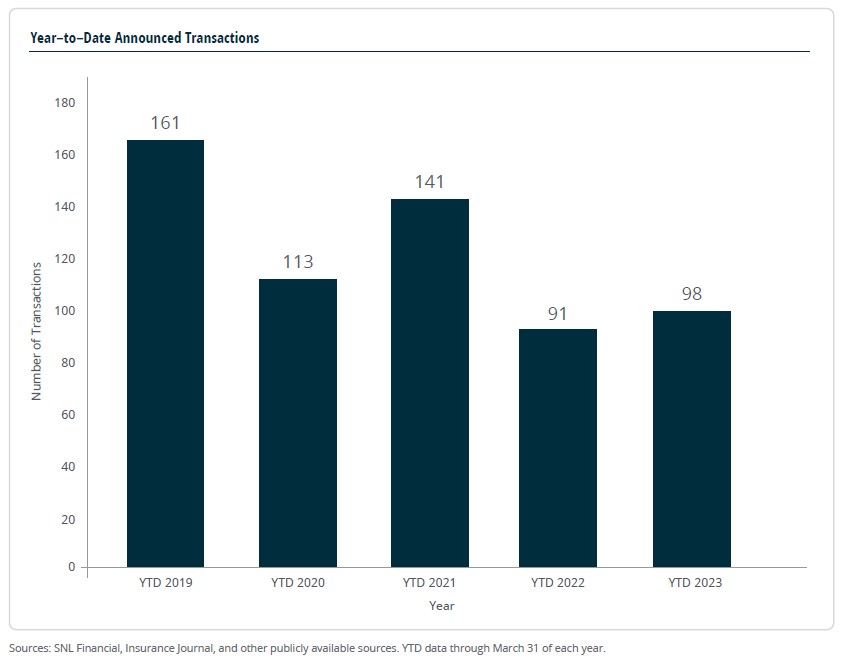

As of March 31, 2023, there have been 98 announced insurance distribution merger & acquisition (M&A) transactions in the U.S. — a 7% increase in total deals compared to this time in 2022, which ended Q1 with 91 transactions.

Private capital–backed buyers have accounted for 73 of the 98 transactions (74.5%) through March, which is consistent with proportion of announced transactions over the last five years. Total deals by these buyers increase at a Compound Annual Growth Rate (CAGR) of 26.9% since 2018. Announced transactions by independent agencies have continued to decline as a percentage of total transactions since 2021. On average, 23.1% of deals were done by independent agencies from 2018–2021 compared to 12.6% in 2022 and 12.2% to start 2023. High valuations and availability of capital could be the main drivers for the decline in independent agency share in deal activity.

Strong deal activity from the marketplace’s most active acquirers has remained constant to begin 2022. Ten buyers have accounted for 51% of all announced transactions observed, while the top three account for 21.4% of the 98 total transactions.

Are valuations starting to plateau?

Insurance M&A seems to take the economic environment with a grain of salt, understanding that at the end of the day — everyone still needs insurance. That’s not to say this industry is immune to the impact of economic factors, or that they are ignored. It’s just that adjustments can be made, and this industry has a long history of resiliency.

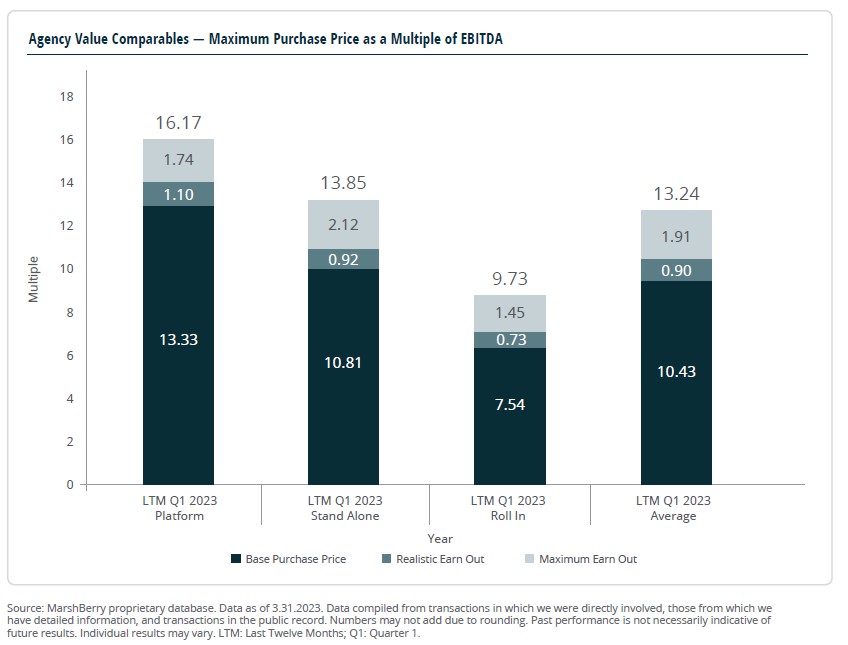

One of those adjustments may be in the form of valuations starting to plateau for average firms. The average deal value, on a guaranteed basis, for the last twelve months (LTM) ending Q1 2023 is 10.43x Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA) — down 2.6% compared to year end 2022 (10.43 vs. 10.71). However, platform agency values are actually up slightly, on a guaranteed basis, by 1% compared to year end 2022 (13.33 vs. 13.20). Considering margin of error, both metrics are basically flat year–over–year. A sign that we might have seen a flattening of valuations.

Buyers are looking at potential targets who they believe can make them better and help give them a competitive advantage. Proven growth is still the biggest differentiator for buyers, and they are looking for agencies who already have the right tools and capabilities, but just need a partner to help them grow even more.

Because of this, valuations for premium quality firms are higher than they’ve ever been — while valuations for average firms are starting to plateau or even decline in some areas. With the continued rate increases, firms that are showing organic growth below industry averages will likely struggle to find valuations that the industry has benefited from over the past 36 months.

It’s likely that this will be another strong year for M&A activity — the industry will continue to watch the economic conditions unfold in 2023 and make adjustments as needed.

Explore Insurance M&A Advisory Services in 2023

If you have questions about Today’s ViewPoint, or would like to learn more about M&A activity or M&A advisory services for insurance agents and brokers, please email or call Phil Trem, President – Financial Advisory, at 440.392.6547.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230