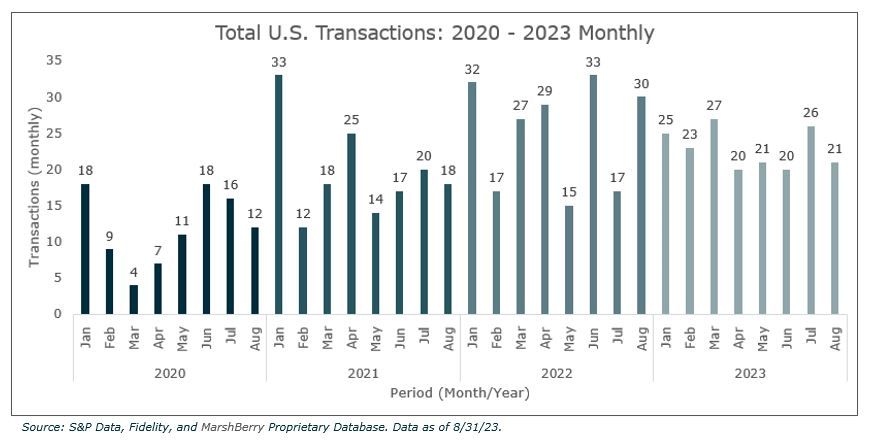

With 21 announced wealth advisory merger and acquisition (M&A) transactions, August 2023 brings the year-to-date (YTD) total deal count up to 183.1

August experienced a slight dip from July’s deal count, which was the second largest number in 2023 with 26 deals. This month was also down compared to August 2022, which delivered a whopping 30 deals closed.

On an absolute basis, YTD the gap between 2022 and 2023 is now 17 deals. This is the same amount of variance from June 2023. This highlights the importance of not overly scrutinizing month-to-month results and why MarshBerry tries to look at monthly variation through a more macro lens.

The average monthly transactions in 2023 is a little under 23 deals per month. Annualized total deal count would be approximately 275 deals for the full year 2023. This aligns with the annualized projections made in June (end of Q2 2023) which also estimated 275 deals. This reinforces the consistency and stability of wealth advisory M&A activity in 2023.

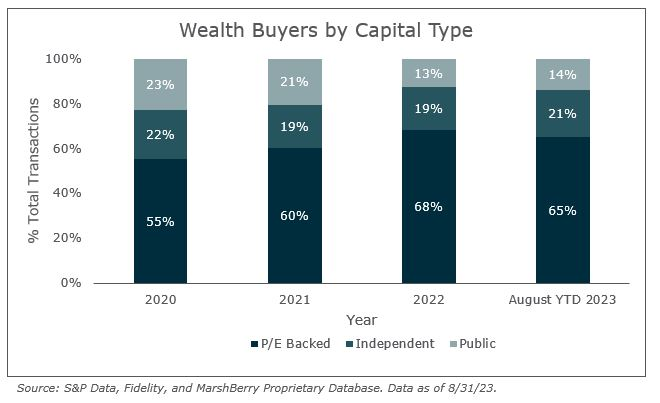

Private equity continues to lead buyer types

Private equity-backed buyers continue to account for most transactions with 120 of the 183 wealth advisory transactions (65%) YTD in August 2023, as they continued expanding their presence in the marketplace. Independent firms account for 38 of the total deals (21%), with public firms making up the remainder with 25 deals (14%) YTD.

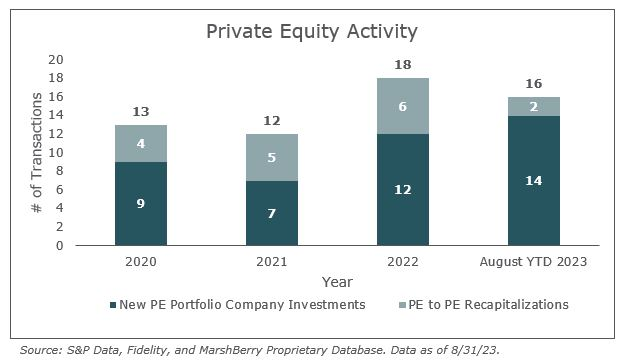

Since 2020, the number of private equity investments in wealth advisory firms has been on the rise. In full-year 2022, 18 firms received new private equity-backed investment, up from 12 the previous year. Through August 2023 there were 16 private equity investments, of which new money investments represented 14 while two of the transactions were private equity recapitalizations.2 If this trend continues, 2023 may hit a record for private equity investment in wealth firms.

Deal spotlight: Summit Wealth Advocates acquired by Avantax

August 22, 2023: Avantax, Inc. (Avantax), a national tax-focused financial planning and wealth management firm, announced their acquisition of Minnesota-based wealth management firm Summit Wealth Advocates (Summit). Summit had approximately $330 million in client assets. Bruce Primeau, who founded Summit in 2010, was attracted to Avantax because of their tax-intelligent approach to financial planning and wealth management and their long history of success.

Michael Molnar, SVP of Corporate Development, M&A and Succession Planning at Avantax stated his views on why the transaction was important to the firm: “Bruce and team share a similar philosophy in serving clients as we do at Avantax – a holistic approach to financial planning with a focus on integrating the implications of tax. When there is a philosophical fit like this, there’s a good shot we are going to create a lot more value together than apart, and that’s the foundation of a great deal for everyone involved.”

Avantax is a publicly traded firm (NASDAQ: AVTA) that emphasizes the tax component of financial planning and wealth management. They have two separate business models. As of June 30, 2023, Avantax has more than $83 billion in client assets. Todd Mackay, President of Avantax Wealth Management stated: “Flexibility is the power of our multiple affiliation model… We have decades of experience working in an employee-based RIA model, especially serving large accounting firms looking for a proven planning and wealth management partner.”

Looking forward

Stay tuned for next month’s report on September’s deal count and an overall wrap-up of Q3 2023. Last year September 2022 saw a significant drop in deals with 23, down from 30 in August. MarshBerry continues to be cautiously optimistic and will closely monitor the market. Only time will tell what will happen next month.

Frequently Asked Questions About M&A Deals for Wealth Advisory Firms

How do M&A deals in wealth advisory affect the broader financial industry?

M&A deals in the wealth advisory sector often have ripple effects throughout the financial industry. Understanding these impacts can provide a comprehensive view of how the August dip may have influenced related markets and stakeholders.

1 There is a general caveat about timing of deals being reported that could affect the distribution.

2 Recapitalization refers to activity where one outside investor acquires the position of, in whole or just a part of, the position of another outside investor, oftentimes adding additional capital.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2023 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.