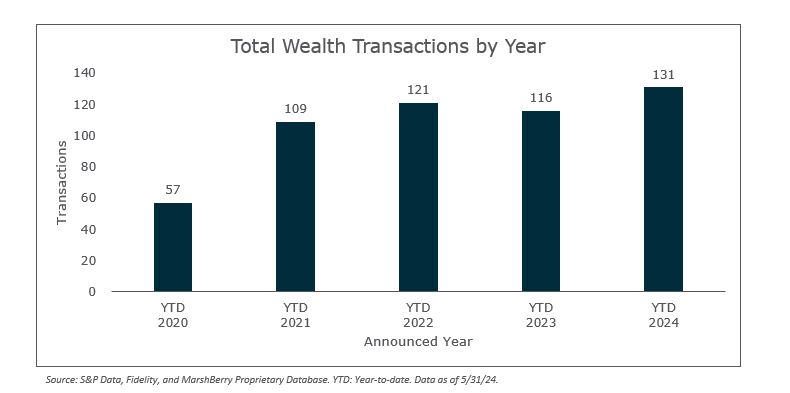

May brought about another solid month of activity with 23 merger and acquisition (M&A) deals closed, which increased the 2024 YTD deal count to 131. This is ten deals higher than 2022 and 15 deals higher than 2023, an increase of 8% and 13%, respectively.

2024 is beginning to extend its lead over prior years. Much like running a marathon, it is important to increase at a steady rate and not overextend too early, but MarshBerry has an optimistic view on deal activity for the remainder of the year. Once again, the 2024 YTD total deal count is the highest on record and continues to support our thesis that deal appetite and volume is here to stay. As referenced above, the gap between 2024 and the prior years is increasing more and more.

There was a slight decrease in private capital-backed buyers. The total dropped from 76% of deals closed through April to 71% of the 131 transactions through May. Even with a slight decrease, private capital-backed buyers continue to maintain their overall dominance of the marketplace. Independent firms saw an increase from 19% of total deals through April to 24% of total deals through May. Public firms continued to maintain their 5% of total deal activity. MarshBerry anticipates this percentage to rebound as the year progresses.

The return of buyer diversification is appearing to stick. Again, the top ten buyers collectively represented close to 36% of all announced transactions, a notable decrease from February when they accounted for nearly 50%. The top three buyers (Focus Financial Partners, Waverly, and MAI Capital Management) comprise nearly 15% of the total 131 transactions. This resurgence in buyer diversity signals a healthy appetite within the market.

Notable transaction:

May 9: New York, NY-based Wealthspire Advisors (Wealthspire) has acquired Beachwood, OH-based Walden Wealth Partners (Walden). Walden, a female-owned, led, and operated firm, was established in 2015 and has approximately $420 million in assets under management (AUM). The firm specializes in providing sophisticated financial advisory and investment management services that are designed for affluent individuals and families. These services include comprehensive financial planning and fiduciary consulting for retirement plan sponsors, trustees, and charitable organizations. The acquisition enhances Wealthspire’s presence in the Midwest by establishing a new location in the Cleveland metro area. MarshBerry served as the advisor for Walden.

Phil Trem, MarshBerry President of Financial Advisory had this to say about the transaction: “We are thrilled to have advised Walden in their acquisition by Wealthspire Advisors. This strategic move underscores our commitment to facilitating transformative transactions that drive growth and value for our client. Walden’s decision to join forces with Wealthspire Advisors is a testament to the strength of both firms and their shared vision for the future. We are proud to have played a role in this successful transaction and look forward to seeing the continued success of the combined entity.”

Read more about this transaction.

Looking forward

As we near the midpoint of the year, buyer interest shows no signs of waning. MarshBerry continues to maintain a positive outlook for 2024 along with foreseeing the possibility of a record-breaking year that is fueled by the strong transaction data thus far. This optimism stems from several economic factors, such as the upcoming presidential election which could bring about regime changes, anticipated stability in interest rates making capital more accessible, and the aging population of advisors. MarshBerry continues to closely monitor these factors and their impact on M&A activity both for this year and in the future. Stay tuned for our Q2 report which will dig deeper into industry trends and uncover insights on projections for year-end deal volume.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230