Creating value in your business is always difficult, but hard markets can make it seem impossible. FirstChoice, a MarshBerry Company, recently hosted a webinar to address the challenges many insurance agencies are facing and discussed some strategies that independent agencies can use to navigate this hard market.

Here are some of the key takeaways:

Know the hard market trends

The insurance market operates in a cycle and this is one of the hardest markets since 2004. Between the impact of high inflation, unpredictable weather patterns, higher risks and decreasing profitability – many agencies, and their clients, are experiencing unique challenges for the first time.

Communicate like a trusted advisor

As an independent agency, you’re a trusted advisor to your clients. Reinforce your value and dependability by communicating proactively. Reach out to clients before they call you to let them know what’s happening in the market. Share that rates are increasing across the board, there are fewer options for coverage, and possibly reductions in insurance benefits. Demonstrate that you recognize what’s going on in this difficult economic environment and will look to provide solutions that are in their best interest.

Make proactive renewals

Part of effective communication is educating your clients. Explain why renewing now is the best choice for them, not just your business. Inform them that everyone is experiencing higher rates and coverage issues, so switching carriers or agencies won’t solve the problem. Review coverages, limits and possible discounts to provide the best support for their decision. You can also discuss how hard markets are temporary, so a positive shift will eventually happen.

Partner with the right carriers

In this climate, carriers have some tough decisions to make. For example, State Farm, Allstate, Nationwide and many others have announced slowdowns in new business or increased underwriting guidelines. Conduct due diligence on who you partner with and be cautious when considering new carriers: do they have financial stability and the ability to pay claims? Do they have an “A” rating as a carrier? Is this j someone with staying power? Remember that long-term relationships matter to carriers. Who do you want to work with 5, 10, 15 years down the road?

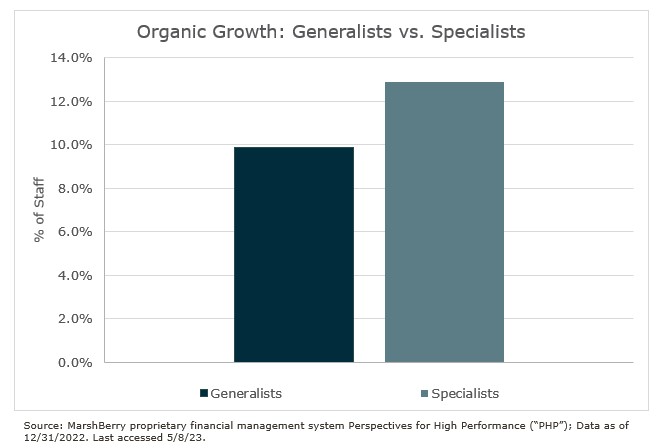

Become a commercial specialist

As much as insurance agencies want to help everyone, some clients just aren’t the right fit. Start by looking at your top 20 accounts. Where are they located? What industries are represented? What products or coverages are sold? Questions like these can help you determine which customers fit your specialty – and which customers should shop elsewhere. Becoming a specialist often leads to stronger growth.

Consider the future

Identify growth mechanisms that can help you prepare for the market shift, such as new talent acquisition, evaluating your culture, or adjusting your marketing strategy. While it may not make sense to spend money on marketing right now, you can prepare your strategy for when the hard market begins to turn. Get ready now to hit the ground running when the economy improves.

Is FirstChoice, a MarshBerry Company, right for you?

FirstChoice, the next generation agency network model – provides direct carrier access, high value resources, assets that enable independent agencies to scale their business, talent development support, and agency differentiation coaching. FirstChoice has helped hundreds of growing agencies find the best path to address market fluctuations while developing lasting partnerships. Do you have a plan for the current hard market? More importantly, who will help you come out the other side even stronger and more successful?

If you have questions about Today’s ViewPoint, would like to explore our tailored solutions for maintaining partnerships, please email or call Keith Captain, President, FirstChoice, at 704.831.8708 or email or call Jason Juarez, FirstChoice Regional Vice President, at 440.398.5171.