The world of artificial intelligence (AI) is an exciting yet potentially confusing space. For some business owners, it might feel like you’ve missed the bus and that your business could be in jeopardy unless you do something with AI immediately. The reassuring truth is that your business won’t collapse if you don’t adopt AI right away. However, this is a great opportunity to learn more about AI, demystify it, and understand what options are available. This knowledge can give you the confidence to make informed decisions about using AI to grow your business.

An overview of AI’s evolution

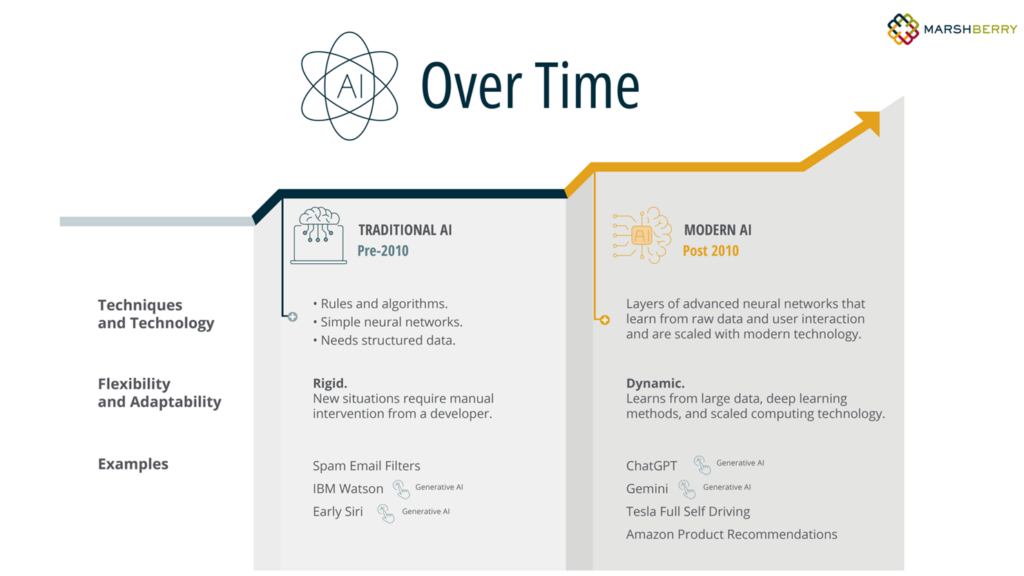

AI has evolved significantly over the years. It started with simple systems, like early email spam filters, and has progressed to advanced models powered by computing technology that is significantly more powerful than a decade ago. These advancements have enabled the development of autonomous vehicles, chatbots that serve millions of users, early cancer detection, and other groundbreaking innovations.

The biggest shift in AI software capabilities occurred during the 2010s with the development of deep learning. This technology, which mimics the human brain’s layered structure, allows AI to consume and learn from large volumes of raw data. On the hardware side, the significant advancement has been in graphical processing units (GPUs). GPUs can handle the parallel processing of massive amounts of data, which is crucial for training and scaling AI models. These two advancements have enabled AI to operate at a scale that fuels today’s AI “hype.”

How can modern AI help an insurance brokerage firm?

Now that you have a general understanding of the evolution of AI, let’s dive into some of the options available for leveraging this new technology.

Option 1: Implementing an AI model into your existing IT infrastructure

There are many different types of AI models, but the most commonly used today for integrating pre-built solutions is a large language model (LLM). This is the technology behind ChatGPT and can be licensed separately from major providers like OpenAI, Microsoft, Google, and others. However, LLMs are just one type of AI model that could benefit your business. Other examples include predictive models, machine learning models, and recommendation systems.

This is the most advanced option and deciding whether this option is viable for your organization requires answering several critical questions, including:

- What specific problem are you trying to solve?

- Do you have an IT infrastructure and developer on staff?

- Do you have a dedicated data professional (e.g., a data scientist or analyst)?

- How many policies does your firm currently service?

- How many policies do you plan to service within the next two years?

Given the complexity of these considerations, this option is unlikely to be suitable for the masses. Depending on your answers to these questions, implementing an AI model could be a relatively low-effort and cost-effective endeavor – or quite the opposite. The biggest advantage of this approach is the ability to customize a solution specifically for your business and modify it as your needs evolve. However, it involves a complex web of decisions that will require significant dedication and time.

Option 2: AI Add-Ons

The next option involves using existing software with an AI add-on. In recent months, nearly every software company has introduced an AI feature designed to enhance business operations. These options are advantageous because they can be easily “turned on” and are likely part of software you already use, minimizing the learning curve. When evaluating these add-ons, consider the cost and the ease of implementation. Many of these products offer trial periods that are either free or heavily discounted. And here are a few popular tools with AI add-ons that may help your company:

- Microsoft 365’s Copilot: Assists with document creation, data analysis and more.

- Zoom’s AI Companion: Enhances meeting productivity with features like automated notetaking and summaries.

- Salesforce’s Einstein: Provides AI-driven insights for sales and customer relationship management.

Option 3: AI software designed for specific business purposes

Given the recent technological advancements, many new software solutions are available, each promising to solve various business challenges like customer service, process optimization, and data-driven insights. However, the field is vast, and many of these companies are startups without a proven track record. To assist you in making informed decisions, here is a list of three popular options that MarshBerry clients have recommended:

- Zapier (zapier.com) can automate workflows by connecting different software applications, enabling insurance firms to streamline repetitive tasks like data entry, client communication, and policy management.

- Donna (aureusanalytics.com/donna) is an AI-powered analytics platform designed for independent insurance firms to enhance customer experience through real-time sentiment analysis and predictive modeling. It helps firms boost retention, identify cross-selling opportunities, and make data-driven decisions to improve overall client satisfaction and business growth.

- LeO (meetleo.com) is an AI-powered personal sales assistant designed for insurance firms, helping them automate and enhance their sales processes. It provides detailed insights, generates targeted prospect lists, and integrates seamlessly with CRM systems, enabling agencies to boost productivity and streamline client engagement.

Option 4: AI chatbots

The final category involves using mostly free AI chatbots, such as ChatGPT, which can offer quick and easy ways to improve your business operations at a low cost. Here are some of the top chatbots available today:

| Chatbot | Features | Differentiation |

| OpenAI ChatGPT | Strong conversational abilities, widely used for diverse tasks. | Limited to data up until 2021 in some versions, making it less ideal for recent information. |

| Google Gemini | Comprehensive AI platform with strong search capabilities. | Access to up-to-date information, excels in understanding current context. |

| Microsoft Copilot | Integrated with Microsoft products, optimized for professional use. | Leverages Microsoft’s extensive databases for current data and seamless integration with Office 365. |

| Perplexity | Focuses on research with cited sources and links. | Best for research tasks requiring source verification and transparency. |

AI is a powerful new technology, but it doesn’t have to be intimidating. Implemented correctly, it can drive organic growth, uncover innovative solutions, and help you achieve business goals.

Find out which questions to ask, and the right answers to look for, when exploring AI technology for your business – in the next article: Implementing AI Into Your Business: Ten Questions to Ask And The Right Answers To Look For