M&A Market Update

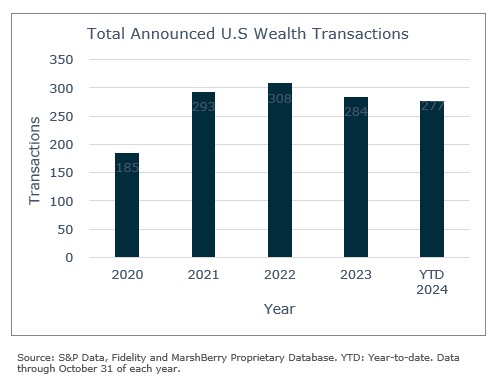

Wealth advisory merger and acquisition (M&A) activity in October 2024 was the strongest month year-to-date (YTD) with 35 announced deals, bringing the YTD count to 277. 2024’s deal count is now only seven deals short of 2023’s total year count (234) and 31 deals short of 2022’s total year count (284). This is a very impressive data point with only two months remaining in the year. There might be a small dip in November activity as historically, November usually sees a lull in deal activity as most acquirers are working to close their deals by year end. As of right now, 2024 appears to be tracking towards a new record setting year.

Whether 2024 becomes the record year or not, MarshBerry’s view remains the same. There continues to be a sustained appetite for quality firms regardless of their size. With two months remaining in the year, which includes the historically high deal count month of December, MarshBerry stands by the optimistic view on continued high deal activity throughout the remainder of the year.

The distribution of buyer types involved in transactions has remained consistent. Private capital-backed buyers continue their hold of the majority market share by accounting for 70% of completed deals through October, or 195 out of 277 transactions. Independent firms represent 22% of deals, while public companies account for the remaining percentage. Although the share of deals by public firms has declined in recent years, these acquisitions tend to be larger in scope. Consequently, the number of public firm acquisitions should be viewed differently. Notably, in 2024, public companies have already acquired more assets through 20 transactions ($273 billion) than they did in 30 deals in 2023 ($121 billion), with $100 billion of the 2024 total attributed to the LPL/Atria Wealth Solutions deal. The main takeaway here is that even if you remove the outlier deal of the year (LPL/Atria), the 2024 assets under management (AUM) still surpasses the prior year deal by over $50 billion.

The top ten buyers represent approximately 31% of all announced transactions through October with 85 of the 277 deals YTD. This means the remaining 192 deals were completed by buyers outside the top serial acquirers. This diversity among the buyers is good for all parties and demonstrates a positive forecast on the strength of the wealth advisory M&A space which is unique to only a few industries.

Once again – Focus Financial Partners, Wealth Enhancement Group, and Waverly Advisors continue to lead the buyer pool, accounting for nearly 13% of the 277 transactions with 13, 12, and 10 deals completed, respectively.

Notable transactions:

October 21: Lido Advisors, a Los Angeles-based registered investment advisor (RIA) with over $24 billion in AUM, announced its merger with Pegasus Partners, a Wisconsin firm managing over $3 billion in AUM. The 22-person Pegasus team will join Lido, with a majority of the team becoming partners under Lido. This merger represents part of Lido’s strategy to expand into the Midwest and enhance its services for ultra-high-net-worth clients. The deal follows a series of acquisitions by Lido, who is backed by private equity firm Charlesbank Capital Partners, which has helped grow Lido’s assets from $9 billion to $19 billion since 2021. Lido’s president, Ken Stern, emphasized the strategic alignment of both firms’ cultures and client-focused missions. This is noteworthy for another reason as well, as this transaction marks Lido’s first deal under its new head of mergers and acquisitions, Henry Hagenbuch.

Looking forward

With the presidential election behind us, the topic of taxes in 2025 can be looked at with more certainty. President-elect Trump made it clear in his pre-election campaign his intention to permanently extend the policies of the Tax Cuts and Jobs Act (TCJA) of 2017, keeping capital gains taxes at current levels, or possibly even lower. While pre-election talk of possible capital gains tax increases may no longer be a concern, it shouldn’t slow deal activity for retirement and wealth advisory firms for the remainder of 2024, and into 2025.

It’s a favorable macroeconomic climate in which interest rates are dropping, and the incoming Republican leadership is promoting stabilized taxes, lower regulations, and pro-business policies. All in all, this is expected to create tailwinds for continued revenue growth and profitability, as well as M&A activity for wealth advisory firms into 2025.