As the current market navigates through the economic cycle, many economists are predicting that the U.S. will sidestep a recession. However, the U.S. is still considered within the “contraction” phase of the economic cycle and there are still risks for high inflation, softer corporate profits, and aggressive monetary policy. As monetary policy has tightened, the yield-curve has remained inverted, which is usually considered an indicator of an upcoming recession.

While it may be difficult to predict how much longer the economy will linger within this phase, or when we’ll start to transition into the next phase, there will always be insurance brokerages that thrive no matter the economic environment. These firms manage to grow organically at above average levels as their peers struggle and are at the mercy of the market currents.

Here’s how you can join the premium firms that achieve strong growth and command premium valuations:

Shift your strategies with changing market conditions

Market and economic conditions can help drive growth and value for your business – but can also stifle growth and indicate when you need to pivot. Factors like inflation, interest rates, consumer confidence, and hard markets all influence growth trends in the insurance sector. However, most firms don’t manage to grow consistently throughout market cycles.

Consider shifting your strategies to account for each of these conditions and challenges. For example, in an economic downturn, prepare to take on less risk and cut costs. In a hard market, there may be opportunities to specialize your offer, improve client services and develop a strategy for when the market transitions back to a soft market. In the current hard market, clients are increasingly facing significant rate increases or in some cases, non-renewals. Understanding where you are in the economic cycle will help inform business decisions and brace for when the pendulum swings the other way. Strategies and areas of focus shouldn’t be a one-size-fits-all-conditions approach.

Focus on elements within your control

Even in a challenging macroeconomic environment, brokerage firms can stand out by focusing on things within their control, including annual goal setting, compensation strategy, and sales planning. These standout companies are often attracting interest from potential buyers and getting premium valuations, even when the overall volume of merger and acquisition (M&A) activity slows.

Have an organic growth mindset in all markets

Despite the strong demand, current economic conditions may be starting to impact valuations for average firms. Firms that are showing organic growth below industry averages will likely struggle to find valuations that the industry has benefited from over the past 36 months. This gives other firms an opportunity to stand out from the crowd by evolving to a growth mindset.

Here are three ways to help drive above-average double-digit organic growth.

1. Annual new business goal setting

Setting individual producer goals requires historical reflection on several years of production, strategic planning and potentially using a sales planner. Here are suggested categories of goal setting:

- Minimum goal: Minimum amount of new business to maintain producer status. Also used for enforcing negative consequences

- Individual goal: Producer’s stated personal goal

- Organizational budget goal: Firm’s budget goal for projection and growth budgeting purposes. This number is typically not communicated to the producer.

- Stretch goal: Best case scenario goal typically used for closed business scoreboards.

2. Reward the hunter mindset

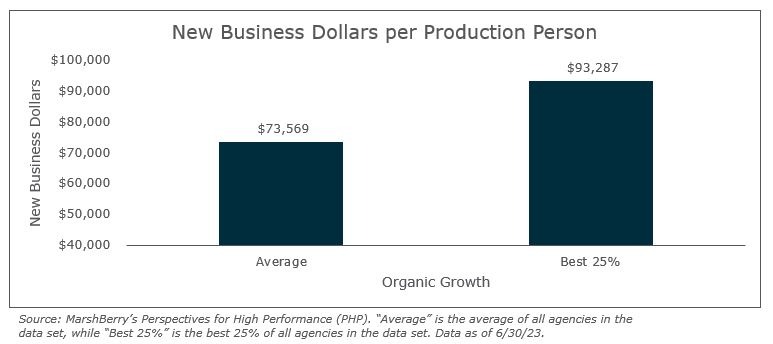

Firms with the greatest organic growth (Best 25%) generate 27% more total new business dollars per production person compared to the average firm, according to MarshBerry’s proprietary financial database Perspectives for High Performance (PHP). This indicates that high revenue generating firms are better incentivizing producers to focus on new business.

A compensation model should have both an upside and downside related to compensation based on production — commonly termed as “carrot and stick model.” It is important to note that compensation restructuring is very comprehensive and involves several critical areas, including small business thresholds and minimum account thresholds.

3. Pipeline management

A pipeline management system enables your producers to stay engaged in every step of their sales process, drives accountability around prospecting activity, and ultimately increases closing probability on targeted accounts. Producers must track and monitor their successes on closing accounts — as well as detail what has not worked. Results show that producers adequately using a pipeline consistently sell more new business than those who do not.

Additionally, as a book of business becomes more complex, producers need to focus on true differentiation and a unique value proposition. Finding opportunities to train your team to navigate complex selling scenarios, as well as finding niche opportunities, can create better results for you and your firm.

Overall, insurance brokers continue to see strong demand from well-capitalized buyers. However, because of shifting market conditions, investors are becoming more stringent in their due diligence process. Proven growth is still the biggest differentiator for buyers, and they are looking for firms who already have the right tools and capabilities, but just need a partner to help them grow even more.

Recently, the CEO of public insurance broker Brown & Brown stated, “We’re seeing fewer bidders for businesses and valuations have come down slightly from their peak, but that doesn’t mean that a good business won’t trade at high multiples.”

Firms that continue to implement strategies to boost organic growth and profit margins will command top valuations, no matter the economy.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.