For a good part of the last decade, the insurance brokerage industry and broader U.S. economy enjoyed economic tailwinds, particularly due to consistently low interest rates. However, the economic environment shifted, becoming more challenging and uncertain in recent times. In response to inflation, the Federal Reserve (Fed) hiked interest rates 11 times since March 2022, leading to a substantial increase in borrowing costs compared to the low levels experienced just a few years ago. Higher interest rates have had repercussions for private equity firms, heavily reliant on debt financing to leverage their investments for amplified returns. With rising interest rates, their cost of capital increases, putting pressure on overall returns.

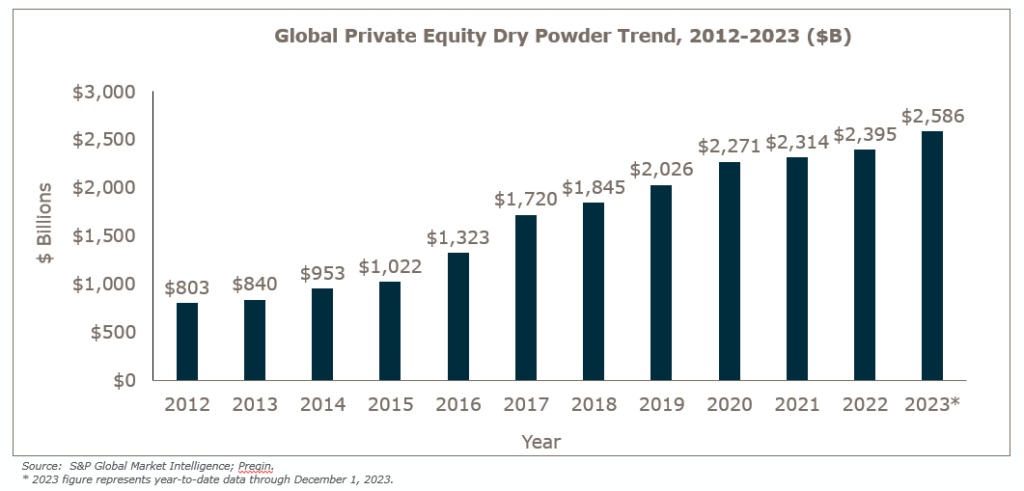

The recent economic uncertainty and higher cost of capital has made many private equity firms more calculated in their acquisition strategies, slowing the pace of deals from that of the last two years. As a result, uninvested capital, often referred to as dry powder, has been building up. According to S&P Global Market Intelligence, as of December 1, 2023, private equity firms were sitting on $2.59 trillion of dry powder globally, a historic high and an 8% increase compared to the total in December 2022.1 As time passes, private equity firms face mounting pressure to put committed capital to work, actively investing in companies to generate returns.

Private equity’s interest in insurance distribution

The insurance distribution market has been a major sector of interest for private equity firms. According to McKinsey & Company, insurance accounts for ~60% of private equity financial services transactions, and a significant portion of these relates to insurance distributors.2 Private equity firms have come to recognize the attractiveness of the industry with its stability and relative resistance to recessions, recurring revenue model, and low capital intensity. Moreover, the highly fragmented nature of the market, comprised of numerous small and mid-sized firms, provides opportunities for consolidation, which drives growth and the ability to capitalize on economies of scale and other synergies.

So, despite the prevailing market challenges, private equity’s appetite for insurance brokerage investments remains robust, underlying the sector’s resilience and enduring appeal. Below are some recent private equity moves in the space:

- August 2023: World Insurance announced that Goldman Sachs Asset Management would invest more than $1 billion in the brokerage, joining World’s existing private equity investor Charlesbank Capital Partners.

- September 2023: Oakbridge Insurance Agency announced that Audax Private Equity would acquire a majority stake in the company as Corsair Capital exits its investment in Oakbridge.

- September 2023: USI Insurance Services announced that existing shareholder KKR would be making a new equity investment of more than $1 billion in the brokerage.

- November 2023: Inszone Insurance Services announced that Lightyear Capital would be making a strategic investment in the company, joining current private equity investor BHMS Investments.

- November 2023: Amwins announced that its existing private equity investors Dragoneer Investment Group, Genstar Capital, and SkyKnight Capital, along with employee shareholders, acquired $1 billion in equity from the company’s employee shareholders and private equity firm Public Sector Pension Investment Board (PSP), which sold 20% of its equity position.

Outlook for 2024

On January 31, 2024, the Fed left the benchmark federal funds rate unchanged in a range between 5.25% and 5.5%, where it has stood since July 2023. However, the Fed formally shifted its interest-rate outlook at this meeting, providing flexibility to lower rates going forward if it is convinced “inflation is moving sustainably toward 2%.” Federal Open Market Committee (FOMC) members’ median forecast for the federal funds rate as of December 2024 stands at 4.6%, implying the expectation for future rate cuts. The prospect of these rate reductions, coupled with the accumulation of private equity dry powder, potentially bodes well for increased private equity investment and heightened M&A activity within the insurance brokerage sector in 2024.

What does this mean for insurance brokerages?

While there’s no crystal ball that can predict how economic conditions or the private equity investment climate will change, insurance brokerage leaders should prioritize strategies for thriving in any business environment. Those with a growth mindset tend to stand out from the crowd. Proven growth is still the biggest differentiator in the eyes of buyers, who are looking to partner with firms that can help them achieve their own growth goals and expansion plans.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

Get Your Complimentary Insurance Industry Compensation Study Report

Help position your firm for success by completing MarshBerry’s Agency & Broker Compensation Study. The study compiles anonymous compensation structures, incentives and benefits information of various roles within independent agencies and brokerage firms, and then summarizes the findings in a comprehensive report. All participants that complete the study, and provide a valid email address, receive a complimentary copy of the report as well as an invite to attend a future MarshBerry FocalPoint webinar highlighting the results at no cost. The final report will allow you to better understand how your firm stacks up against your peers and will give you a leg up on recruiting new talent and growing your firm. Complete the study, valued at $1,500, here.

Sources:

1 https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-equity-firms-face-pressure-as-dry-powder-hits-record-2-59-trillion-79762227

2 https://www.mckinsey.com/industries/financial-services/our-insights/insurance-investors-priorities-and-opportunities

3 https://www.bloomberg.com/opinion/articles/2023-11-17/the-case-for-two-fed-rate-cuts-in-early-2024-is-building