Over the last few weeks, six publicly traded insurance brokers reported results for the second calendar quarter of 2022: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW) and BRP Group, Inc. (BRP).

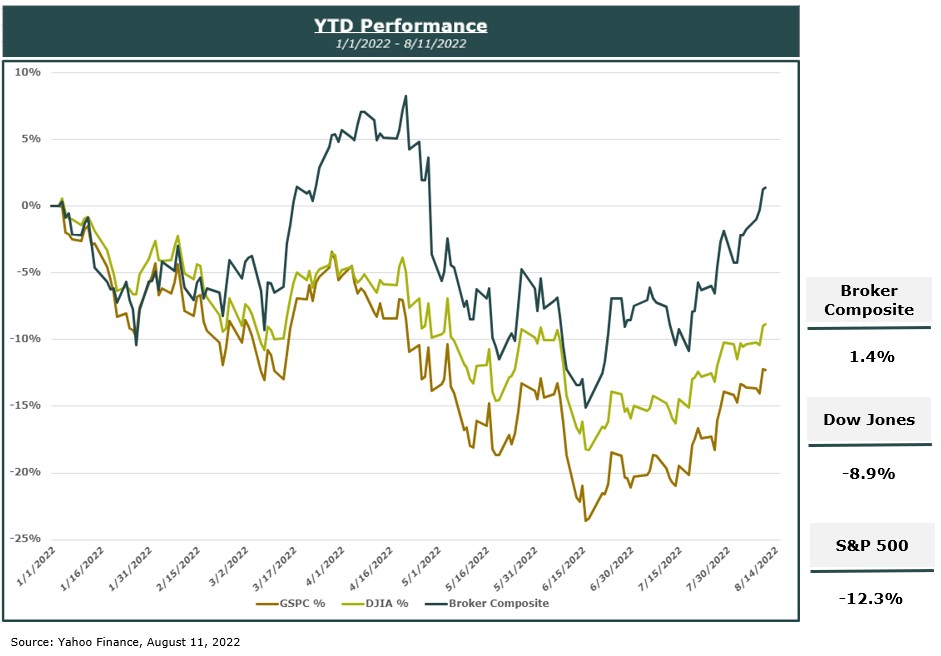

Amidst the current market volatility, the broker composite index again outperformed benchmark indices through August 11, 2022, highlighting the strong fundamentals of the insurance brokerage industry. While the S&P 500 and the Dow Jones Industrial Average (DJIA) ended July in negative territory, Public Brokers, LLC and the public broker composite handily outperformed both major indices.

Although the overall performance of equities is down across the board, as indicated by the two major indices, investors appear more confident that the insurance distribution sector can deliver stable growth despite the challenging environment.

2Q22 Results Were Strong for Top Insurance Brokerages

Insurance brokers once again reported strong results for the second quarter, which were attributed to a combination of improving new business, strong retention and continued insurance rate increases.

Most brokers reported organic growth rates in the range of 8%-10% for the quarter. MMC reported organic revenue growth of 10% in 2Q22, in-line with its 10% organic growth in 1Q22 This was its fifth consecutive quarter of double-digit growth. Brown and Brown reported organic growth of 10.3% in 2Q22, while AJG saw organic growth of 10.7% in the same period. Above the 8%-10% range, BRP posted 2Q2022 organic growth of 24%, with double-digit organic growth in all four segments. BRP’s MGA of the Future segment’s organic revenue grew 70% year-over-year (YoY), which was the best quarter in the firm’s history as a public company. AON reported 2Q22 organic growth 8%, on-par with 1Q22’s 8%, citing ongoing strong retention and net new business generation.

Brokers Cited Greater Macroeconomic Challenges

While management at many brokers cited concerns about the macroeconomic environment, many noted that their companies are well positioned for continued growth. For example, WTW CEO Carl A. Hess said on WTW’s 2Q22 earnings call: “Our portfolio of businesses is relatively noncyclical, we estimate that about 80% of our revenue base is recurring, often built upon nondiscretionary solutions and services.” WTW also sees the business as less sensitive to economic downturns. In 2020, when U.S. GDP declined by 2%, WTW posted organic revenue growth of 2%; in 2008-2009’s recession, WTW’s predecessor posted organic revenue growth of 2% to 4%.

Insurance Market Outlook for the Rest of 2022

While many brokers saw economic growth moderating from the impact of continued inflation, federal fund rate increases, and geopolitical tensions, they remained confident in their abilities to meet their organic growth targets for 2022.

Aon PLC’s CFO Christa Davies said on Aon’s 2Q22 earnings call: “While we’re seeing signs of economic uncertainty, we remain confident in the strength of our firm and our financial guidance for 2022 (mid-single-digit or greater organic revenue growth, margin improvement and double-digit free cash flow growth). Overall, our business is resilient, and our Aon United strategy gives us confidence in our ability to deliver results in any economic scenario.”

While MMC remains positive about its outlook for the second half of 2022, the firm noted greater uncertainty in the macroeconomic outlook: “the highest inflation in two generations, geopolitical tumult, central bank hawkishness and bear markets in risk assets.” The firm sees full year 2022 organic growth coming in at the high end of its guidance of mid-single digits or better, and solid growth in adjusted EPS.

Mergers & Acquisitions (M&A) Activity

Most brokers did not cite a slowdown around Merger & Acquisition (M&A) activity in the second quarter, with many noting robust pipelines. AJG’s CEO J. Patrick Gallagher noted on AJG’s 2Q22 call that the firm’s pipeline has more than 40 term sheets signed or being prepared, representing nearly $350 million of annualized revenue. He also did not see concerns around a recession having an impact on M&A deals. AJG CFO Douglas Howell noted that AJG has “more than $4 billion of tuck-in M&A capacity here in ’22 and ’23 combined.”

BRO also saw strong M&A performance over 2Q22, with eight acquisitions completed, representing annual revenue of approximately $11M. The pipeline continues to be strong, as the firm engages with many prospects and has already completed two deals in the current quarter.

Overall, the second quarter results from the public insurance brokers came in fairly strong, with management teams confident around meeting their guidance for 2022. Although the heightened macroeconomic challenges will likely continue, most view their businesses as well positioned to meet growth targets.

With uncertainty and inflation an ever-present challenge for top insurance brokers, keep your edge on the market with MarshBerry insurance market intelligence and our extensive proprietary and custom research. MarshBerry continues to deliver results for brokers as the leader in insurance brokerage advisory.

Source: Yahoo Finance of 7/31/22 at close. BRP, BRO, AON, AJG, MMC, WTW.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

This earnings summary has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information.

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.