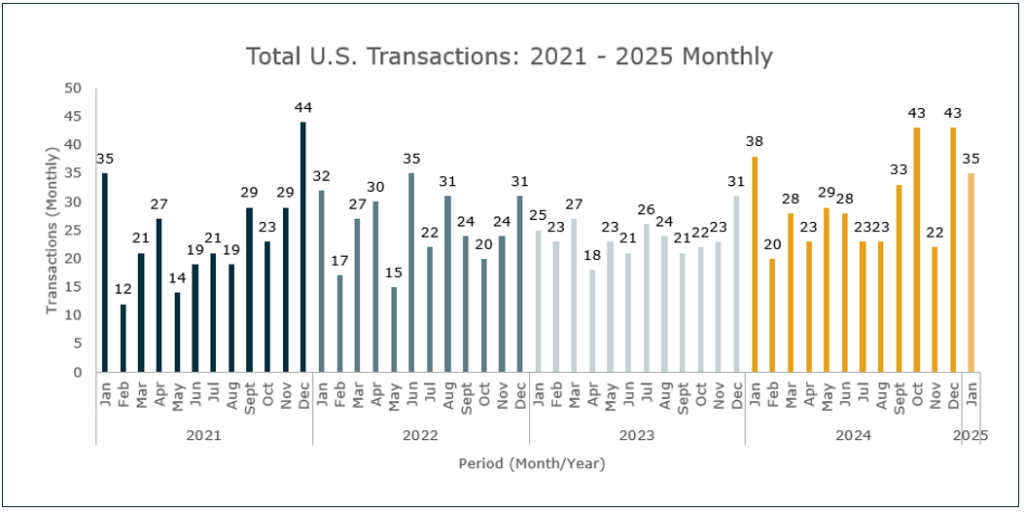

Carrying over from a strong December, January continued the momentum from 2024 and specifically Q4 2024, the biggest quarter on record. January delivered 35 announced merger and acquisition (M&A) transactions in the U.S. Once again private capital-backed wealth management firms led the way. While January 2025’s total represents a slight decrease of ~8% compared with January 2024, there are still many reasons to be optimistic about 2025.

Much of the activity of Q4 2024 was driven by an improving economic environment, firms pursuing strategic partnerships for growth, and reduced urgency to finalize deals in case of capital gains tax changes (if Democratic candidate Harris had won). Following Donald Trump’s re-election, that urgency ceased, leading to some deals being postponed to 2025 in order to delay tax payments another 12 months which is likely part of what contributed to January’s activity. There is a strong possibility that this deal delay from December will continue into the remainder of Q1 and perhaps even Q2.

Source: S&P Data, Fidelity, and MarshBerry Proprietary Database. Data as of 1/31/25.

Private capital-backed buyers accounted for 24 of the 35 transactions (69.6%) through January, representing a 14% increase since 2020 when private capital-backed buyers accounted for 55.4% of all transactions. Independent firms accounted for nine deals and 25.7% of the market, an uptick from 2024’s final percentage of 21.0% on 76 total independent deals. Insurance brokerages acquired two wealth management and retirement firms in January.

Notable transactions:

- January 15: Corient, the U.S. subsidiary of Canadian firm CI Financial, has acquired Geller & Company, a New York-based multi-family office managing $10.4 billion in assets. This acquisition bolsters Corient’s family office services, adding expertise in personal CFO services, tax compliance, estate planning, and investment management for ultra-high-net-worth clients. The deal provides Geller’s team with access to Corient’s technology, operations, compliance infrastructure, and expanded resources. Corient, a fiduciary and fee-only firm managing approximately $182 billion in assets, has been aggressively expanding in the U.S. wealth market through multiple acquisitions.

- January 29: Hub International, a Chicago-based insurance brokerage and financial services firm, has acquired Legacy Planning Partners, a Pennsylvania-based hybrid advisory affiliated with Commonwealth Financial Network. Legacy, which manages nearly $1.98 billion in client assets, consists of 12 advisors operating from offices in Horsham, Allentown, and West Chester, Pennsylvania. The team will continue utilizing Commonwealth for brokerage and advisory services. This acquisition strengthens Hub Retirement and Private Wealth, a division focused on private wealth, business owner advisory, and retirement services. Hub has been actively expanding through numerous acquisitions, with Legacy joining a platform managing approximately $172 billion in total assets. MarshBerry advised Legacy Planning Partners on the transaction.

Looking forward

With the republican administration’s focus on stabilizing or lowering taxes, reducing regulations, and implementing pro-business policies, the M&A market is expected to remain highly active in 2025. MarshBerry is optimistic for another potentially record-breaking year in 2025. January has already seen robust activity in the M&A market with several factors driving this optimistic outlook. From a buyer perspective, the expected stabilization of the rising rate environment and continued infusion of capital from private equity firms into RIAs are bolstering confidence. An aging advisor base is increasingly exploring adding strategic partners amidst uncertainty, and 2025 may be the best time to do so. MarshBerry remains vigilant in monitoring these factors and their impact on M&A activity throughout 2025 and beyond.