As an insurance broker, you advise clients every day on making the right financial decisions to protect them from risk. That’s your expertise. So, whether you are just thinking about selling your firm, or actively talking with interested buyers – why not speak with an advisor whose expertise is understanding the intricacies of insurance distribution mergers and acquisitions (M&A)? You could sell your business on your own, but working with an experienced advisor will give you the best chance for finding the right partner and achieving your maximum value.

An investment banker (also referred to as an M&A advisor or consultant) will learn about your goals and use their industry expertise to help you understand what buyers are looking for and what you may need to do to maximize your firm’s value. Their experience in facilitating large financial transactions, negotiating deals, uncovering risks, and developing strategic sale objectives can provide invaluable strategic advice to you and your management team. Here’s what the right investment banker can bring to the process of selling your business:

Valuable market and buyer insights

A knowledgeable, licensed investment banker, with experience in your industry niche, will maximize the value of your business. They are most likely familiar with, and may already have professional relationships with, the relevant buyers. They also know the characteristics of buyers’ ideal investment criteria and how to best position your firm to justify its valuation. These experts can help create the right buyer universe and generate a competitive environment by supplementing the owners’ knowledge of their markets with the right potential partners.

Expanding the buyer universe is key as competition drives better terms and conditions. Just like when you solicit multiple insurance rates from multiple carriers for your clients, you too should have an expert bring you several options from which to choose. Since not every potential buyer fits a seller’s criteria, an expert investment banker will try to provide multiple options so you can make the most beneficial decision for your business.

The best deal for you and your business

Most buyers will look for reasons to pay you less. Having an investment banker represent you, at a minimum, signals to potential buyers that you are serious and can’t be taken advantage of. But at its core, an advisor will ensure you are receiving fair market price or better.

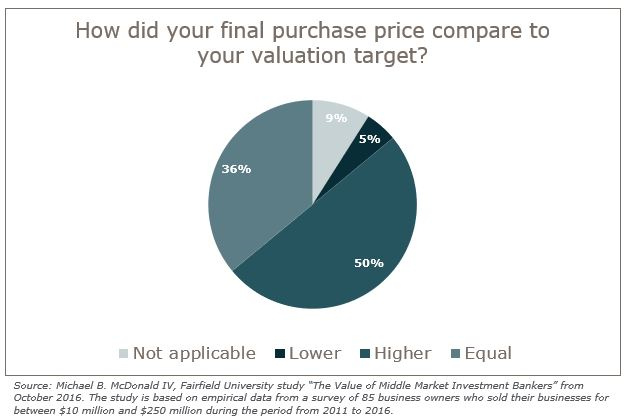

A 2016 study conducted by Fairfield University titled “The Value of Middle Market Investment Bankers” found that when an investment banker over-saw the process, most business owners received a final sale price equal or higher than the initial sale price estimate.

Here’s how an advisor can enhance the selling process to secure the best deal for your business:

- Letter of Intent (LOI): Buyers will create this document to outline the preliminary commitment to a sale and start the negotiation process. LOIs can be complicated and nuanced, so don’t sign one without an advisor involved. An investment banker will ensure you get a fair LOI by confirming that the calculations are accurate, comparing other offers, and determining the general terms of the deal.

- Due diligence: Having an experienced consultant conduct a due diligence review of your business and a potential deal is about having someone who understands the steps in the process, understands the insurance industry and can provide unbiased assessments that both parties can trust. The due diligence process can expose potential pitfalls (i.e., culture clashes, HR issues, strategic misalignment, pro-forma disagreements), saving time down the road and avoiding a potential bad deal.

- Agreement of sale: This formal contract contains the provisions for the sale, including purchase price, terms and conditions, timing, payment terms, and more. It takes a team to create a strong formal contract. While the attorney has an important role, a good investment banker will provide crucial input on key business terms because they know the nuances of the insurance brokerage industry and can offer more specialized insight.

- Earnout terms: An earnout is a provision in the purchase agreement that allows the seller to receive additional payments based on the future performance of the acquired business. A good advisor stays involved, sometimes for years after the sale takes place. They’ll check the numbers, ensure accuracy, and follow-up on your payments post-sale.

Protection from pain points

A lot of the selling process involves stressful or time-consuming tasks, like analyzing detailed financial reports, spending time on long phone calls, or pushing back on perceived unfair offers or transaction terms. The right advisor will remove the stress and uncertainty and ensure the process runs smoothly and professionally. They’ll clean up everything before the buyer starts their due diligence, so when both parties come together to finalize the deal, there will be no surprises on either side of the table.

In addition, an investment banker will uncover ways to improve the value of your business ahead of marketing your firm. The right advisor will also increase the likelihood of closing the transaction by guiding you for the length of the process: creating timelines, setting up calls, and firming deadlines. An investment banker is dedicated to closing the sale – and if a particular buyer can’t or won’t, they’ll try to find a better buyer.

You’ve worked hard building your business and this may be the most important financial decision of your life. It’s a decision that, most likely, you’ll make only once. You hire experts all the time to help you with much more low stakes decisions, why would you go it alone for the most important one?

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230