The main responsibility of an insurance producer is to sell and generate new business. Many insurance brokerages employ validated producers who fail to generate minimal new business production each year. Contrary to what some might think, these validated producers aren’t retired, they have simply evolved into non-producing producers. These producers may also be one of the biggest threats to a firm’s organic growth.

To address the challenges around non-producing producers, organizations need to assess motivation through new business production goals and compensation plans, as well as a culture of accountability within the firm. An organization should have a sales culture, complete with realistic targets and objectives for each producer that align with the organization’s overall growth goals. The producer’s goals should be married to their compensation.

Firms that have clear new business goals for producers, including a minimum annual new business requirement, tend to have higher organic growth rates and higher new business production. If a firm treats non-producing producers who are not hitting minimum new business goals as producers, this can damage the firm’s productivity.

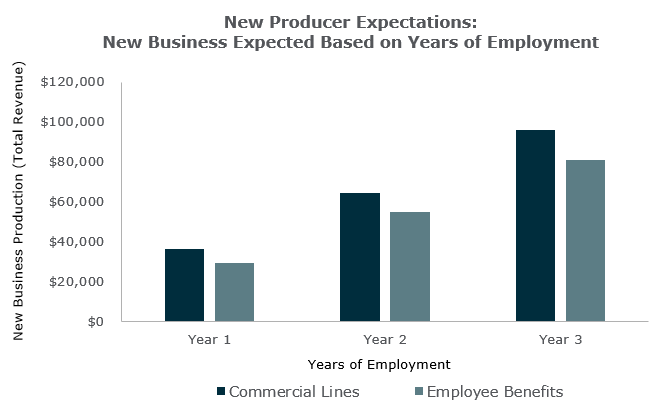

According to MarshBerry’s 2024 Insurance Agency & Brokerage Compensation Study firms expect producers (by year 3) to write over $96,000 in new commercial lines business.

Source MarshBerry 2024 Agency & Brokerage Compensation Study.

MarshBerry recommends a minimum annual new commercial lines business threshold of $100,000 in agency commissions. Considering the year 3 expectations for new producers, this $100,000 threshold is not unreasonable for established producers.

Here are three ways firms can improve growth and ensure producers are meeting their business goals.

1. Create accountability with minimum new business requirements

Each producer in your firm should be held accountable to a minimum new business goal. If the minimum goal is not met, the producer’s renewal commission percentage should drop. There should be consequences for missing the minimum goal. The goals should also include an organizational goal component, which typically is about 20% of the prior year’s book. Those who exceed these goals should be well rewarded.

Accountability accelerates performance. A manager should review the goals and progress with the producer on a quarterly basis and hold producers accountable to them. Far too often firms set goals but never discuss them, let alone enforce them. High growth firms that regularly identify producers within their organization, set realistic but aggressive new business goals, then hold them accountable, have a 50% higher organic growth rate.

2. Shift non-producing producers to account executive roles

For producers who are not meeting production goals, consider moving them into more appropriate and effective roles. Account executives play an extremely important role in brokerage firms. Reassigning non-producing producers to a service role may allow them to shine and be more effective. Account executives are mission critical and as important to the firm as producers are.

If successful in this new role, these non-producing producers may help boost the margins in a brokerage firm while also helping to preserve the sales culture and motivation among the producers.

3. Training and mentoring new producers

Firms can attract new producers by messaging and advertising the unique opportunities in the insurance brokerage industry, including potential exceptional compensation and equity rewards. Firms can enact dedicated, regimented, and continual searches for top talent, followed by rigorous screening and testing, including benchmark personality assessments.

To ensure new producers succeed, firms should have a comprehensive training plan in place, including working with mentors. Brokerages that have a mentor structure have a lower rate of failure among new producers. Producers would also complete technical training programs and prospecting training.

Firms also need to have a clear validation schedule for new producers so both the sales manager and the unvalidated producer know where they stand, and whether they will ultimately be successful. It should be time-bound and have specific goals for the new producer to meet.

Firms with clear and intentional systems in place, to ensure that their producers understand and meet new business goals, will likely have higher organic growth rates and margins. Brokerages can also take steps to reassign non-producing producers into more effective, suitable roles, while maximizing success for new producers with robust hiring and training programs.