The labor market was dynamic in 2023, with rising wages and solid hiring. But factors like the Fed’s interest rate hikes, and subsequent higher costs of capital, have cooled hiring activity in the second half of the year and into 2024. There were signals of a slowing labor market towards the end of the year with layoffs at several prominent companies, including Google, TikTok, Salesforce, and Microsoft.

While the overall labor market may see rising unemployment in 2024, the insurance job market may buck that trend as hiring needs remain elevated. MarshBerry is seeing consistent year-over-year (YoY) increases in hiring across all functions, with insurance brokerage employment at a peak and potentially remaining tight this year.

The Key Factors Driving Challenges for the Insurance Job Market

- The future shortage of talent. The entire insurance industry is expected to lose around 400,000 workers through attrition by 2026, according to U.S. Bureau of Labor Statistics projections.1 The industry is also projected to lose about 50% of its workforce to retirement by 2028.

- A growing industry. The overall insurance industry and brokerage segment have low unemployment rates and are adding jobs at a fast clip. Today, the insurance industry has a 1.6% unemployment rate compared to around 3.6% for all other industries. Within insurance brokerage, total occupations (including insurance producer roles) are projected to increase by 11.1% by year 2032.2

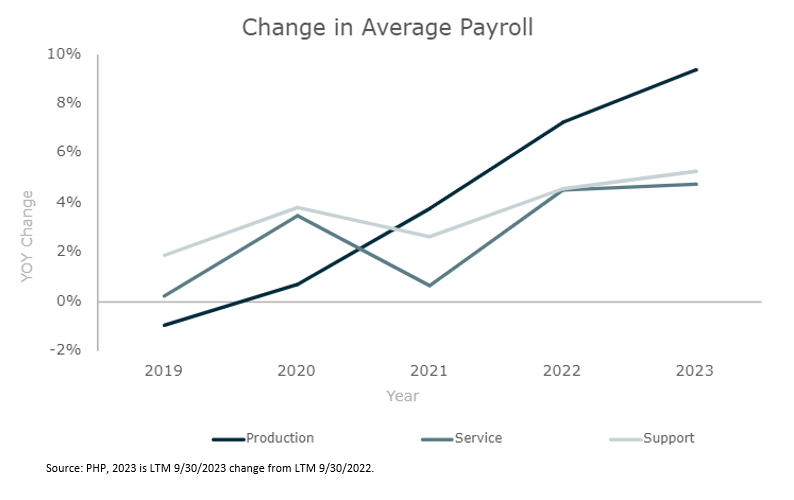

Because of these factors, compensation increases will likely continue in the insurance sector, following the impressive increases over the last few years. MarshBerry’s data shows that percentage increases in compensation at insurance brokerages rose across most roles since 2019, with a respite in 2021.

While the change in average production payroll saw the sharpest increases over the last few years, this may be largely tied to rising firm commissions and premium volume increases. Therefore, these may not necessarily be reflective of an increase in base salaries, as these figures include commissions. However, the service and support segments may more accurately reflect changes in base salaries. The last couple years have been above 4% for average payroll increases for service and support. In comparison, the average growth over the past decade for service and support has been only around 2.5%.

Optimizing your compensation strategy

According to MarshBerry’s proprietary financial management system Perspectives for High Performance (PHP), brokerage total compensation as a percent of net revenue has consistently averaged ~62% over the past several years. So, compensation expense is the single largest expense for brokers. Firms should ensure they are allocating expenses towards compensation in the most strategic manner to drive optimal growth.

Here are two ways to ensure that your firm is optimizing its compensation strategy:

- Improve your use of data. Well run firms use data to influence their business decisions. Accessing information and financials from peers, including key compensation metrics, can help firms optimize their strategic plans.

- One key metric is Net Unvalidated Producer Payroll (NUPP), which measures a firm’s investment in unvalidated producers. According to PHP, the Best 25% of MarshBerry’s Connect executive peer exchange firms invest more in unvalidated producers compared to the Connect average.

- Total Commissions & Fees per Service Person is another important compensation metric that measures the productivity of service staff by depicting the relationship between a firm’s income and the amount of business the service staff maintains. PHP data shows a direct positive correlation between average service personnel pay and productivity of the service staff, as well as organic growth of the firm.

Benchmarking is essential to not only measure performance of your firm’s current state, but also set realistic goals comparative to peers of similar size. Embrace a culture of continuous improvement, where you regularly evaluate your business processes, strategies, and other metrics to identify opportunities for optimization.

- Improve your compensation models. A hard market may require more strategy around raises and bonuses, as brokers work harder to keep clients happy during a hard market. But there are options to keep your producers engaged and productive. Incentive programs include rewarding producers for reaching milestones, such as profit sharing, guaranteed renewal commissions or increased expense accounts. Competitive compensation packages can entice talented individuals to join (or stay with) the company and discourage them from seeking opportunities elsewhere. Review compensation reports and industry trends to gain a better understanding of how compensation is evolving over time. Understanding benchmarking data on the average salaries and benefits packages for different positions is particularly useful during salary negotiations or when making job offers.

2024 Insurance Industry Compensation Study

While no one really knows what challenges and changes the next year holds for the insurance brokerage sector, a solid compensation and hiring plan can help your firm achieve strong organic growth and capitalize on new opportunities regardless of shifts in the economic environment and labor market. Gaining insights into the 2024 job market dynamics based on current data and information from many insurance brokerages may ensure that your firm has an effective compensation plan.

MarshBerry’s Industry Compensation Study offers crucial observations and data into the compensation landscape, based on input from participating insurance brokers. It also helps enhance your understanding of remuneration structures to drive firm growth.

Sources:

1https://www.insurancebusinessmag.com/us/news/breaking-news/us-insurance-sector-to-lose-around-400000-workers-by-2026-466593.aspx

2Industries at a Glance: Insurance Carriers and Related Activities: NAICS 524 : U.S. Bureau of Labor Statistics (bls.gov)