There have been many fluctuating M&A forecasts in 2023 since the beginning of the year. On February 1, the Federal Reserve (Fed) made its first federal fund rate hike of the year (and eighth since March 2022) with a 0.25% increase, bringing the target range to 4.5%-4.75%, the highest since October 2007. And despite signs that the interest rate increases are starting to help ease the inflation rate, Fed chairman Powell took a hawkish stance, stating that there still may be a need for “ongoing increases in the target range” and should remain elevated throughout 2023. All to try and slow down the economy and lower inflation.1

However, Wall Street either didn’t believe it or didn’t care as the S&P 500 jumped 2.5% in the two days following the Fed rate hike announcement and up 8.7% since 1/1/23.2 A few days later, the January U.S. jobs report came out announcing 517,000 new (nonfarm) jobs and another slight decrease in the unemployment rate, down to 3.4% – the lowest since 1969.3 This positive economic news sent the S&P 500 down 1%, as fears that job growth would give the Fed more incentive to continue raising interest rates (even though Fed chairman has been saying so for months).

Throw in a better-than-expected GDP of 2.9% in December, a decline in the Consumer Price Index to the tune of 6.5%, but continued recession talks by economists still projecting the 2023 economy to be “sluggish” – and it’s a strange economic environment indeed.

The Insurance Distribution Space Keeps Moving Forward

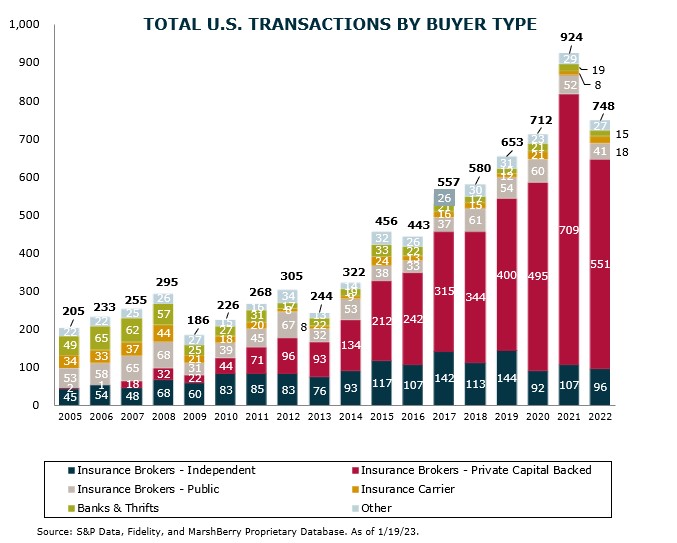

As January rolled, year-end merger and acquisition (M&A) deal data for 2022 continued to roll in. The current count shows that 2022 delivered 748 insurance brokerage transactions and became the second-highest year on record.4 This total deal count represents an 18.9% decrease from 2021 but a Compound Annual Growth Rate (CAGR) of 6.6% since 2018.

For 2022, private capital-backed buyers accounted for 552 of the 748 transactions (73.7%) as they continued expanding their market presence. Total deals by these buyers have increased at a CAGR of 12.5% since 2018.

Independent agencies accounted for 97 deals (13.0%) of the total deal count. This portion of the total announced transactions is consistent with 2021, yet there has been an overall decline since prior years. From 2015-2020, Independent firms completed 23.2% of deals on average.

The top three most active U.S. buyers in 2022 were Acrisure LLC, Hub International Limited, and Peter C. Foy & Associates Insurance Services, Inc. Their combined transactions (144) represented 19.2% of the 748 total transactions. The top 10 most active buyers completed 365 of the 748 announced transactions (48.7%).

2023 M&A outlook

2023 has gotten off to a slow M&A start – similar to the previous two years. There have been 30 total announced transactions in January, which is on pace with the number of deals last year. As the year progresses, it is anticipated that a substantial number of deals will be announced retroactively.

However, coming off a year like 2022, which saw the insurance brokerage industry overcome economic challenges and still deliver a strong year for growth and dealmaking – 2023 has an optimistic feel. The large public brokers are all projecting premium increases and high single- to double-digit organic growth in 2023. Arthur J. Gallagher & Co’s CEO, Pat Gallagher stated during the firm’s Q4 2022 earnings call that “the full year 2023 organic [growth] should be pushing 10% and adjusted EBITDAC margins should be around 19%.”5

While some buyers are still sitting on the sidelines, for various reasons, including the rising cost of debt, plenty of well-capitalized buyers are very active in the M&A market. The only difference is they will be slightly more selective in their targets and how they view valuations.

We remain cautiously optimistic but believe it’s going to be another strong M&A year, with plenty of demand from plenty of buyers, despite the specter of a possible recession and continued economic challenges.

If you have questions about Today’s ViewPoint or want to learn more about M&A activity for insurance agents and brokers, insurance market intelligence, or insurance aggregation, please email or call Phil Trem, President – Financial Advisory, at 440.392.6547.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.