“If you fail to plan, you are planning to fail.” – Benjamin Franklin

This simple quote from one of the nation’s founders seems obvious on the surface – but so many of us overlook this important concept when times are good. There has been a huge increase in insurance premiums over the last few years as a result of the hard market environment and many brokerages are enjoying the nice growth this produces. However, relying on external factors to fuel growth breeds mediocrity. This can also mean the difference between average organic growth and the double-digit growth achieved by the Best 25% of firms in MarshBerry’s proprietary financial and productivity benchmarking system – Perspectives for High Performance (PHP).

Tools For Strategic Planning

Organizations need a blueprint for the future and the right strategic planning tools to measure success. To compete in the modern insurance brokerage market, you must design the future you want and make it happen. There’s proof that adopting a proactive planning approach works, and having a blueprint can help get strategic planning started in a positive, proactive direction.

Tools for measuring and improving growth

One key part of successful strategic planning for business growth is assessing the firm’s financial strength and market position. Does your company have written and published multi-year financial and operational targets? Are you on track to achieve those goals? It’s essential to regularly measure and assess the progress towards these financial and operational goals.

When was the last time you rolled up your sleeves and took an analytical deep dive into the numbers that really matter to your business? Here are a few key questions on business metrics to address when creating a strategic plan:

- How are you growing your Policies in Force (PIF)?

- Is your EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin steadily improving?

- How efficient are your customer service representatives? Do you need to hire more to keep up with growth?

- How effective are your producers? How are you measuring their success?

- Do you know if you are paying competitive wages to attract and retain quality talent?

What’s your PIF growth?

To illustrate the value of these metrics, take a look at your PIF growth and see how you stack up against your peers. PIF growth measures the number of policies you have this year versus the number of policies you had last year. If you have more policies in force this year, you added new business. If you have less, you lost some business. While this does not take into account the premiums for these policies, having more policies year-over-year is a pretty good sign of your organic growth.

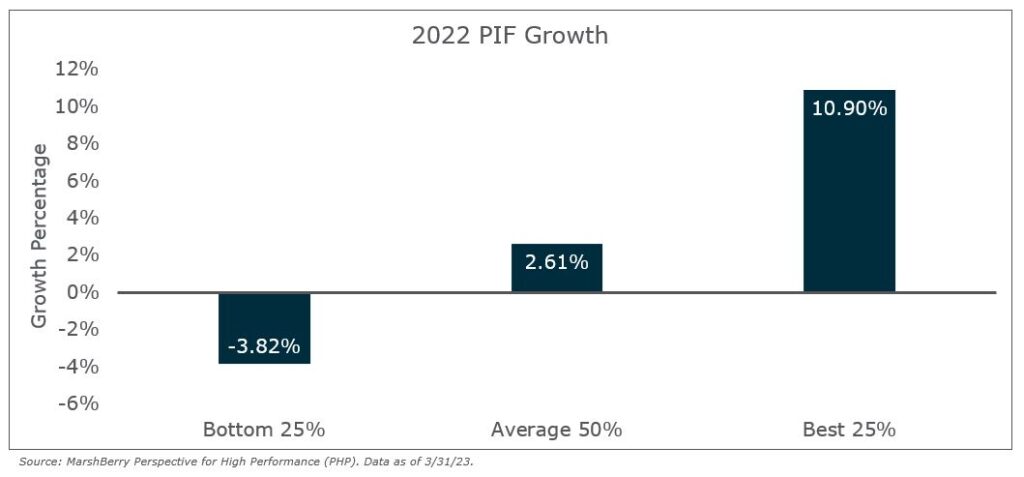

For comparative purposes, the average brokerage grew PIF by 2.61% in 2022. High performing firms (Best 25%) grew PIF by over four times the average at 10.9%. Where does your business fall in this metric?

Isn’t revenue growth enough of a measurement?

Relying purely on revenue growth as a metric for success can be a risky proposition. Keep in mind that external factors often play a part in the growth of a business, but they are circumstantial and cannot be targeted or controlled. Having a growth mindset leads to actions that promote growth within the business. Writing new business and increasing your policy count is fundamental to the long-term success of your company. But this is only one metric of many that play an important part in the strategic planning process. There are dozens of measurement tools to utilize when developing a plan, a path, and measurable steps as you progress along your journey.

Additional key performance indicators (KPIs) that can be helpful to track progress include:

- Customer Retention: This refers to a firm’s ability to retain clients. A higher retention rate is linked to better organic growth, and producers have more time to focus on new business.

- Sales Velocity: Sales velocity shows a firm’s growth in new business over the prior year. When faced with a hardening market, sales velocity is one of the strongest indicators of true organic growth that can reveal how your producers are performing because it does not include growth from existing policies.

- Total Revenue Per Employee: Revenue per employee measures employee productivity. Generally, the higher this number, the greater the employee productivity.

- Average Account Size: Increased average account size is one of the main drivers of organic growth.

- Pipeline: This metric shows the number of prospects in various stages of the sales process and can indicate whether new business goals are tracking to plan.

Many of these KPIs can also be used to assess how well your firm is performing compared to competitors in the sector. MarshBerry works with clients to analyze their metrics and help identify opportunities through PHP.

Using Strategic Planning Processes and Tools

As you reflect on where you are now, where you want to go and how you’ll get there, a strategic plan provides the data and tools necessary to successfully lead your business planning to reach its full potential and value. When you create a path to attain your goals, you have more options to control your destiny as well as establish the foundation for the next generation to continue to successfully grow the business into perpetuity. Having a qualified partner work with you throughout this important process is instrumental in successfully developing and executing a strategic plan tailored to your business, your goals, and ultimately your destination.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230