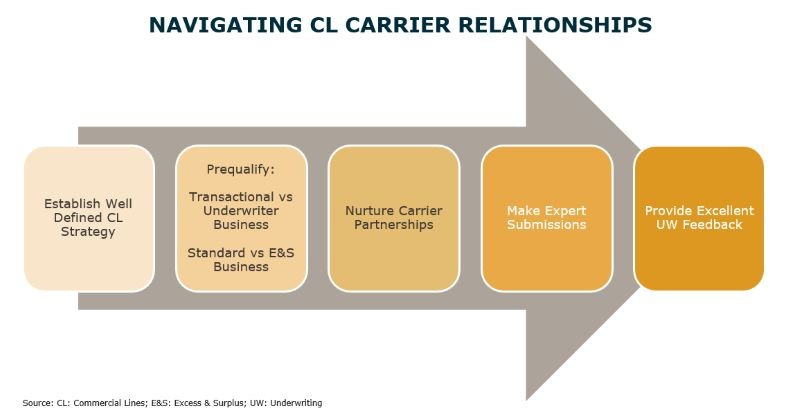

As the hard market continues to evolve, carriers are increasingly careful with the types of business they’ll write, the level of underwriting scrutiny they apply, the quality of their agency and broker partnerships, and their expense management. Because of this, agents looking to grow their commercial lines business in this environment require strategic planning and thoughtful allocation of agency time and resources. MarshBerry recommends developing a roadmap to maximize your commercial line’s growth and insurance carrier relationships using these five components during these trying market conditions.

1. Establish a Robust Commercial Lines Strategy (AKA “The Rules of Engagement”)

Having a plan for prospecting in preferred classes and establishing niche expertise allows your team to channel their time and effort most effectively. By developing an agency-wide prospecting strategy defining “good business,” you can identify preferred classes of business that align with your carrier appetites and service team capabilities, thus strengthening your carrier partnerships. Also, develop standards for quality prospect meetings that will lead to quality submissions and adhere to lead time expectations.

Avoid “no obligation free quotes” and be cautious of walk-in business, as these generally monopolize time and resources with meager success rates.

Lastly, create boundaries to help guide the team on when to consider walking away from unproductive prospects while cultivating a focused “preferred client” approach.

2. Pre-Qualify & Pre-Underwrite

Recognizing the important differences between various sizes and classes of business helps commercial line teams identify and create winning strategies around their best opportunities. Recognizing transactional business (quoted and issued online) versus underwriter business (requiring an ACORD certificate) and understanding whether a prospect will fit standard carrier versus Excess & Surplus (E&S) lines appetites play crucial roles in assessing the lead time, submission requirements, and market suitability, which can improve your relationships with carrier partners. These can ultimately enhance (or detract) from the ability to win accounts.

3. Nurture Carrier Partnerships

Nurturing strong carrier relationships helps get your submissions to the top of the stack for optimal time and focus from your underwriters. For underwriters, maintaining a consistent flow of qualified prospects and establishing a track record of successfully writing business is the most important goal. By learning their underwriting process and supporting underwriting requirements, you will demonstrate your commitment to writing business with them. Also, support professional-level claims on existing accounts to help build trust and credibility.

Most importantly, ensure you have open and timely communication. Many underwriting and claims disagreements can be traced directly to poor two-way communication.

4. Make Expert Submissions

Professionally completed applications are the table stakes for a good submission. Never take property valuations or critical updates (electrical, plumbing, roof, HVAC) for granted. The best agency submissions also convey a winning strategy and commitment upfront on what it will take to win the business. Craft a professional cover letter containing details of the exposures, claims history, safety programs, and other important factors. Proactively provide completed supplemental applications for complex classes. Understanding lead time restrictions, providing necessary documents (loss runs, safety plans), and timely responses to follow-up questions are essential in making expert submissions, all of which can strengthen insurance carrier partnerships.

5. Provide Excellent Underwriting Feedback

Investing in underwriter relationships and respecting their time is pivotal. Agents should aim to understand and meet underwriters’ limitations and prerequisites. Providing prompt and relevant responses while offering feedback on business that is not written allows for continuous improvement.

In conclusion, thriving in the commercial lines insurance business during challenging market conditions requires a holistic and strategic approach. Insurance agents can effectively elevate their success and navigate the complexities of a hard market by establishing clear guidelines, nurturing carrier partnerships, making expert submissions, and providing exceptional underwriting feedback. These strategies form the bedrock for sustained growth and profitability in commercial lines.

Adapting to market changes, leveraging expertise, and building strong relationships are key factors in staying competitive and thriving in the commercial insurance landscape.

Choose FirstChoice for Growth Strategies, Talent Development, & Differentiation Coaching

Joining the right agency network during a hard market can provide agency owners with benefits that may not be available by going at it alone. FirstChoice is the premier network for independent agencies seeking direct access to top national and regional insurance carriers. FirstChoice is leading the next generation of aggregation – providing high-value resources, assets that enable independent agencies to scale their business, talent development support, and agency differentiation coaching.

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.