Being an independent broker already provides owners with rewards that come with being in the insurance brokerage industry – recurring revenue, robust cash-flows – as insurance is a “must-have” product. MarshBerry deems this to be the “greatest industry in the history of mankind.” But achieving regional or national broker status means being an above average top performer, with control over one’s destiny, and who makes an impact.

Rewards to becoming a regional or national broker with broker formation

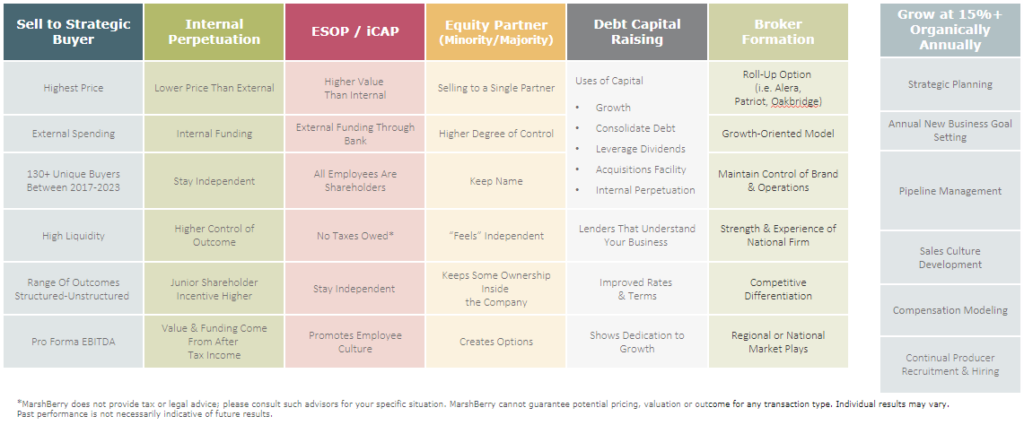

There are several paths a firm can take to become a sizeable regional broker, including selling to a strategic buyer or internally perpetuating, but this broker formation strategy will likely be the fastest way to get there.

Broker formation is a strategy where multiple firms join together in a short time frame to form one regional or national brokerage. This happens when multiple firms sell to one firm at the same time, usually with financial backing from a private equity firm. These firms tend to have strong relationships built over time through various networks.

Becoming a regional or national broker allows you to control your future and potentially own a share of a much larger pie. Here are some of the major benefits to achieving this level of growth.

- Maintain significant operating autonomy and individual identity for brokerage owners. Owners have control over branding and can design the culture when they take the broker formation route, especially compared to selling to a larger firm. There’s also greater scale to enhance your long-term ability to raise additional capital and remain viable. The firm can gain resources due to size and potential future acquisitions that can contribute additional resources.

- Obtain a higher valuation with broker formation. When several firms come together, the combined entity will likely be valued at a higher multiple. Valuation is highly dependent on the size of the firm being valued; larger firms tend to command higher valuation multiples than smaller firms.

- Benefit from the power of leverage and rolling equity. This may seem like financial magic. As part of the formation transaction, sellers are typically required to “roll” a portion of their equity into the new broker. After the transaction, and due to the use of debt, that rolled equity portion can become a larger portion immediately. In one example, the sellers all rolled 25% of their current equity into the new broker, and the use of debt increased their ownership to 40%. On top of this, the percentage can continue to increase over time as the broker continues to acquire new firms and new sellers continue to roll additional equity. The goal is to continue driving return on equity through new acquisitions and smart uses of debt capital.

Why now is an opportune time to pursue the broker formation path

Capture value at a time when valuations are high. 2025 will likely be a favorable time to crystallize value as valuations remain high and merger and acquisition (M&A) activity is expected to rise for the year.

Following a favorable macroeconomic climate which has seen consistent revenue growth and profitability for the insurance brokerage sector, the incoming Republican leadership – promoting stabilized or lower taxes, lower regulations, and pro-business policies – is expected to create tailwinds into 2025 and support strong valuations.

At MarshBerry’s recent Impact Summit in November, the insurance brokerage industry’s premier event on capital markets, a guest panel of industry capital lenders expressed their continued interest in lending for investments in the insurance brokerage industry. The panelists suggested they expect M&A activity to increase between 10-20% in 2025, believing the space will continue to benefit from its demonstrated resilience to market volatility.

Access to credit. Access to credit is still relatively inexpensive, is more likely approved by regulators, and it’s more easily obtained by larger brokers with higher profitability.

Additionally, the Federal Reserve’s most recent interest rates cuts and projections for continued cuts in 2025, should help fuel continued debt capital borrowing for investments in the insurance brokerage sector.

Firms that have supercharged their growth with broker formation include the following:

- In 2016, Alera Group, Inc. formed when 24 separate firms came together and took on capital from private-equity firm Genstar to become a national broker. The firm had offices in 15 states after coming together. The 24 firms that became Alera had known each other through a few different networks prior to this historic deal. Following this, Alera has continued to grow both organically and through acquisitions. Now, Alera is the 15th largest broker in the U.S. with offices in 35 states. The firm grew from $158 million in combined revenue in 2016 to $1.3 billion in 2024, with a compound annual growth rate (CAGR) of approximately 35%. Alera Group, Inc. was the industry’s second largest deal in 2016. MarshBerry acted as the exclusive investment banking firm for the historic merger.

- Patriot Growth Insurance Services, LLC formed in 2019 when 18 firms came together to become a national broker with 18 offices in seven states. These firms came together through relationships from various networks. Patriot’s formation involved financial backing from Summit Partners. In 2024, Patriot is ranked as the 26th largest brokers in the U.S. by Business Insurance and has 156 office locations across 28 states. The firm has continued its robust growth both organically and through acquisitions. MarshBerry sourced and valued the participating firms, brokered the individual transactions and assisted in vetting financing sources that brought the 18 firms together to form Patriot.

- In 2020, Oakbridge Insurance Agency LLC formed when four firms sold to Oakbridge at one time. The firm started with 18 offices in Georgia and received financial backing from private equity firm Corsair Capital. Oakbridge has continued to grow with acquisitions and organically, ranking as the 51st largest broker in the U.S. MarshBerry served as financial advisor in the formation of Oakbridge.

While there are multiple paths towards aggressive growth and individual acquisition opportunities that a firm can take to reach regional or national broker status, following such a broker formation strategy is likely to be the fastest way to get there.