Maybe it was the heat of the summer or the usual peak of family vacations, but insurance brokerage M&A activity in August took a nap, delivering only 24 announced transactions for the month. Whatever the reason for the dip in deals, the latest economic news of cooling inflation and projections for a soft landing – may be enough to spur a strong final four months of M&A deals. In which case, firms should be prepared.

For many high performing insurance brokerages, discussions (whether intentional or not) with potential partners looking to make a deal – continue to be a normal occurrence. There are plenty of stories of owners taking meetings with buyers, even though they are unsure if they are going to sell. The results of those meetings are often one of indecision with owners being relatively unprepared to react to a buyer’s proposition. Sellers often don’t know what they are looking for and take meetings out of curiosity.

Strategic Planning for Strong Insurance M&A Deals

It is critical to the future of your business to start with strategic planning of what you are trying to accomplish.

Start with an honest conversation with the right people

Determining the goals of the company and mapping out a strategic plan to accomplish those goals is the very first conversation you should be having with anyone. Have honest conversations with family, company leaders, and stakeholders about what you want the future of your company to look like. Once agreed upon, work with partners or advisors to build the roadmap for reaching those goals. That might mean raising debt or equity capital to remain independent, or perhaps it means taking on a capital partner, or it could mean selling completely.

In any scenario, that roadmap will help you determine who you want to meet with and whether those meetings and conversations align with your goals.

Once you start taking meetings with prospective partners, you will now be able to measure any opportunity you are presented with against a pre-determined strategic plan. This should help you clearly determine whether this opportunity is going to help you accomplish your goals.

The time to set a strategic plan for your company’s future is before you start taking those meetings with potential partners. It’s also before you even utter the words “I’m thinking about selling.” The time to set a strategic plan – is now.

M&A Market Update

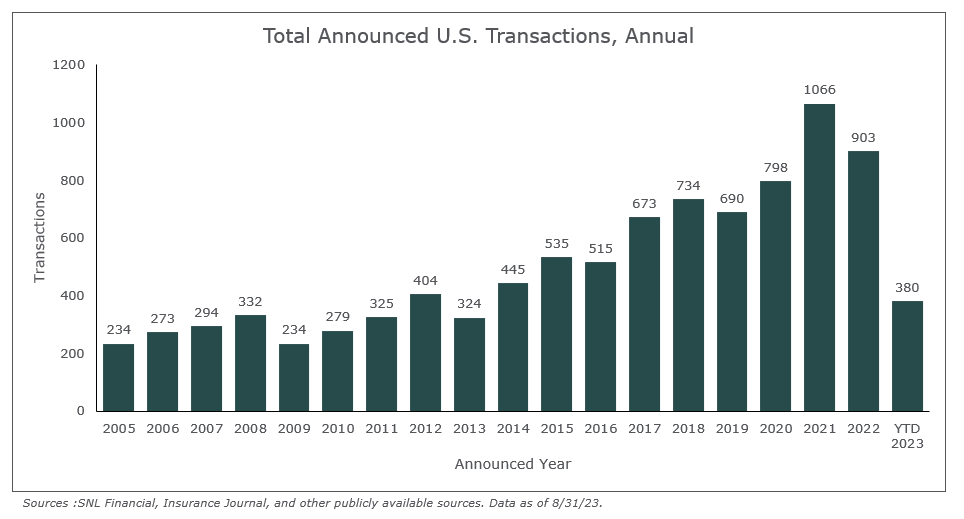

Through August 31, 2023, there have been 380 announced merger & acquisition (M&A) transactions in the U.S.

Private capital-backed buyers have accounted for 274 of the 380 transactions (72.1%) through August, which is consistent with the proportion of announced transactions in 2022. Total deals by these buyers increased at a compound annual growth rate (CAGR) of 11.1% since 2018, with a marked increase after the onset of the pandemic.

Through August, Independent agencies as buyers accounted for 55 transactions (or 14.5%) – down from 17.2% in 2022. Bank and thrift as buyers accounted for four announced deals (or 1.1%) – down from 2% in 2022.

Deal activity from the marketplace’s most active acquirers has remained strong in 2023. Ten buyers have accounted for 48.7% of all announced transactions, while the top four (Hub International, BroadStreet Partners, Risk Strategies, and Inszone Insurance) account for 27.6% of the 380 total transactions. Learn how to successfully position your brokerage to attract more buyers with our M&A advisory services.

Notable transactions:

- August 1: The Graham Company announced their sale to Marsh & McLennan Agency, LLC. The Graham Company is an insurance and employee benefits broker that partners with business owners in high-risk industries including construction, manufacturing, distribution, chemical, health and human services and others. MarshBerry served as the exclusive financial advisor to The Graham Company on the transaction.

- August 7: Ambac Financial Group, Inc. has completed the acquisition of a majority stake in Riverton Insurance Agency Corp, a company based in New Jersey that offers insurance services. Riverton’s MGA, Professionals’ Best, specializes in providing professional liability insurance programs for licensed architects, engineers, construction managers, and real estate professionals. Riverton also owns ALIA, a retail agency that arranges professional liability insurance for real estate agents through various insurance markets. This is Ambac’s 1st transaction of 2023 in the insurance brokerage sector.

- August 17: Gibson, an employee-owned, top-100 U.S. insurance agency, has announced the acquisition of Brisk Advisors. This is Gibson’s first presence in Utah and it plans to expand throughout the state. Brisk Advisors (formerly Insurance Network) has provided risk management and personal insurance solutions to clients for more than 50 years. This is Gibson’s first transaction of 2023.

- August 29: Risk Strategies specialty business, One80 Intermediaries, has acquired MGA GMI Insurance. GMI Insurance, established in 1980, specializes in providing insurance solutions for commercial transportation and related industries. Initially focusing on auto rental coverage, GMI expanded its offerings over the years to include a market-leading monoline business auto program, catering to accounts that do not require a comprehensive insurance package. The transaction is Risk Strategies 25th acquisition and 7th specialty acquisition of 2023.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230