Why is Leadership Important?

In the insurance brokerage industry, cultivating future leaders is vital for the long-term sustainability of an organization. Insurance brokerages rely on a hierarchical structure where experienced professionals ascend to leadership roles. Thus, fostering a culture of leadership development becomes crucial to drive a smooth transition into leadership positions. Effective leadership development and smooth transitions into leadership roles safeguard the company’s legacy and ensure continuity and adaptability in a dynamic market.

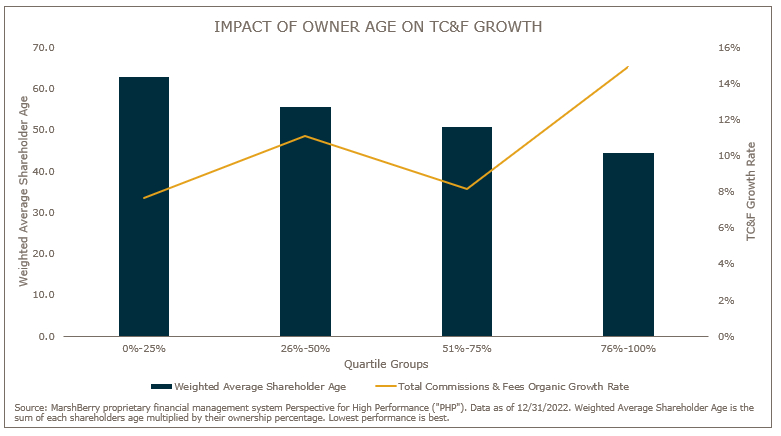

The insurance industry faces a unique challenge in the form of a high weighted average shareholder age (WASA). According to MarshBerry’s research, agencies with a lower WASA have higher organic growth rates. As a significant portion of industry leaders approach retirement, the role of leaders in the insurance industry becomes increasingly prominent as there is an imminent need for a new generation of leaders to take the reins. Organizations must identify and nurture talent to fill these leadership voids and ensure the company’s sustained growth and success.

In the current competitive landscape, there is a pressing need to cultivate strong leadership to drive growth. Effective leaders navigate change and inspire their teams to adapt swiftly. Developing the next set of leaders through strategic executive peer exchange is not merely a proactive measure but a critical imperative to remain agile and responsive to market dynamics.

Characteristics of Effective Insurance Leaders

- Self-readiness: Many leaders do not feel prepared for their roles. This feeling is not unique to insurance but underscores the importance of leadership development. Leaders must continually seek personal and professional growth to excel in their roles.

- Distinct from producer abilities: Being a successful producer does not necessarily translate into being an effective leader. Leadership requires a distinct skill set, including creating and communicating a vision, managing a team, and navigating organizational challenges.

- Cultivates culture: Leaders play a critical role in shaping the culture of their organizations. A strong organizational culture can enhance employee engagement, improve retention rates, and contribute to overall business success.

- Effective communicator: Effective communication is a cornerstone of leadership. Leaders must adapt their communication styles to resonate with various behavioral styles within their teams. Understanding these nuances fosters better collaboration and cohesion.

- Trustworthiness: Trust is fundamental in any organization, and leaders must lead by example to build trust within their teams. Trust empowers employees to take ownership of their roles and responsibilities.

- Strong ability to manage difficult conversations: Leaders must handle difficult conversations, whether addressing performance issues, conflict resolution, or change management. These skills are essential for maintaining a harmonious, productive work environment.

- Skilled at change management: Change is constant. Leaders must effectively communicate and guide their teams through changes in processes, technology, and market conditions.

- Emotional intelligence: Leadership requires a high degree of emotional intelligence. Leaders who understand themselves and their behavioral personality styles can better manage their emotions and relate to their teams effectively.

Developing Effective Insurance Leaders

- Coaching and development: Coaching and development programs nurture leadership talent. These initiatives help individuals identify their strengths and weaknesses and provide guidance for improvement.

- Individualized plans: Working with individuals early in their careers and putting them on personalized development plans can accelerate their growth as leaders.

- Mentorship: Assigning mentors to aspiring leaders can be immensely beneficial. These mentors can provide guidance, share experiences, and track the mentees’ development.

- Personal growth: For those aspiring to be in leadership roles, pursuing an MBA or other continuing education courses can be a strategic move. It equips leaders with the knowledge and skills necessary to make informed decisions and drive the organization forward.

- Outside leadership training programs: MarshBerry offers a variety of leadership solutions and programs that provide valuable insights and tools to enhance leadership capabilities.

Leadership has two facets: the art side and the science side. The art side encompasses soft skills like communication and culture-building, while the science side involves technical skills such as financial analysis, strategy development, and risk management. A well-rounded leader should excel in both areas.

In the insurance industry, leadership is not a mere formality but a critical driver of success. Developing future leaders, managing the challenges of an aging ownership demographic, and fostering a sense of urgency for growth are all essential aspects of leadership in insurance. A strong and capable leadership team is the linchpin for insurance brokerages seeking to thrive in an ever-evolving industry.