Building a strong service team to support your production staff is a critical component of long-term organic growth strategies and can provide a competitive edge in the insurance brokerage industry. However, the role of the account executive (AE) is often misused or misunderstood as firms look to deliver on client promises.

AEs often have the highest-level client interaction amongst a brokerage’s service personnel and are key to client retention and strong client relationships. AEs are typically entrusted with sophisticated relationship-management responsibilities since they share many of the same key natural skills, talents and knowledge that producers have. For example, ideal AEs have superior written and verbal communication skills, can build long-term client relationships, and have technical insurance backgrounds that make them the most knowledgeable team members about an insureds’ policy. Additionally, insurance brokerage leaders are noticing that motivating AEs to cross-sell accounts and nurture relationships helps their firms achieve their growth goals faster.

While specific titles for service personnel can vary depending on the firm, MarshBerry generally segments service personnel in three main roles when using a tiered service model.

- Account Executives: These are individuals with high-level, client-facing service responsibilities. They tend to have more experience and typically handle the largest and/or most complex accounts, which sometimes includes owning the renewal process and remarketing accounts.

- Account Managers: These are individuals with less direct exposure to insureds and who tend to handle the day-to-day account management.

- Processors: These individuals are typically responsible for reviewing and processing applications and assisting with various day-to-day servicing tasks.

How to motivate account executives

While AEs are in high-level, client-facing service roles, they often also manage their own books of business without producer involvement. They can also be attached to producers with larger books to execute important renewal activities. AEs are not typically required to hit new business production minimums and are paid a salary based on the total book they manage/support. However, many are incentivized to grow existing books of business by being eligible to receive a bonus based on identifying and closing cross-selling opportunities.

Most AEs will be uncomfortable with the idea of being asked to “sell,” but if implemented to ensure better service to clients, adding cross-selling in their workflow will be a lot smoother. It’s important to remind AEs that they are advising clients on risks, not just selling them products. If those risks are there, and clients aren’t covered properly, AEs are helping them in the long term.

Every opportunity to speak directly with a client can be a revenue generating opportunity. Very subtle changes in the way an AE speaks with clients can uncover new opportunities. Standardized sales pitches may not be the best strategy for AEs as they likely chose a service role because they like to help people. Instead, arming AEs with strategies to better serve clients and mitigate their risk profiles will likely be more effective.

Consistent communication and guidance to your AE team around the importance of discussing risk and gaps in your clients’ policies should be part of your long-term business strategy. Providing training for AEs on how to identify opportunities for adding lines of coverage, like workers compensation, cyber insurance, D&O, and others, is beneficial for helping to drive additional growth.

Measuring success for account executives

Firms can measure and track the performance of their AEs with different methods. One way is to track the total commission dollars and accounts assigned to each account executive. To measure success, a firm can look at the changes in average account size over time for each AE (by dividing the total premiums handled by the number of accounts). Benchmarking can also be helpful to gauge success and determine whether goals were met. This can provide clarity around the profitability of each AE; and whether they hit the realistic, achievable goals from the start of the year.

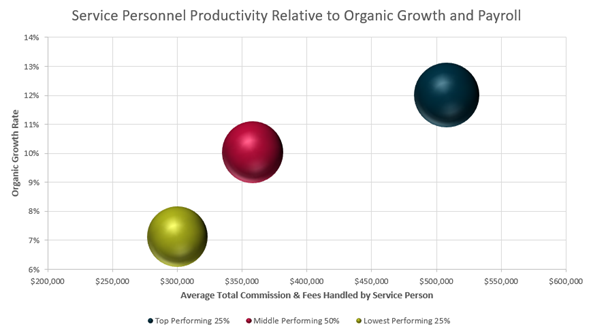

According to MarshBerry’s proprietary financial management system Perspectives for High Performance (PHP) – Total Commissions & Fees (TCF) per Service Person is a metric that measures the productivity of service talent by depicting the relationship between a firm’s income and the amount of business that its service personnel maintain. The graph below shows that firms with higher payroll per serviceperson tend to have efficient staff that can handle more business. Having more efficient and effective service personnel helps producers better focus on writing new business. Firms who pay service personnel in the Top 25% of the database have an average organic growth rate that is 2.0% higher than the average organic growth at the firms that pay in the middle 50%.

Source: MarshBerry database Perspectives for High Performance (PHP), 3/31/24.

Firms that offer competitive compensation to account executives may see higher growth

Brokerage firms should consider offering competitive salaries and other financial incentives for their AEs (and other service employees). Firms with higher payroll per serviceperson tend to have higher service staff productivity, which allows producers to spend more time producing, leading to higher organic growth.

Generally, some variable compensation is recommended for service employees. Service personnel compensation and incentives can and should be aligned with meeting company goals (such as new business production or retention), team goals, and any individual goals.

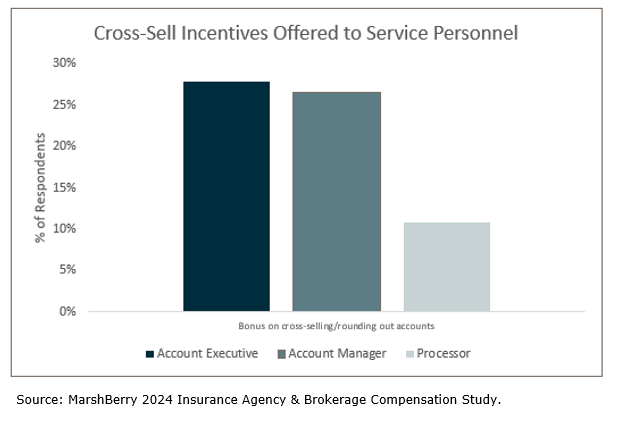

While most firms surveyed in MarshBerry’s 2024 Insurance Agency & Brokerage Compensation Study offer some variable compensation to their AEs, only about 28% of firms offer bonuses on cross-selling/rounding out accounts to AEs. Many brokerages can potentially motivate their AEs to do more cross-selling by offering bonuses that are aligned with strategic goals.

Overall, account executives help drive a firm’s organic growth, quality of the service, and the retention at the firm. The path to achieving top-tier organic growth requires effort, but the right account executives can be a key part of reaching that goal.

Whether you are looking to hire new AEs or develop a team of high-level service personnel incentivized to help accelerate the growth goals of the business, MarshBerry can provide tailored solutions to build and maintain sustainable sales practices and strategies to build a strong team of cross-selling talent.

Reach out to a MarshBerry Growth Advisory Consultant to learn more about how to identify best practices, opportunities for talent acquisition, and whether additional communication and sales training would be beneficial for hitting your long-term goals.