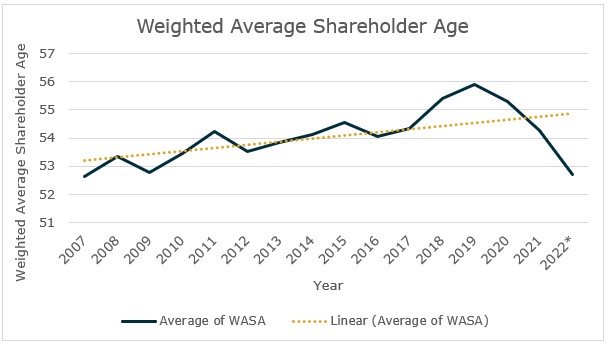

In 2019, according to MarshBerry’s proprietary financial database, Perspectives for High Performance (PHP), the average Weighted Average Shareholder Age (WASA) was approaching a peak of 56. However, it did drop in the following two years, coming in at 55.3 in 2020 and 54.3 in 2021; it further dropped below 53 in 2022. Rising valuations in recent years may have encouraged older owners to separate with all or part of their holdings bringing the average WASA down.

WASA, which shows the average of the shareholders’ age weighted by the percentage of stock they own, can potentially signal a firm’s need for a perpetuation strategy. Seeking predictable growth by reinvesting in future generations is key to a company’s future success.

A lack of reinvestment in perpetuation can destroy a company’s value. The value and appeal of a business lies in the company’s possibility for future growth and profitability. Without a clear plan for growth, a company’s value may decrease as the potential risks can outweigh the potential for growth. Sometimes buyers see a limit to the potential growth and profitability of a company when there is a shorter runway with existing leadership.

Creating a Productive Perpetuation Plan That Involves Younger Producers

Firms that have a higher than average weighted average shareholder age should consider investing time and effort into equity succession planning. Developing a formal perpetuation strategy that is targeted towards empowering younger producers can lead to an increase in organic growth. When the plan is shared with the firm at large, it can provide clarity for producers who aspire to become stakeholders in the business which in turn can help drive an increase in focus and performance.

Creating a clear and formal process for turning over equity to younger producers will not only decrease the firm’s WASA, but it can create a higher valuation due to the increase in potential growth and decrease in potential risk. Furthermore, creating a perpetuation plan can empower the next generation and foster loyalty within the firm.

When there is an ownership perpetuation strategy for key staff, there is a better opportunity to motivate and create purpose for your team which will help with talent retention and overall growth and value.

If you have questions about Today’s ViewPoint or would like to learn more about how you can create strategies for growth acceleration, email or call Jen Martin, Vice President, at 440.287.6790.

MarshBerry advised more than 95 companies and completed 130 M&A transactions in 2021, closing another record year for the firm. MarshBerry continues to remain the number one sell side advisor for the 23rd year in a row and retains the top spot in the industry for total number of clients advised.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, LLC. 28601 Chagrin Boulevard, Suite 400, Woodmere, Ohio 44122 (440.354.3230)