Producer compensation is likely your largest expense. However, in most cases, it’s also the most inconsistent expense on your income statement. During stable environments, it’s easier to avoid the elephant in the room. But, with uncertainty and continued threats to our industry, addressing this topic at your next planning meeting should be a priority.

The opportunity to harness the advantages of an effective compensation structure for an insurance producer are bountiful. A well-designed sales compensation plan has tremendous impact on:

- Growth

- Talent acquisition

- Perpetuation planning

- Sales culture

- Employee performance

In times of highly competitive and challenging job markets, modifying producer compensation plans to peak effectiveness can give firms an advantage in retaining and attracting top talent. As the industry and market change, and firms add services, capabilities, and a higher level of technical employees, firms can benefit from a more focused approach on refining compensation plans. This isn’t just compensation for producers, but also your incredibly valued service team.

A Metric for Insurance Producer’s New Business Production

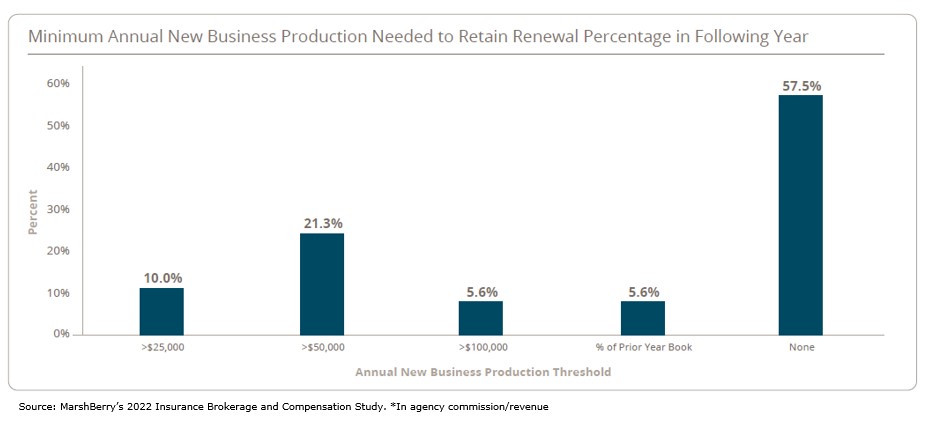

According to MarshBerry’s 2022 Insurance Brokerage and Compensation Study, over half of respondents indicated that they do not have a minimum annual new business production threshold that producers need to achieve to maintain the same renewal percentage in the following year. In other words, aside from producers getting paid less because they didn’t meet their agreed upon goals, there isn’t a negative financial impact for them going forward.

4 Keys to Improve Your Producer Compensation Strategy

As you venture down the path, consider the following MarshBerry fundamentals:

- Measure twice, change once. Far too often, clients don’t ask the holistic questions as it relates to producer compensation leading to ineffective changes being made and suboptimal results due to lack of strategic insight. Showing the data behind the decisions confirms the validity of the decision to have (and enforce) the “carrot and stick.”

- Ensure you have a measurable spread between new and renewal commission percentages. This spread differential helps focus the producer on new business production over renewal compensation. Account retention is important for both the producer’s personal income and firm revenues. However, new business production is critical to the future viability of the organization. A producer’s W-2 should be highly impacted by generating new business.

- Have well defined, long-term goals around growth and perpetuation. These goals should always be factored into why, when and how to implement strategic changes.

- Create sales compensation models that incentivize and reward high performers. The best performing firms reward high performing originators that are able to generate sustainable new business. This compensation model protects the firm from overpaying non-performing salespeople on the residual, due to lack of new business performance.

This approach is not a one-size-fits-all model. But leadership needs to be having these conversations, and not just about compensation models. Leaders need to talk about how technology, marketing and a robust mentorship program can serve as a differentiator for the firm, aiding in producers’ and firm’s success. A producer compensation strategy is not for the faint of heart. The top performing firms attack this challenge head-on and have built cultures that embrace change, no matter how difficult and uncomfortable it can be.

The Power of Consultants Towards Sustainable Change

The industry has evolved considerably over the past ten years and so have your competition and customers. Now it’s time for producers to adapt for sustainable change. The necessary resources that an average brokerage needs to win and retain customers have transformed and producer compensation models have not kept up. Has yours? If not, reach out and have a conversation with an insurance agency consultants from MarshBerry to see just how your producer compensation model can lead to an increase in sales year after year.

If you have questions about Today’s ViewPoint, or about creating a compensation strategy for your firm, please email or call Eric Kuhen, Senior Consultant, at 440.637.8118.

Compensation Market Pulse Study – Now Open

MarshBerry is conducting a market pulse study on what firms are paying sales, service, support and management personnel. Be a part of this industry benchmarking study by completing a 5-minute survey to help MarshBerry gauge how compensation trends have changed over the last year. Pulse study results will be shared with all participants in a future edition of Today’s ViewPoint. Survey closes October 28.