When you hire a new producer to your insurance brokerage business, the first step is crucial: creating a culture of accountability among new hires starts on day one. Some firms struggle with balancing realistic expectations while at the same time pushing new hires to meet ambitious targets. Once performance goals are clear, how can leaders get producers off on the right foot? And what do you do if new hires fail to meet expectations?

Setting Clear and Reasonable Insurance Producer Expectations

All producers should have goals. But it’s important to set up goals based on a producer’s years with the firm. (i.e., Year one goals should look different than year two.) Next, identify the right expectations by looking at how successful producers have performed in their first few months and years. Consider your marketplace, line of business, and how much support your firm can give new producers. For example, a firm may have high expectations for new business, but also offers strong lead generation resources. Or conversely, a brand-new firm, without established sales tools, may have lower business goals for new producers. Communicating expectations early on is key for long-term success.

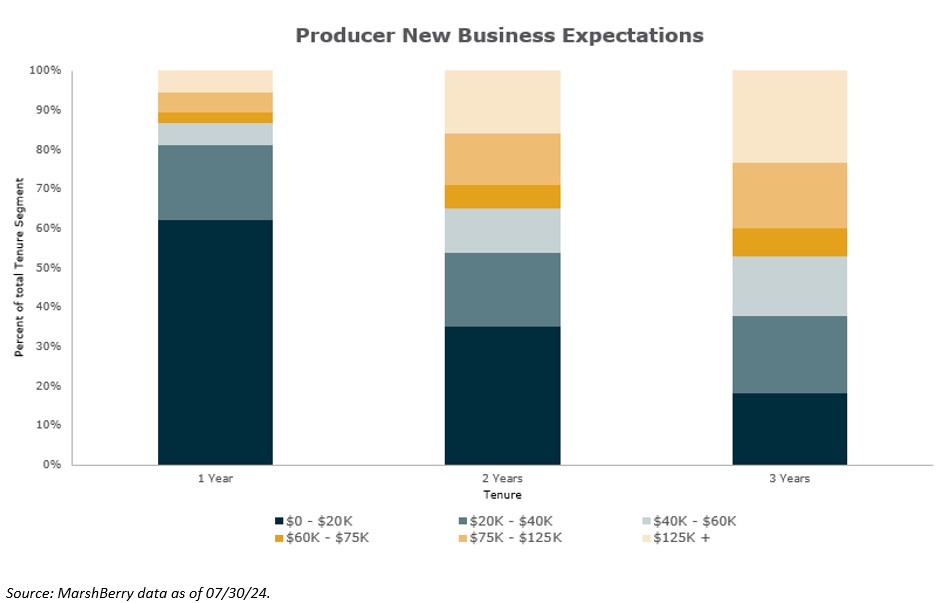

Based on MarshBerry’s proprietary financial management system Perspectives for High Performance (PHP), here is a breakdown of an average firm’s specific new business numbers for a producer’s first three years in the role:

These numbers are also based on the average of all firms in MarshBerry’s database and may need to be adjusted based on your firm’s specific expectations and sales support model. Remember that these expectations are best suited for new insurance sales producers, with no insurance experience.

Learning Techniques to Support New Insurance Producers & Drive Sales

Coaching and training should be a major part of the new producer’s experience. Create defined onboarding plans and dedicate mentors to offer advice and acknowledge successes. A key tool in developing sales skills is role playing. Producers may feel awkward acting out a conversation with a client but encourage them to think like an elite ball player warming up in the batting cages. It’s important to condition and refine those sales muscles. Likewise, role-playing and practice can help them prepare to overcome objections and first-time nerves.

MarshBerry also recommends assigning an onboarding mentor. An experienced producer can help with challenging situations and answer questions. New producers should never go on their first appointment by themselves, mentors or more senior producers should help close business and pitch your products.

Other tools that help achieve expectations are checklists, scripts, and sales guides. These aids can help producers ensure they cover all key points in a conversation and remember all elements of the business’ value proposition.

New Insurance Producer’s Role in Onboarding

A new producer should take ownership of their development and be a self-starter: they should confirm expectations, seek out support, and solve problems. If they’re not successful, encourage them to talk to their manager and other internal experts to deepen learning. A strong producer should be able to demonstrate how they’ve achieved milestones and prepared to take on new business. Overall, strive for better than average in new producer development.

Managing Elite Insurance Producers and Addressing Underperformance

When a new producer has met or exceeded goals, offer rewards and recognition to keep up the momentum, but encourage them to continue focusing on new business and increasing average account size. As producers become validated, and goals become more challenging, the next step is to become experts and specialists in certain industries.

When producers are struggling, it typically becomes apparent in year one, so don’t wait to address poor performance. Consider additional mentoring, introduce a performance improvement plan (PIP), or evaluate whether they may be a better fit in a role with different skills, like an account executive role. But avoid adjusting expectations due to economic conditions or insurance market cycles, as that can become an excuse for underperformance. This is also a key time for analysis – was the individual a poor fit for the role or was the sales process, training, or mentorship a hindrance? Evaluate all areas to improve your success rate next time.

Professional development doesn’t end after the first two years, so training and expectations should adapt as producers become more experienced. Clear expectations drive motivation as they help producers visualize success but also avoid burnout or aiming for impossible goals. Your staff – and bottom line – will thank you.

MarshBerry’s 2025 Agency & Brokerage Compensation Report: Available for Purchase

MarshBerry’s 2025 Insurance Agency & Brokerage Compensation Report explores the prevalent compensation trends concerning insurance agents and brokers. This one-of-a-kind report comprehensively examines current compensation data for 38 roles commonly found across insurance agents and brokers. The report offers insight into Executive & Management Compensation, Production, Service Staff, and Support Staff.