According to the recent 2023 RIA Edge Study, developed by Wealth Management IQ in partnership with MarshBerry, firms continue to be bullish on their growth. Survey data shows that nearly 70% of firms target asset and revenue growth levels between 10-30% in 2023. However, considering that average revenue growth for RIAs in 2022 was only 4.1% (compared to 7.8% in 2021)1 – how do firms plan to achieve this growth?

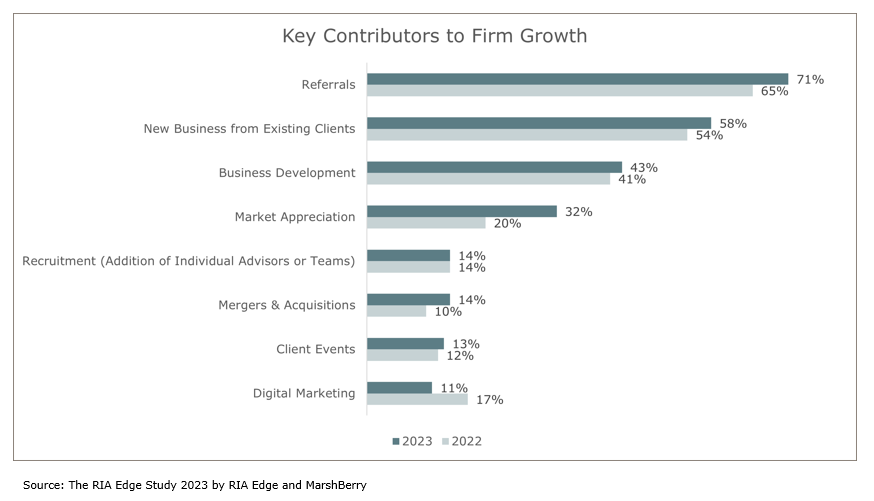

According to survey results, wealth advisory firms are looking to traditional methods for growth, with referrals and new business from existing clients topping the list.

Increasing your advisory firm’s assets and revenue through referrals and existing clients is table stakes. But it’s not a comprehensive strategy and will likely not generate the expected 10-30% top-line growth. And relying on market appreciation to reach revenue goals isn’t a strategy. Firms that are growing “the right way” go beyond referrals and expansion of wallet share and focus on those additional initiatives that can contribute incrementally to a growth strategy – recruiting advisors and deploying digital marketing strategies.

The Importance of Recruiting Advisors

Investing in talent is an investment in the business and, if done properly, will generate significant ROI. Hiring should be intentional, thoughtful, and aligned with the firm’s strategic goals, and it should include a mix of experienced and newer advisors to ensure success in the near and long term.

A few benefits of looking to talent to drive growth include:

- Capacity: Create the capacity to grow revenue without sacrificing client service excellence and business retention.

- Specialization: Recruit talent with specific skills to augment your service offering or expand your geographic reach.

- Diversity: Hire advisors with diverse experiences and backgrounds to extend your offering to a new segment of clientele.

- Workforce segmentation: Improve sales productivity by allowing those with strong business development skills to focus their time and energy on generating new business, while those with client service and fulfillment skills can focus on providing a great client experience.

Like any investment, bringing on new talent may take time and effort before you realize the financial benefits, but surely beats the alternative of maintaining the status quo.

The Benefits of Digital Marketing

Digital marketing offers wealth advisors the power to build brand, expand reach, educate your audience, generate leads, and differentiate yourself in a crowded market.

Further, for good or bad, your clients and prospects spend most of their time online. Experts say Americans spend an average screen time of 5 hours and 25 minutes on their mobile phones daily and their time on their computers.2 Since almost every customer researches products or services on the web, it’s optimal to feature your business where potential clients spend their time. Here are some simple ways to use digital marketing to grow your firm:

- Website: Inbound leads can draw legitimate growth. However, prospects need to find you first. This means your website and content must be search engine optimized (SEO). When someone searches for a financial advisor with a specific set of services or in a specific town, you want your firm to top the list or, at a minimum, show up on the list. Your site needs to be easy to navigate, up to date, and communicate your story and value proposition. If you’re looking for inspiration, Stash Wealth, Wealthspire Advisors, and Safran Wealth Advisors are great examples of firms with best-in-class websites. Note that these pages feature prominent calls to action (CTAs), such as appointment links and contact forms – making it easy for potential clients to connect with them.

- Email campaigns and newsletters: Low-cost yet effective engagement with prospects is best accomplished through consistent drip email campaigns that nurture leads and provide educational content. Distributing newsletters with market updates and unique commentary is also a great way to convey your expertise to prospects. Don’t forget to include contact information or a link to your website.

- Digital ads: If you operate within a niche, digital ads can help you reach potential clients with specific job titles, industries, ages, education, and more. Google offers pay-per-click (PPC) advertising campaigns to target specific keywords, while Facebook and LinkedIn allow firms to run targeted ads that address a specific audience.

- Social media: Use platforms like LinkedIn, X (formerly Twitter), and Facebook to demonstrate thought leadership, participate in industry groups, and engage with your audience via another channel. Facebook even offers free business pages for firms looking to expand their reach using their platform. Iron Oaks Wealth Advisors is an example of a Facebook business page offering informative content and clear ways to contact.

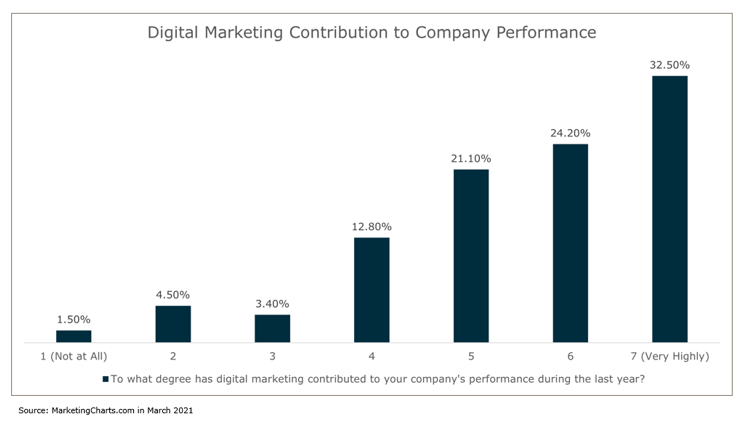

As noted in the chart, most companies found that digital marketing contributed to their company’s performance.

Buyers of wealth firms place a premium on those who can demonstrate consistent organic growth. For a firm to do this effectively, they need to employ a variety of methods that together create a cohesive growth strategy and process. Referrals and cross-selling strategies aren’t going anywhere but will not yield upper quartile outcomes and valuations. 2022 was one of the most challenging years for RIAs in recent history – but a handful of firms have made strategic shifts and investments that led to outsized growth and performance. These are just a few of the secrets behind their success.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.