Do you want to just maintain your business? Or do you want to grow your business? Producers are the key to uncovering new business but sometimes work on preserving their current book, instead of expanding their book. Insurance brokerage owners may hear the excuse, “My book is too large to take on more accounts.” While that may be true when it comes to volume, their focus should be on those accounts with large dollar amounts. Larger books offer more opportunities and greater growth over time.

There’s a three-step process that can help producers focus on finding new leads and remove accounts that aren’t as gainful. Once a year, producers should follow this strategic approach to create capacity:

- Analyze your book of business.

- Identify and shed the smallest accounts.

- Hunt new, larger accounts.

It’s important to note that the goal of this process is not just to uncover any new business, but to bring in accounts that can afford to add services and products and will be advantageous to your insurance brokerage business.

Analyzing your book of business

The first step is for producers to look at their broad book of business and identify the smallest 20% of their accounts in revenue. These are the clients that most likely should be managed by another team at their firm, such as a service team or account executives. Then, producers should look at the top 20 accounts in their book as a guide for the lowest size they can take on and still drive growth. For example, if a producer’s smallest account in the top 20% is $25,000 in revenue, the producer should be prospecting accounts that size or above.

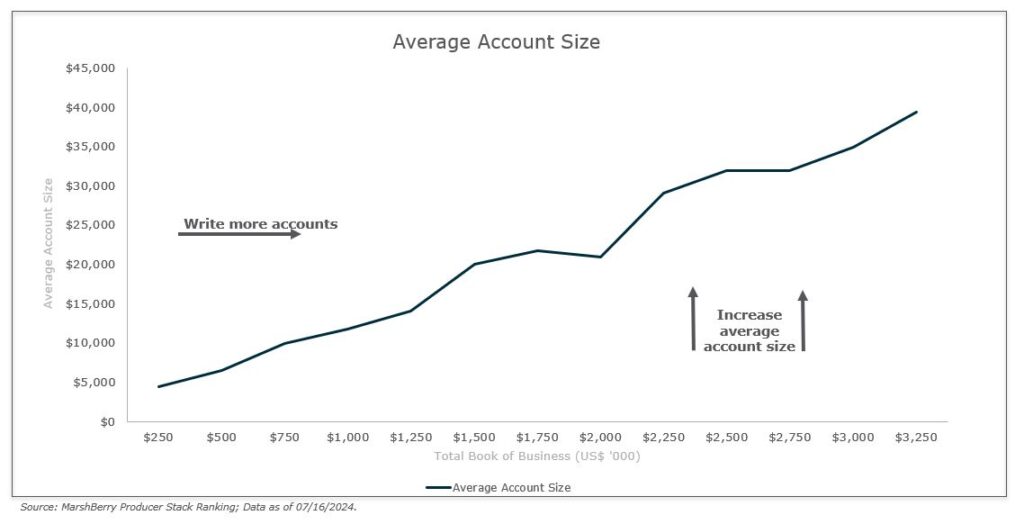

Looking at the chart below, you can see recommendations on how to determine when a producer needs to write more accounts or increase their average account size.

This doesn’t mean producers can’t write any smaller accounts, but if they receive a referral that’s below their threshold, they should work with the firm to offload that relationship with the right team. Typically, 80% of the revenue comes from their top 20% of accounts.

Transitioning smallest accounts

After identifying the least profitable accounts for that producer, transition them to a service team or another producer. The firm’s leadership should work with producers to determine how to best manage the client’s needs. Producers may fear losing a longtime relationship, but a smooth handoff can alleviate client concerns.

Another concern is that removing accounts reduces compensation, but often these accounts have minor impact to their W-2. Producers may find that it makes sense to shed these accounts because they don’t spend a lot of time on them and aren’t contributing to their financial stability. MarshBerry has seen first-hand how firms that created strategic compensation solutions ultimately motivated producers to shed these small accounts and be incentivized to hunt for larger clients.

Removing the day-to-day handling of small accounts from their book will create capacity for them to generate new business and build their book a little bit more strategically. Aligning accounts to the best people to serve them, such as service teams, newer producers, or account executives, should be built into the firm’s culture.

Using largest accounts to drive new business

Those remaining top accounts help producers mine referrals and get introductions to other business, but producers should start with becoming a strategic resource. Producers who are skilled at working with their top 20% of accounts tend to be industry experts. They focus on a certain niche or two where they’re actively involved in that industry’s community. This may be serving on a board for a local association or taking leadership positions in specific networking groups. This enables producers to be more intentional in hunting for business and helps proactively prospect larger accounts.

For those struggling to drive referrals, look at these larger accounts and consider how you won their business at the onset. What value did you offer them that is relevant to similar prospects? Maybe you introduced policies that helped prevent business loss or allowed them to expand their product lineup. With smaller accounts off their plate, producers can share those success stories with targeted clients who need more of their services.

As a producer’s book increases there becomes a capacity restraint, so it’s key to manage the way their accounts grow. Otherwise, they will hit a wall where they have too many clients, too many relationships to manage, and can’t dedicate time to developing more valuable client relationships. If you want your business to grow and thrive, you must learn to overcome this challenge. A large volume book is great, but it can’t beat a large monetary figure.

High performing producers are the lifeblood of your business

MarshBerry’s Producer Stack Rank offers insight into how your sales staff are performing relative to their peers in the industry. Each producer’s book of business is benchmarked against MarshBerry’s proprietary producer database. This analysis is unlike any other available in the industry.

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.