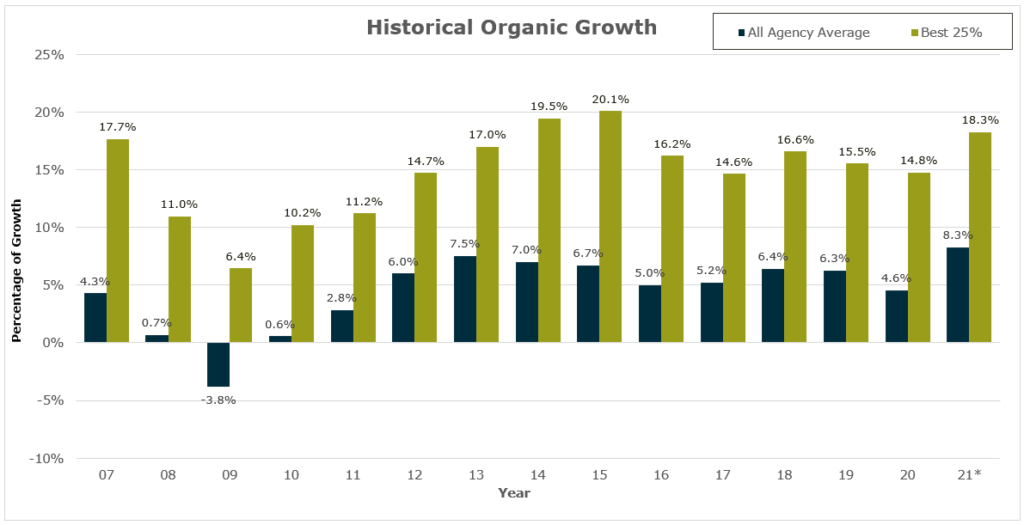

In 2021, brokerage and agencies reporting to MarshBerry’s proprietary financial management system Perspectives for High Performance (PHP) saw, on average, a nice lift in organic growth from 4.6% in 2020 to 8.3% in 2021. This increase in organic growth was likely driven by several factors, including:

- Increases in asset prices and higher premiums, leading to an increase in commissions.

- The ongoing economic recovery post-COVID-19.

- Pent-up demand and business pushed from 2020 into 2021 due to restrictions, a decrease in travel, and fewer in-person meetings.

Over the last decade, the Best 25% of firms in PHP consistently saw double-digit organic growth, outperforming the agency average. The results have been relatively consistent over the past four years, with a slight decrease in 2020 as COVID-19-related issues impacted the economy.

How Top Brokerage Firms Remained Resilient

Overall, the insurance brokerage sector remained resilient during the short COVID-19 slowdown in 2020. However, the Best 25% saw even less of an impact to organic growth vs. the average firm. Furthermore, the Best 25% of firms also saw less of a drop in organic growth levels during the recent pandemic-related slowdown vs. in the prior recession in 2009. These findings suggest that top-performing insurance brokerage firms may be in a better place to weather future market volatility and are now even better positioned to handle slowdowns.

Growth Strategies of Top Insurance Brokerage Firms

How are the Best 25% achieving these organic growth rates – and keeping them relatively stable even in a pandemic? They’re:

- Focusing on PPOG, or Predictable, Profitable Organic Growth, key variables to predict top line new business growth.

- Conducting frequent sales huddles; weekly is ideal.

- Leveraging team selling with subject matter experts to close business.

- Utilizing time previously designated for travel for virtual huddles, strategic planning for clients and training sessions to improve sales acumen.

- Searching for quality opportunities vs. quantity.

- Adding value to their clients by impacting their Total Cost of Risk.

The top brokerages likely make ongoing strategic investments in people, analytics and systems which further boost their growth and resiliency. Effective data, analytics and resources can help drive successful outcomes for top firms to organically outpace, outperform and outgrow the competition with data-driven insights and proven sales strategies for success.

Now is a good time to consider what the Top 25% of firms are doing to achieve success and think of how you can take similar steps to position your firm for outsized organic growth and resilience during both upturns and challenging times.

If you have questions about Today’s ViewPoint, or would like to learn more about how you can drive growth acceleration for your firm, email or call Frank Cox, Senior Vice President, at 616-426-8522.

MarshBerry 360 Forum helps decision-makers increase growth and profit with strategies designed to meet today’s and tomorrow’s challenges. Attendees will gain valuable insights, methodology, and resources from highly in-demand industry speakers in sessions designed to improve firm performance, earnings, value, and market resiliency. Learn more and register at www.MarshBerry.com/360.