When it comes to total rewards for your staff, aligning with insurance industry compensation trends can make a big difference. Your firm’s compensation cost is likely the most significant expense, but it can also be the expense that most needs adjustments. Inconsistencies across roles can leave some employees feeling less valued. A thorough approach to compensation across positions leads to endless benefits.

The importance of a strong compensation strategy

Strong compensation models give your firm a competitive edge in retaining and attracting top talent. A well-designed total rewards package can help you make long-term decisions related to salary, benefits packages, or budget planning.

Proper compensation contributes to the overall success of your business. Top-level salaries and bonuses make your staff feel valued, motivating them to contribute their best work. Workers go above and beyond to serve customers when company morale increases, increasing client retention.

Compensating service staff

Many firms have a strong compensation structure for producers based on individual performance, but few have a compensation structure based on service staff performance.

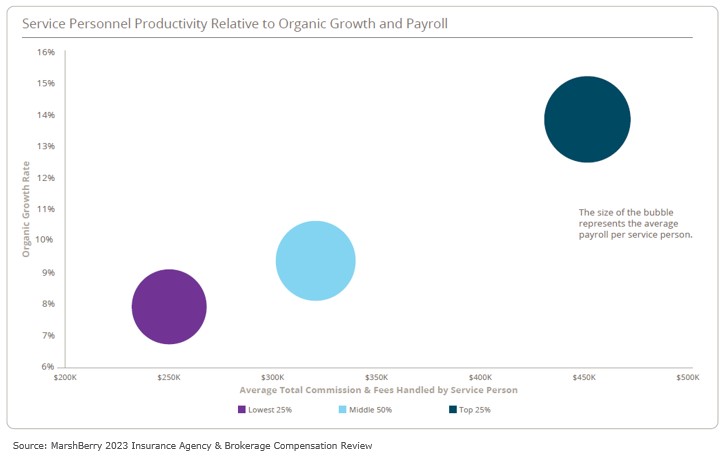

A direct relationship exists between being a top-performing firm and offering competitive pay for service personnel. This chart illustrates the relationship between service staff payroll and organic growth rates. Top-performing firms spend 33% more per employee; their average productivity is 80% higher than the lowest 25% group.

Think beyond the commission model

Top-performing firms look for alternative ways to structure compensation plans for service personnel. Employees desire a work environment with a work-life balance, including remote work options and flexible scheduling. The primary motivator for getting the best results from an employee isn’t always monetary. Providing generous paid time off policies, including vacation days, holidays, and personal leave, allows employees to recharge and rejuvenate. Other team members may be motivated by career development. Sponsoring them to achieve a specific designation or tuition reimbursement can boost current staff and attract others to your firm. Creating a thriving culture where people can meet/exceed personal goals is a surefire way to become a preferred employer.

Total rewards packages for service staff in the insurance industry encompass a broad range of benefits and incentives designed to attract and retain talented individuals. These packages prioritize competitive compensation, health and wellness benefits, work-life balance, career development opportunities, and financial security. Insurance agencies create an engaging and supportive work environment that values their employees’ contributions and well-being by providing comprehensive rewards.

MarshBerry’s 2023 Agency & Brokerage Compensation Review: Available for Purchase

MarshBerry’s 2023 Insurance Agency & Brokerage Compensation Review explores the prevalent compensation trends concerning insurance agents and brokers. This one-of-a-kind report comprehensively examines current compensation data for 31 roles commonly found across insurance agents and brokers. The report offers insight into Executive & Management Compensation, Production, Service Staff, and Support Staff. Learn more and purchase here.

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.