The entry point: The United Kingdom

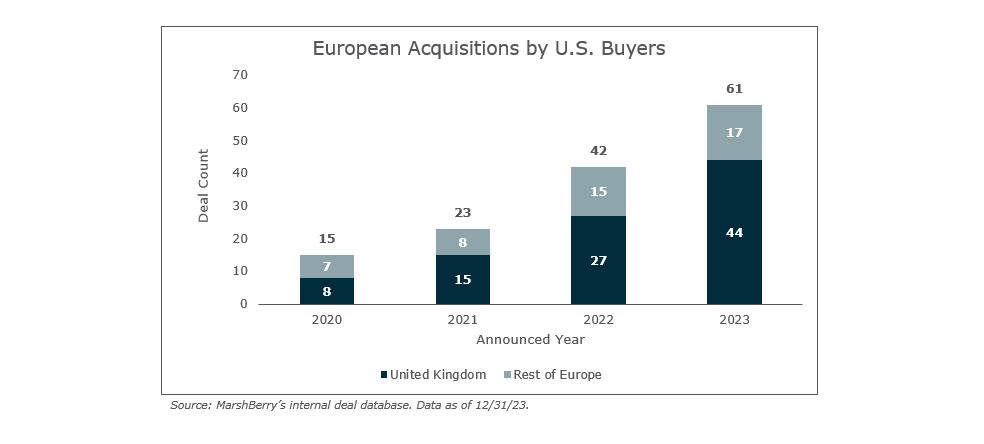

The natural starting point for European expansion for U.S. buyers has proven to be the U.K. Aside from the major benefit of a common language, the U.K. represents an economy, consumer base, and insurance distribution market that is very similar to the U.S. The U.K. also boasts the birthplace of insurance in London, where many U.S. brokers still do business and have existing ties (such as accessing capacity through Lloyd’s of London). Pairing these facts with the need for consolidators to continue to find ways to grow each year (both organically and inorganically), has driven a flurry of U.K. deal activity by U.S. buyers over the last several years. In 2023, these buyers accounted for 44 acquisitions in the U.K., up over 500% since the eight deals completed in 2020.

Building on this momentum, many U.S. buyers have gone on to make select acquisitions throughout Europe, including 17 transactions outside of the U.K. in 2023. In totality, European acquisitions by U.S. buyers surged from 15 in 2020 to 64 in 2023, representing a compound annual growth rate (CAGR) of 36%. This trend is laying the foundation for the construction of a Pan-European brokerage.

Continental Europe: A larger playing field

In contrast to the ease of working in the U.K. – the insurance distribution landscape in continental Europe tends to be much more fragmented with many distinct markets rooted in unique languages and cultures.

The U.S. based brokers who have already entered the broader European market are many of the largest players in the industry, typically those with more than $1 billion in annual revenues. Zooming in on the top 20 brokers in the U.S., nine currently boast a European presence (which includes Aon and WTW which are headquartered in Europe), with others actively looking to enter or preparing to enter the market.

Bear in mind these U.S. based players didn’t “bring M&A” to Europe. In fact, they face plenty of competition for market share from their European-based counterparts. The U.K. mergers & acquisitions (M&A) market for insurance distribution firms is quite mature, with much of the consolidation driven by private equity-backed compatriot buyers such as Howden, The Ardonagh Group, and several others.

Beyond the U.K., other consolidators with similar ideologies of creating a Pan-European broker have formed, primarily in larger economies such as Germany, the Netherlands, and France. These regional consolidators recently began to expand beyond their borders as well, typically after exceeding $100 million in annual revenues within their native country.

What’s next for the European market?

Two trends for insurance distribution M&A in Europe are expected over the next few years:

- U.S. brokers with an established U.K. and European presence will increase their acquisition activity in broader continental Europe.

- Additional buyers based in the U.S. and Canada will begin a European expansion (likely starting with the U.K.).

That being said, the meaningful consolidation of the U.K. insurance distribution market has created a scarcity factor for platform opportunities. In contrast to the regeneration the U.S. market has seen, with the number of independent brokers remaining relatively stable despite substantial acquisition activity – the U.K.’s number of independent brokers has materially declined.

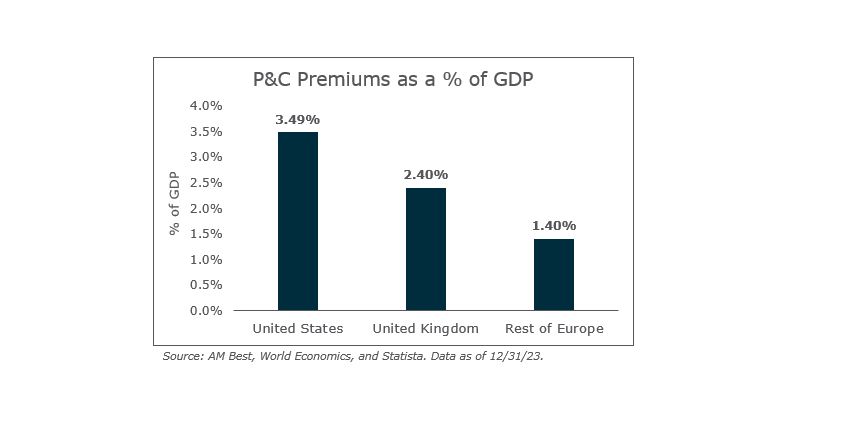

As such, those U.S. buyers who want to expand into the U.K. (and the rest of Europe) will need to act quickly and should expect to pay a premium valuation to do so. However, with the GDP of Europe rivaling that of the U.S., and Property & Casualty premiums in Europe being relatively low in relation to that GDP, the incentives and long-term upside of a European expansion seem to be convincing many buyers it’s worth the investment.

Looking ahead

As insurance brokers in the U.S. search for innovative growth opportunities, many have found success expanding into the European market. Once in Europe, these buyers join an already competitive marketplace, albeit one with significant opportunity and long-term upside, where they race against each other and their European counterparts in the journey to build a Pan-European insurance broker.

With the potential to reshape not only the European insurance distribution industry, but the U.S. as well, buyers should ensure they gain a thorough understanding of this movement. The competitive landscape is changing. How this impacts the market and the continuing trend of the large getting larger will be an important dynamic as U.S. buyers assess growth plans, provide acceptable returns to investors, and add to market clout with carriers, distribution partners, and others. In short, those not giving international expansion serious consideration may find themselves standing ashore as the proverbial boat leaves the dock.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230.