A growing number of Americans are turning to freelance work, with 38% of the U.S. workforce, or 64 million people, engaged in freelancing in 2023 – up from 60 million in 2022. Freelancers and independent contractors play a vital role in the U.S. economy, contributing $1.27 trillion in annual earnings. Between 2020 and 2023, the number of full-time independent contractors surged by 90%, according to Emergent Research. This upward trend is expected to continue with projections indicating that over 90 million Americans will be freelancing by 2028.

What Are the Risks of 1099 Independent Contractors?

Some insurance brokers opt to bring on producers as 1099 independent contractors. Often firms hire independent contractors to launch into a new geography where the firm does not have a physical location. While using contractors offers advantages, such as reduced costs associated with benefits, payroll taxes, and overhead, it also comes with significant risks that need careful consideration.

The differences between an independent contractor and a salaried producer extend beyond classification as a W-2 or a 1099 employee. The major distinction is that a contractor is self-employed, manages their own work, and may place insurance business with several brokerages – thus contractors are not subject to direction and control from any specific firm. They are also generally responsible for their own taxes, business and travel expenses, worker’s compensation and E&O (errors and omissions) insurance.

Because of this, there are several potentially high impact risks related to legal, compliance and security issues, including misclassification risk; liability insurance and coverage gaps for independent contractors; contractors failing to comply with regulations; and data security risks.

How to Mitigate Risks of 1099 Independent Contractors

Properly managing these risks requires a combination of clear contracts, proper classification, and close oversight to protect the company from potential liabilities. Firms can be proactive in preventing any potential issues related to legal, compliance, and security risks when hiring independent contractors.

If you are going to use independent contractors, here are some measures to consider:

- Use legal contracts: Firms should ensure they have clear contracts with details about who owns parts of the business. Sometimes a producer will build a book as part of a firm. It can be helpful to define who owns the business, so when a producer plans to leave the firm, they would need to buy that business out or it becomes the property of the firm.

- Obtain necessary liability and coverage: Firms should add the 1099 employees to their agency liability policy as additional insureds. Also ensure independent contractors have their own E&O insurance.

- Classify employees: Firms can prevent misclassification risks by ensuring that workers are correctly classified – as either independent contractors or employees to avoid legal penalties, back taxes, and benefits liabilities.

- Set clear expectations and communicate them: When hiring independent contractors, set and communicate your expectations on strategic planning and growth goals. Have a written agreement in place with all of the necessary points and directives in the agreement.

Long-Term Risks of 1099 Independent Contractors

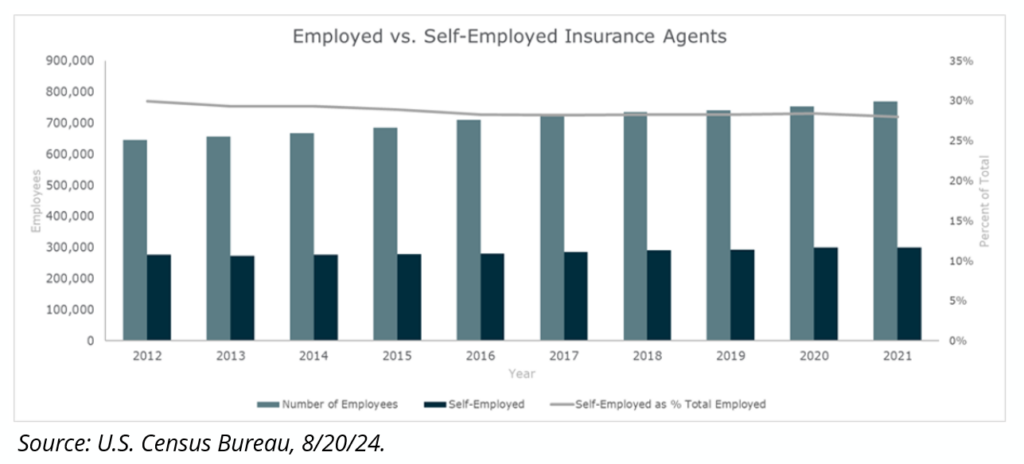

While using independent contractors as producers can reduce the company’s overall expenses, there may be longer-term risks related to overall revenue growth of the firm. In fact, these risks may be what is causing a slow decline in self-employed staff in the insurance brokerage industry (despite the national rise in freelance workers), where the percentage of self-employed workers has decreased slightly from 2012-2021.

Here are important risks that firms may need to look at when considering contractors versus salaried producers.

- Organic growth: It can be difficult for a firm to grow organically when employing many producers who are independent contractors. Driving predictable, profitable organic growth is critical to the success of any insurance agency or brokerage. Because independent contractors are not managed by the firm, they are unable to set sales goals, including minimum sales requirements, making it challenging for firms to have predictable growth.

- Firm valuation: The organic growth and value of a firm’s books of business will often be major factors when determining the firm’s value. Independent contractor producers often own their book of business, compared to the insurance brokerage owning their books for employed producers. If the firm employs many producers who could easily leave the firm and transfer the accounts to a competitor, this will have a negative impact on future revenue and future profits.

- Strategic planning: Having annual new business goals are part of strategic planning and involve individual producer goals. Setting individual producer goals requires historical reflection on several years of production and strategic planning. However, because contractors are not subject to the same guidance or goals, a firm generally may not assign them individual sales goals.

- Firm culture: There may be challenges related to culture, retention, and hiring. If many producers are independent contractors, it can be challenging to drive a strong sales culture. Implementing a true sales culture – the results of planning and strong team commitment can help drive double-digit organic growth that significantly enhances value over time. Furthermore, contractors are likely to be less loyal to the company, less invested in its culture and long-term success, and might be more likely to leave for other opportunities.

- Inconsistent performance and quality control: Unlike employees, independent contractors may not be subject to the same level of oversight and quality control. This can lead to inconsistent performance, impacting client satisfaction, the firm’s reputation and limit a firm’s ability to budget and properly plan to achieve goals.

Overall, while there may be some benefits and cost efficiencies to hiring independent contractor producers for your insurance brokerage, there are many risks that need to be considered as well. Firms can take proactive measures to prevent legal, compliance, and security risks, but there may be longer-term challenges that outweigh the initial savings that could impact the organic growth and valuation of the firm.

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize shareholder value.