“Perpetuation” is an often misunderstood and overused word in the insurance brokerage space, but it’s an important concept to understand, especially if your long-term goal is to remain privately held. But whether you want to remain private, sell to a third party, or infuse capital to fund growth, you must start with the right plan.

A firm that is truly perpetuation-ready has a well-defined strategic plan dedicated to systematic hiring, supported by committed leadership of current and future shareholders. This strategy should be focused on continual internal stock transactions based on fair market value, financial forecasting, and cash flow modeling. But all of this is only possible if the firm has the ability to grow, produce a profit, manage risk, and execute on the plan. To achieve perpetuation goals, firms should consider how to properly incent top performers and next generation talent.

Broadening ownership aligns interests

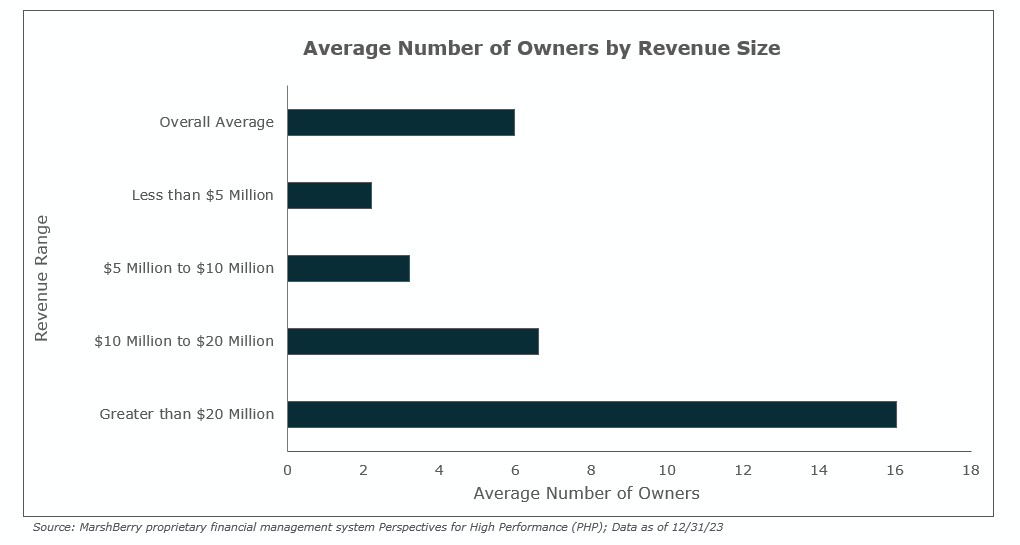

The reality is that the average privately held firm does not broaden ownership or implement a viable equity incentive plan quickly enough. The chart below shows the average number of shareholders within defined revenue bands. It’s really difficulty to perpetuate a $10M organization internally with only three shareholders. In MarshBerry’s experience, internal perpetuation is a very complicated and often emotional decision and there are multiple dynamics and personalities in play.

High growth firms that broaden ownership or build an equity incentive plan can drive higher EBITDA (earnings before interest, taxes, depreciation, and amortization) margins, build more internal collaboration, align interests to achieve growth goals, and build a strong story that attracts and retains top talent. If your goal is to perpetuate internally and control the decision to remain privately held, you may need to start now. The fastest growing insurance brokers in the country use equity as meaningful currency.

Getting started: Identify your goals

An equity incentive plan (EIP) offers employees shares of the company they work for as supplemental compensation, awarded through a variety of vehicles. The first step in developing an EIP involves clearly defining goals and measurements of success. Make sure to engage experienced advisors that can help you understand valuation, tax, and legal mechanics, that align to your strategy.

Even if you don’t have a sense of what you are trying to accomplish, spend time clearly outlining your goals – do you want to perpetuate internally, retain talent, motivate comfortable employees, or address current ownership retirements? Regardless of your goals, establishing a well-defined, thoughtful EIP can drive value. You have many options to introduce an EIP, ranging from common equity, deferred compensation, stock appreciation rights, long term incentive plans, profit interests, and phantom equity grants. A skilled advisor can help identify the best option for your firm.

Equity incentive best practices

Once you decide what “equity” means in your model, consider these core tenants:

- Communication: Giving a top performer an opportunity to own equity in your company does not necessarily mean that they suddenly have decision-making authority over the strategy and tactics of the business. Firms that broaden ownership successfully have clearly communicated the difference between ownership and decision making.

- Clear partnership expectations: Who are your candidates for ownership and why? Allowing individuals to own a part of the business is a reward for high performance – but make sure you do not sacrifice culture by diminishing your standards.

- Transparency without guarantees: It is very important for your equity holders to constantly be reminded about what they own. Far too many firms issue an equity holder a piece of paper that is complicated and hard to understand. Simplify the process and ensure you have continual reminders of what they own, what it can be worth, and what it can look like based on growth.

- Staged liquidity: Delivering an equity benefit that is exercised too far into the future may not appropriately incentivize owners to meet expectations and achieve the intended outcome. High quality equity plans should involve a balance of short-term liquidity with long-term value creation based on performance, growth and employee retention.

- Risk taker vs equity holder: Think about your candidates for ownership and ask yourself this question, “Are they willing to write a check to buy ownership?” If the answer is no, it helps guide your decision-making process.

Firms that embrace the value creation opportunity of offering ownership in a high growth insurance brokerage are able to invest in top tier talent, drive engagement, build an intentional culture and growth mindset, and achieve better financial results. Even if you implement the model and decide to sell to a third party, the results may have a significant impact. What are you waiting for?

The value of a compensation study

Understanding how high performing firms in this industry handle compensation is a great starting point. MarshBerry’s 2024 Insurance Agency & Brokerage Compensation Study evaluates compensation trends in insurance brokerage and provides detailed insights into the results. It offers firms the opportunity to benchmark where they sit in the range of industry peers on compensation approaches. It can provide reinforcement for their current approach – or reveal areas for change.

As insurance brokerages continue to look for ways to grow their business, whether it be through their product offerings, service capabilities, or technology upgrades – people will always be at the root of everything they do. Having a top-performing organization, with top-performing personnel starts with a top-performing compensation strategy.

Learn more about MarshBerry’s 2024 Insurance Agency & Brokerage Compensation Study.