Everyone enjoys a good story, especially one that helps us improve our business or avoid a mishap business decision. At the recent MarshBerry Connect Summit, the industry’s premier peer exchange event, insurance professionals presented engaging stories of success and failure with colleagues facing the same challenges and working toward the same goals.

In the first of our series on leveraging peer insights, here are three best practices other firms are using to solve their talent and staffing challenges.

1. Enhancing Staff Retention Through Competitive Compensation in Insurance Firms

High-level account managers or account executives are the most commonly poached positions, even more than producers, highlighting the need for effective staff retention in insurance agencies, because of their experience and technical knowledge. To combat that, some firms have successfully implemented compensation systems that use both traditional base salaries and variable bonuses based on a percentage of the book of business being managed. That way when the account manager’s workload increases (i.e., book size or premium managed) increases, so does their bonus.

Other interesting anecdotes in this area were related to offers of high compensation by the competition. A few firms shared that when their service people were poached by competitors offering a very high salary, some of the remaining staff raised questions as to why they weren’t receiving the same level of pay. The reality is that while the service professional did receive a higher level of compensation from the competitor, the expectations for performance turned out to be so demanding that it wasn’t worth the pay. Don’t let your staff get swayed by half a story.

2. Preparing for Future Leadership: Perpetuation Planning in Insurance Agencies

Has your firm identified your next generation of leaders? If you don’t have someone you can pass your business on to, due to aging staff or the exodus of baby boomers retiring, start by looking at your firm’s Weighted Average Shareholder Age (WASA). According to MarshBerry’s proprietary financial management system Perspectives for High Performance (PHP), the Best 25% of firms (based on their financial performance, specifically organic growth) have a WASA of 44 years old, compared to the average firm of 54.2 years old. A younger WASA indicates a firm is identifying the next generation of leaders quicker, ensuring those folks have enough runway to purchase stock, and increasing the likelihood of retaining top talent. While there are benefits to retaining experienced top performers, spend some time grooming newer producers to become stakeholders and decision-makers.

This doesn’t mean younger is better. It means that when you reduce WASA, you gain the luxury of time. Use this extra time to explore different options, like developing leadership or researching strategic partners. Look at the up-and-comers and emerging leaders in your firm to help identify who is best prepared to start taking on the responsibility for future plans.

3. Reinvest in unvalidated producers

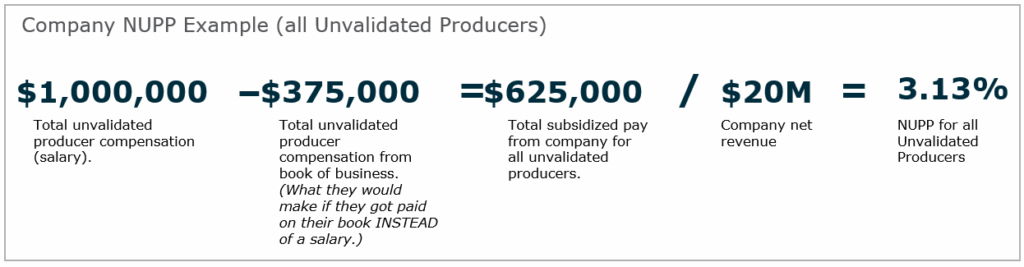

It’s inevitable that senior producers will retire, and you’ll need someone to take on a big book of business seamlessly. Measuring your firm’s investment in unvalidated producers, can help uncover if you’re doing enough to support that transition. Net Unvalidated Producer Pay (NUPP) is a metric used to measure a firm’s investment in producers that haven’t yet built up a significant book of business.

The NUPP metric is calculated by taking the total compensation of all unvalidated producers, subtracting the “validated” compensation they would earn based on their current book of business, and then dividing that difference by the firm’s net revenue. This gives a percentage that represents the firm’s investment in new producer talent.

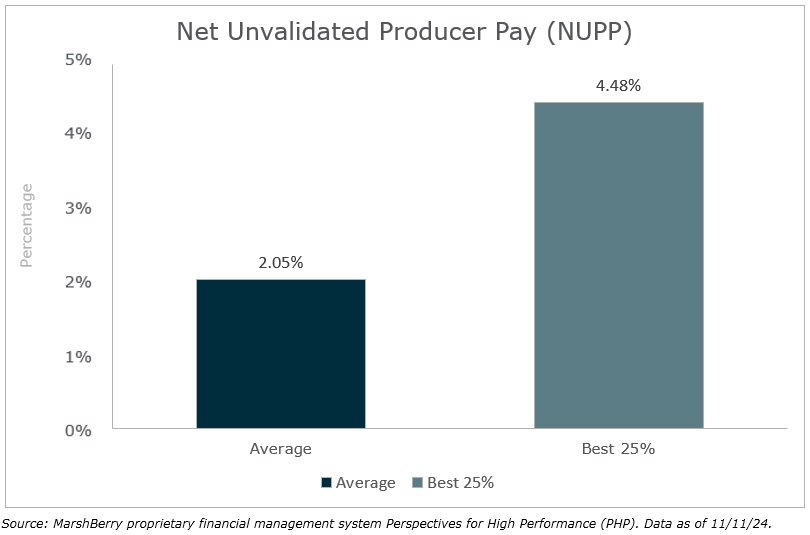

As seen in the chart below, the top 25% of firms have a NUPP percentage that’s almost double the average firm. We can deduce that their unvalidated pay is significantly higher on average and demonstrates the Best 25% of firms are reinvesting in new producer talent. While they’re taking a risk with those new producers, it’s part of a plan intended to motivate new hires to write more new business and drive growth for the firm. By also offering training and mentoring, such as partnering with a senior producer, these top firms are far more prepared to transition large books of business and retain high performing unvalidated producers.

Staying Ahead In The Battle For Talent

The insurance industry is experiencing unemployment rates as low as 2.1% as of November 20241, which means that recruiting new employees can be extra challenging since fewer insurance professionals are actively seeking new opportunities. The flip side of this is that offers from competitors might be generous, and you could find yourself needing to convince a current staff member to stay. Look into a compensation study or hire a consultant to help ensure your pay bands are equal to market.

These insights clearly demonstrate that peer-based discussions aren’t about bragging (or shaming). They’re about sharing and learning in such a way that every participating firm can move forward to cultivate greater success. Don’t base your firm’s future on the hope that a new approach will work. Ask someone who’s been down the road ahead of you — and knows what it takes to succeed.

MarshBerry’s 2025 Agency & Brokerage Compensation Report: Available for Purchase

MarshBerry’s 2025 Insurance Agency & Brokerage Compensation Report explores the prevalent compensation trends concerning insurance agents and brokers. This one-of-a-kind report comprehensively examines current compensation data for 38 roles commonly found across insurance agents and brokers. The report offers insight into Executive & Management Compensation, Production, Service Staff, and Support Staff.

Click here to learn more and purchase this report.

Source:

1 https://www.bls.gov/iag/tgs/iag524.htm